1. CYMAX Divests Z-Bike Stake – What Happened?

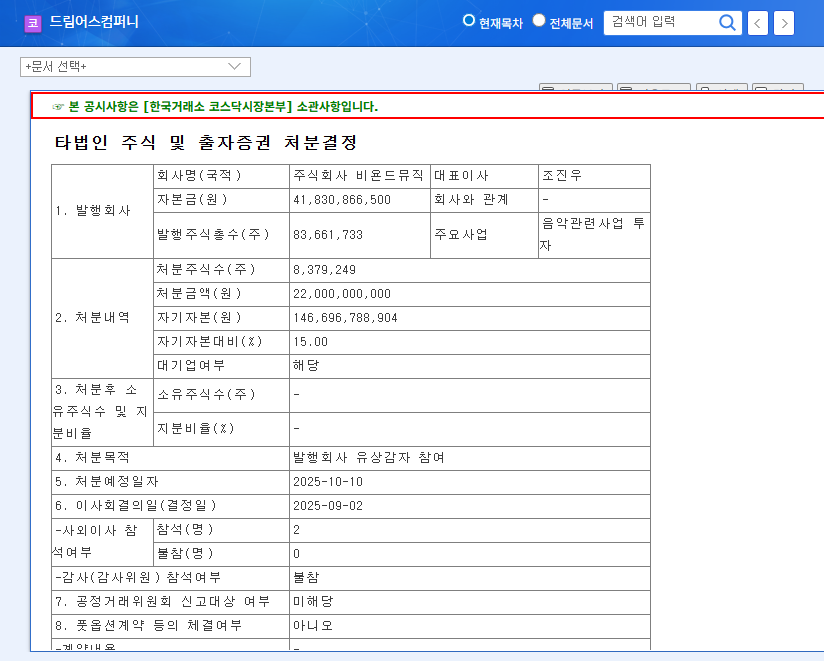

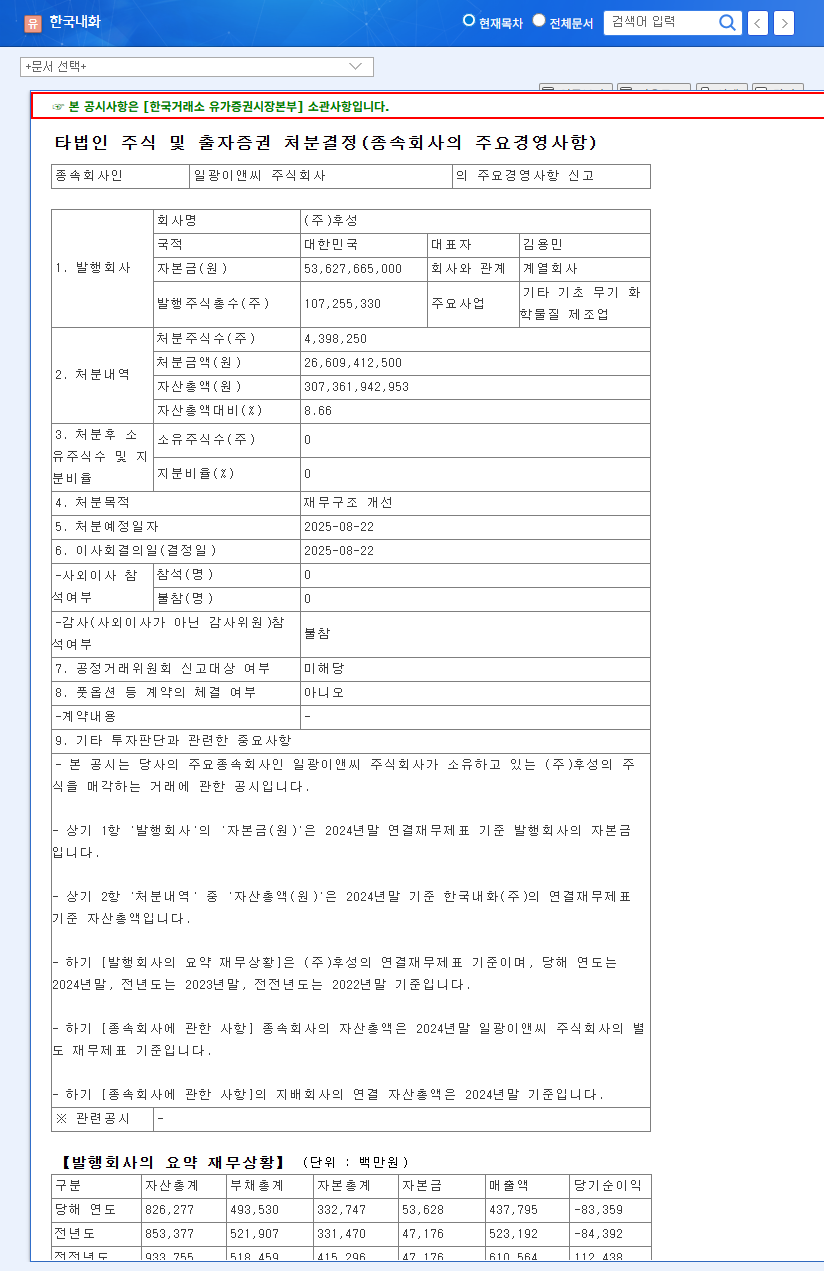

On September 5, 2025, CYMAX announced the sale of its entire stake in Z-Bike for ₩10.5 billion. This represents 6.05% of CYMAX’s capital.

2. Reasons for Divestiture – Why Now?

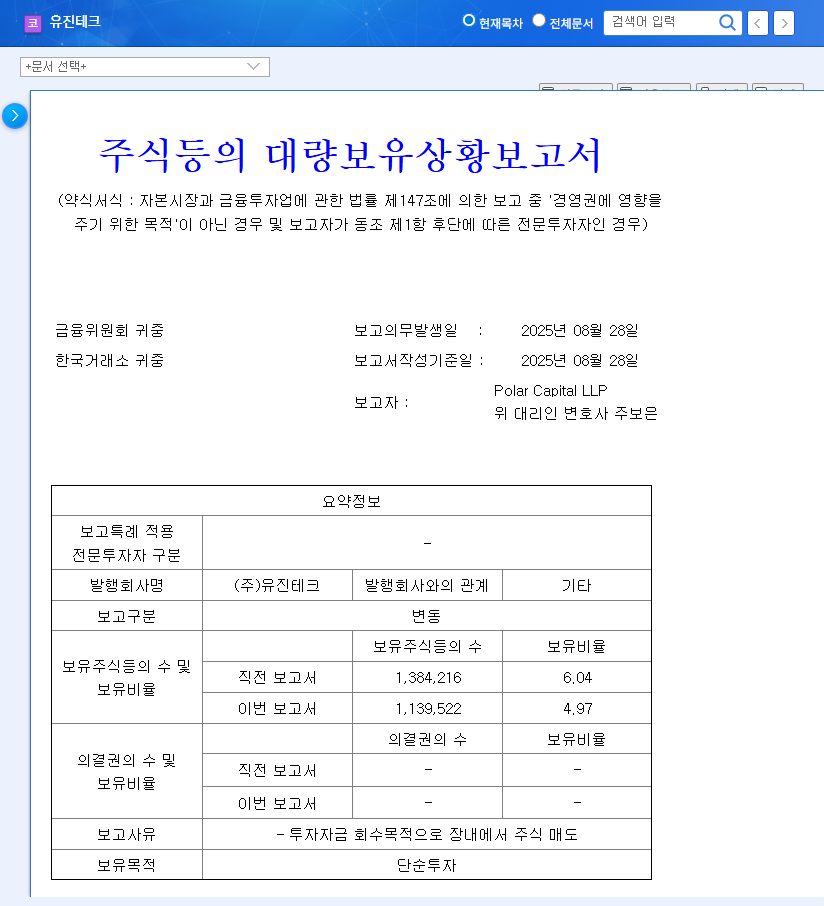

The official reason for the sale is ‘securing cash liquidity.’ This is interpreted as a move to secure funds for increased R&D investment and new business ventures amidst the recent uncertainties in the semiconductor industry. It also suggests an intention to focus on core businesses by streamlining non-core assets.

