1. What’s Happening with Shinsegae?

Shinsegae’s performance in the first half of 2025 was disappointing. Revenue decreased by 48.8% year-on-year to KRW 3.36 trillion, while operating profit fell by 26.0% to KRW 207.6 billion. The decline in sales and the operating loss in the duty-free business significantly impacted the overall results. While the department store business maintained relatively solid profitability, it also experienced a decline in sales.

2. Why the Decline?

The main factor contributing to the slump is the struggling duty-free business. The duty-free industry as a whole is facing difficulties due to the delayed recovery of tourism after COVID-19 and intensified competition, and Shinsegae has not been immune to these challenges. Furthermore, concerns about a global economic slowdown, high interest rates, and inflation have dampened consumer sentiment.

3. Shinsegae’s Plan of Action

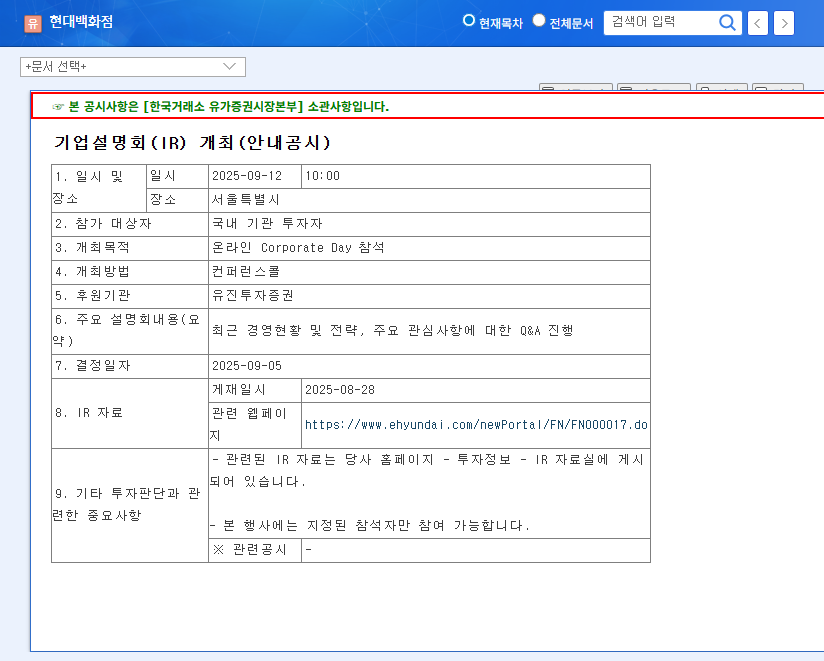

Shinsegae is expected to announce its recovery strategy for the duty-free business, plans to strengthen the competitiveness of its department store business, and new business investment plans at this IR. It will be crucial for them to present specific plans for enhancing the competitiveness of the duty-free business and securing growth engines through new businesses. They are also expected to announce shareholder-friendly policies, such as plans for treasury stock cancellation, to enhance shareholder value.

- Duty-Free: Strategies to address intensified competition and external environment changes

- Department Store: Plans to differentiate offline channels and enhance online competitiveness

- New Business: Presentation of growth potential and investment performance

- Shareholder Value Enhancement: Treasury stock cancellation and shareholder return policy

- Risk Management: Strategies to respond to macroeconomic variables

4. Investor Action Plan

Investors should carefully review the information presented at the IR to formulate their investment strategies. It’s important to focus on the feasibility of the duty-free business recovery plan, the growth potential of new businesses, and the sustainability of shareholder value enhancement policies. Currently, the market maintains a neutral view on Shinsegae, and the investment opinion may change depending on the IR results. Investments always carry risks, so careful judgment is required.

Q: How was Shinsegae’s performance in the first half of 2025?

A: Revenue decreased by 48.8% year-on-year to KRW 3.36 trillion, and operating profit fell by 26.0% to KRW 207.6 billion. The duty-free business slump was the main contributor.

Q: What are the key points to watch for in the Shinsegae IR?

A: Pay attention to the duty-free business recovery strategy, department store competitiveness enhancement plans, new business investment plans, and shareholder value enhancement policies.

Q: Should I invest in Shinsegae?

A: The current investment opinion is neutral. It is recommended to make investment decisions after carefully analyzing the IR results and market reactions.