1. What Happened at Hyundai Mobis?

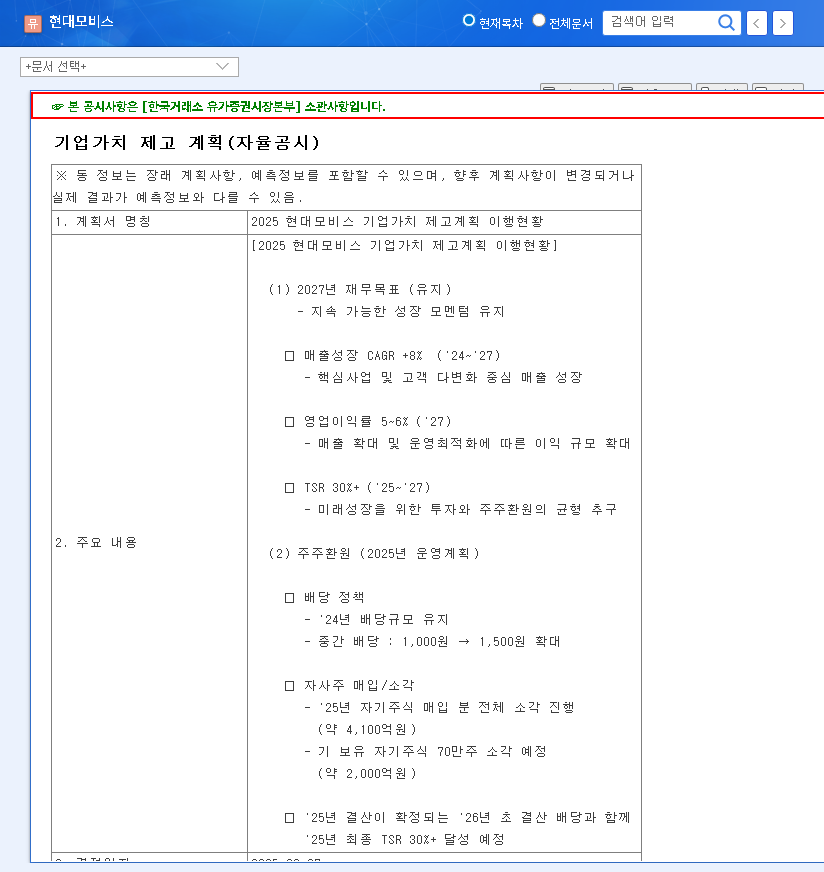

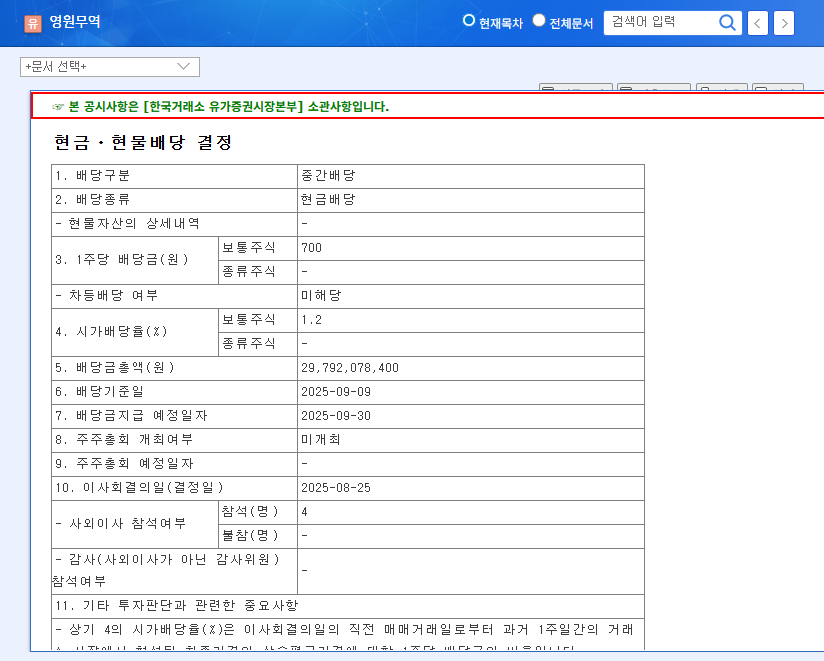

Hyundai Mobis announced its 2025 corporate value enhancement plan, reaffirming its financial targets of +8% CAGR for revenue growth, 5-6% operating profit margin, and 30%+ TSR by 2027. The company will enhance shareholder return policies by maintaining the ’24 dividend level and increasing interim dividends from KRW 1,000 to KRW 1,500. They also plan to cancel all treasury shares purchased in ’25 (approximately KRW 410 billion) and 700,000 existing treasury shares (approximately KRW 200 billion).

