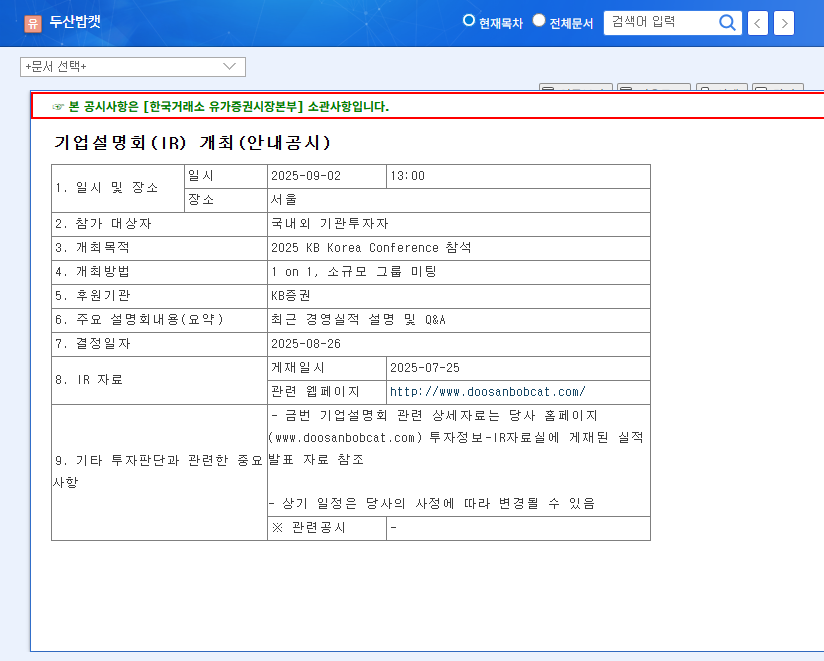

What Happened?: Doosan Bobcat Holds Corporate Briefing

Doosan Bobcat held a corporate briefing at Korea Investment Week 2025 on September 15, 2025. The company presented its recent performance results and future growth strategies, followed by a Q&A session with investors.

Why It Matters: Balancing Short-Term Uncertainty with Long-Term Growth

Doosan Bobcat experienced a decline in performance in the first half of 2025 due to factors such as the global construction slowdown. However, the company maintains long-term growth potential thanks to its strong brand recognition, new technology development, and business diversification. This corporate briefing was a crucial opportunity to accurately diagnose the current situation and assess future strategies.

Fundamental Analysis: Short-Term Challenges vs. Long-Term Opportunities

- Short-term threats: Global economic slowdown, raw material price volatility

- Long-term opportunities: Strong brand power, new technology development (electrification, autonomous driving), hydraulic equipment business acquisition, shareholder return policy

Investor Action Plan: “Wait and See” Strategy

- Short-term: Analyze corporate briefing results and monitor macroeconomic indicators

- Long-term: Make investment decisions after confirming construction market recovery, new business performance, and synergy effects

It is crucial to carefully review the contents of the corporate briefing and management’s response strategies, and to continuously monitor macroeconomic variables when making investment decisions.

How was Doosan Bobcat’s performance in the first half of 2025?

Revenue in the first half of 2025 was USD 3.01102 billion, down 12.26% year-on-year, and operating profit was USD 283.09 million, down 32.19% year-on-year. The deteriorating global macroeconomic environment, including the global construction slowdown, was the main cause.

What are Doosan Bobcat’s future growth drivers?

Doosan Bobcat’s future growth drivers include strong brand recognition, development of electrification and autonomous driving technologies, business diversification through the acquisition of the hydraulic equipment business, and an active shareholder return policy.

What should investors consider when investing in Doosan Bobcat?

Investors should consider the corporate briefing content, management’s commitment to improving performance and future growth strategies, and macroeconomic variables when making investment decisions.