What Happened with SoluM?

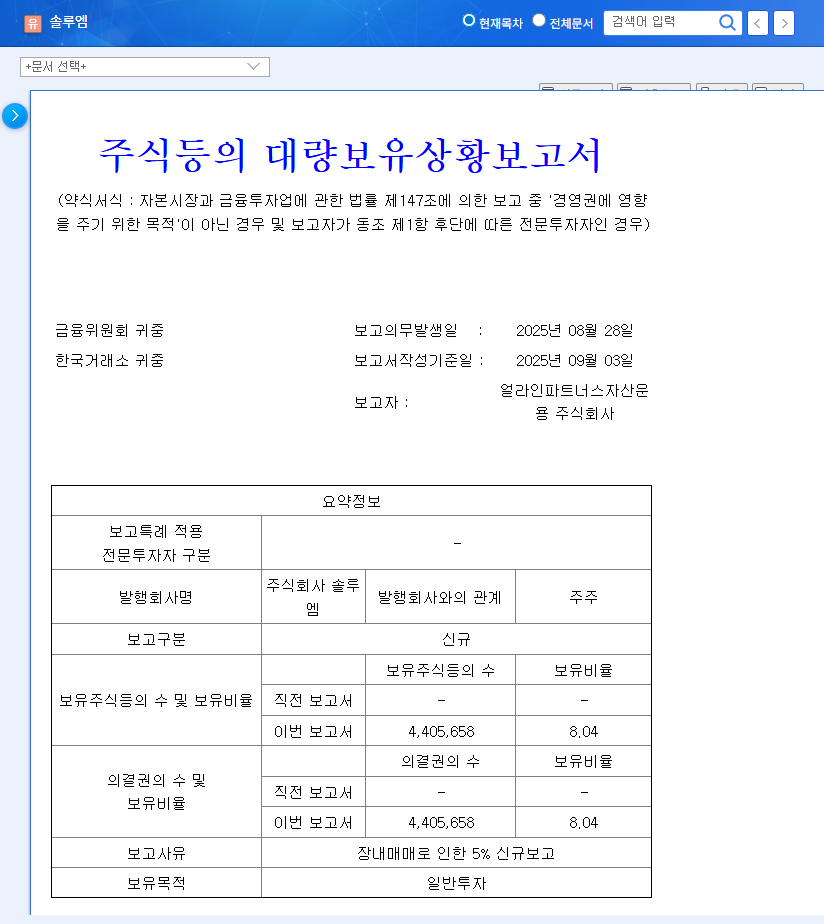

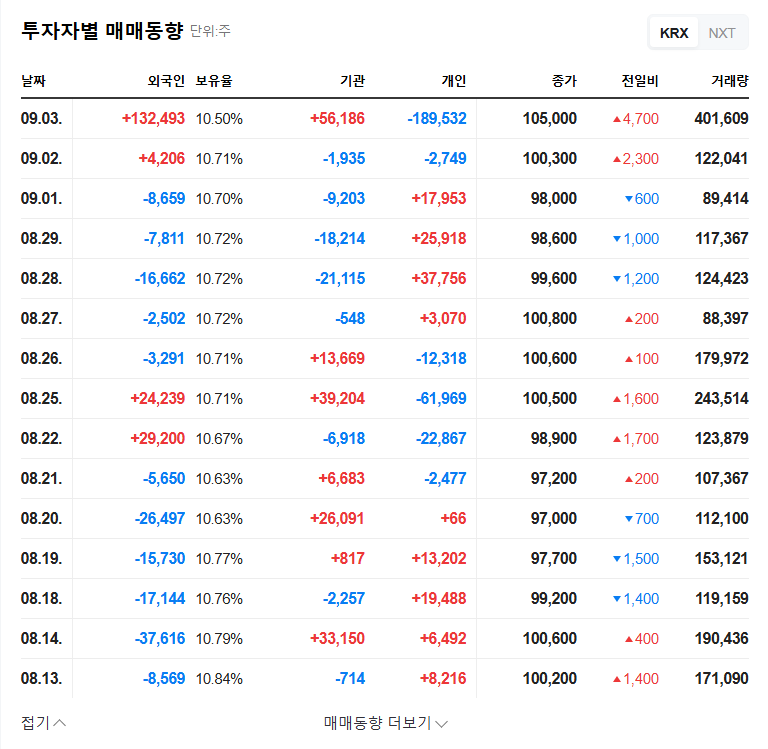

On September 4, 2025, Align Partners Asset Management announced that it had increased its stake in SoluM to 8.04% through a disclosure of acquiring more than 5% of SoluM shares. It is known that the stake was acquired through on-market purchases for general investment purposes.

Why is Align Partners’ Stake Increase Important?

Align Partners is known for its active shareholder engagement. Their stake increase can be interpreted as a positive signal regarding SoluM’s growth potential. In particular, the market’s attention is focused on the fact that the possibility of future management participation cannot be ruled out, going beyond the simple investment purpose.

SoluM’s Current Status and Future Prospects

SoluM is focusing on securing future growth engines by investing in new businesses such as healthcare and battery reuse. However, improving profitability is an urgent task as operating losses and net losses have continued in recent financial statements. The 2025 semi-annual report corrected errors related to related parties, but the impact on fundamentals is limited.

What Should Investors Consider?

- Short-term perspective: Align Partners’ stake increase can act as a short-term momentum for stock price increase.

- Long-term perspective: The success of new businesses and improvement in profitability will determine the long-term investment value.

- External factors: Be mindful of changes in the macroeconomic environment, such as increased exchange rate volatility and interest rate hikes.

Making Investment Decisions

While Align Partners’ increased stake is positive news, careful investment decisions are needed, considering SoluM’s financial status and external environmental changes. It is crucial to coldly analyze the company’s fundamentals and future growth potential without being swept away by positive news alone.

Frequently Asked Questions

What are SoluM’s main businesses?

SoluM is an electronic component manufacturer that produces power modules for TVs, Electronic Shelf Labels (ESL), and 3in1 Boards. They are recently expanding into new businesses such as healthcare and battery reuse.

What kind of company is Align Partners?

Align Partners Asset Management is a South Korean asset management company known for its activist investment strategies. They are famous for carrying out active shareholder activities to enhance corporate value.

What is the most important thing to consider when investing in SoluM?

In the short term, it’s crucial to monitor Align Partners’ further actions and stock price movements. In the long term, the growth potential of new businesses and improvements in profitability are key investment points. In addition, external exchange rate volatility and the macroeconomic situation are also important factors in investment decisions.