2. Why This Decision?

Hyundai Mobis demonstrated strong fundamentals with solid performance in the first half of 2025. Sales increased by 7.6% year-on-year to KRW 30.6883 trillion, and operating profit surged by 39.7% to KRW 1.6467 trillion. This growth fuels their proactive investments in shareholder value enhancement and future growth drivers, as well as the strengthened shareholder return policy. Hyundai Mobis continues investing in future mobility technologies like autonomous driving, electrification, and connectivity, and is strengthening global partnerships to secure future market competitiveness.

3. What Does This Mean for Investors?

This announcement signals positive prospects for investors in two key areas:

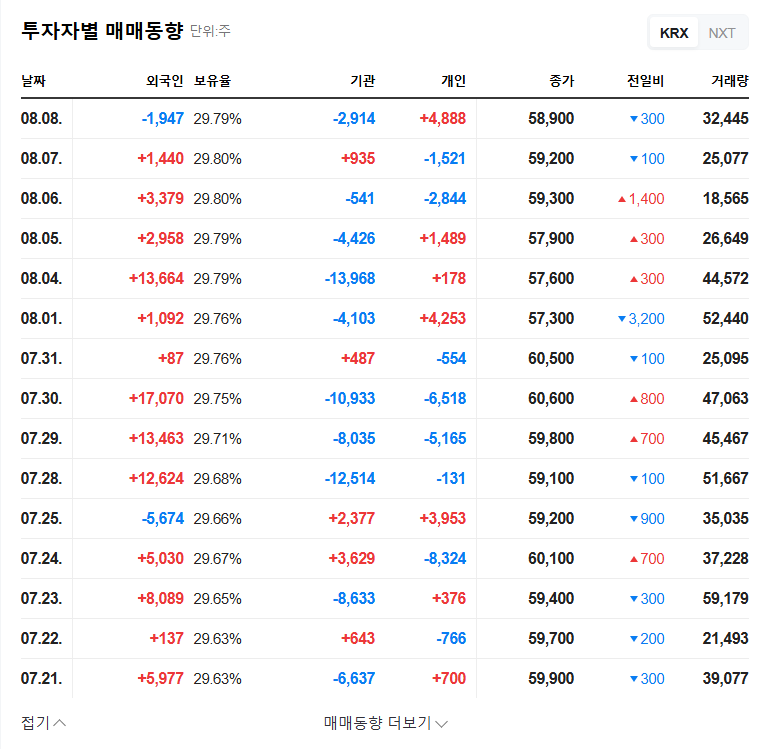

- Enhanced Shareholder Returns: Increased dividends and share buybacks can directly impact stock price positively.

- Future Growth Drivers: Investments in future mobility technologies enhance long-term growth potential.

However, potential risk factors like global economic uncertainties and intensifying competition should also be considered.

4. Investor Action Plan

Investors considering Hyundai Mobis should:

- Focus on long-term growth potential rather than short-term stock price fluctuations.

- Continuously monitor global economic and automotive market trends, as well as competitor activities, to develop an investment strategy.

- Make investment decisions based on their own investment preferences and objectives.

Frequently Asked Questions

What are Hyundai Mobis’ main businesses?

Hyundai Mobis manufactures automobile modules and parts, and also operates an A/S parts business. They are currently focusing investments on developing future mobility technologies, such as autonomous driving, electrification, and connectivity.

How much can I benefit from this shareholder return policy?

The total scale of dividend increases and share buybacks is approximately KRW 610 billion. Investors can expect dividends based on the number of shares they hold, and a potential increase in share value due to the share buybacks.

What is the future growth outlook for Hyundai Mobis?

Hyundai Mobis is securing growth potential through investments in future mobility technologies, like autonomous driving and electrification, and by strengthening global partnerships. However, potential risk factors such as intensifying global competition should also be considered.