3. Impact of the Divestiture – What Changes for CYMAX?

- Strengthened Financial Health: The influx of ₩10.5 billion is expected to improve CYMAX’s financial structure by reducing debt-to-equity ratio and enhancing liquidity ratios.

- Securing Future Growth Engines: The secured funds are likely to be used for R&D investment and new business ventures, securing future growth engines.

- Business Portfolio Restructuring: Divesting non-core assets allows CYMAX to focus on its core businesses and improve management efficiency.

4. Investor Action Plan – What Should You Do?

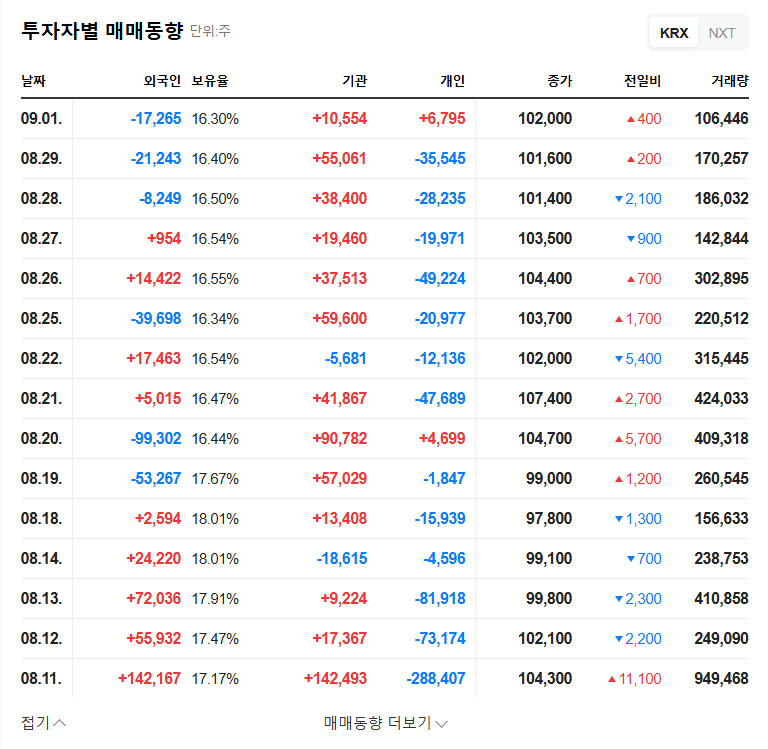

This divestiture is expected to have a positive impact on CYMAX in the short term. However, it’s crucial to continuously monitor the uncertainties in the semiconductor market and CYMAX’s profitability improvement. Closely examining the use of the secured funds and the actual business performance is essential.

Frequently Asked Questions (FAQ)

How will the proceeds from the Z-Bike sale be used?

Officially, it’s stated for ‘securing cash liquidity.’ It may be used for increasing R&D investment, pursuing new business ventures, or repaying debt.

Will this sale positively impact CYMAX’s stock price?

In the short term, it can be positive in terms of strengthening financial soundness. However, the long-term stock price trend depends on CYMAX’s core business competitiveness and profitability improvement.

What is the outlook for CYMAX’s future business?

The growth of the semiconductor equipment market is positive, but CYMAX faces the challenge of improving profitability. It’s important to watch whether new business ventures using these funds can become future growth drivers.