1. Doosan Bobcat IR Event: What Happened?

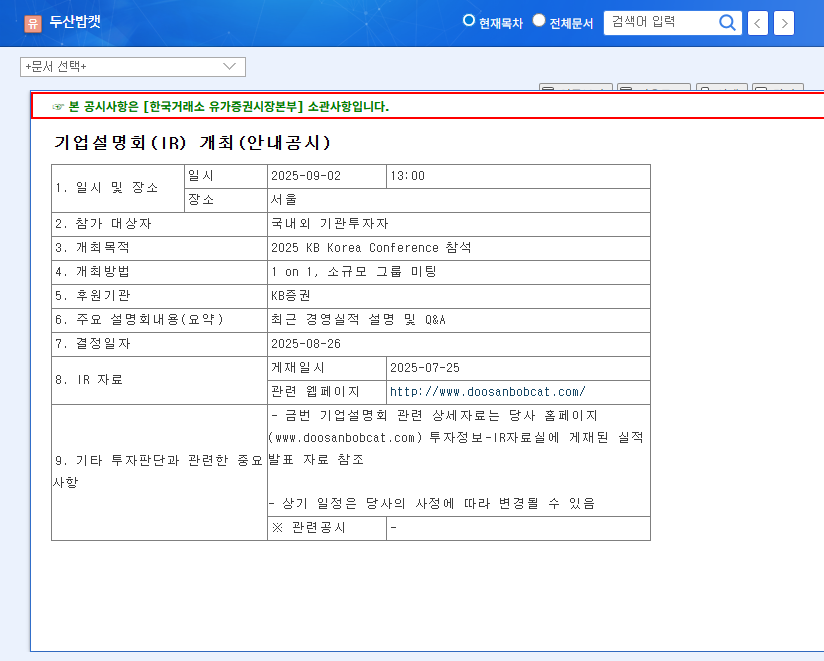

Doosan Bobcat held an investor relations (IR) presentation at the 2025 KB Korea Conference on September 2nd. The company presented its recent performance results and future business strategies, followed by a Q&A session with investors.

2. Key Analysis: Why is it Important?

Doosan Bobcat has experienced a performance slump in recent years. This IR was a crucial opportunity to assess the company’s potential for a turnaround. Investors were particularly interested in the synergy effects following the Doosan Mottrol acquisition and the company’s strategy for securing future growth engines. The company’s response to external factors such as the global economic slowdown and raw material price volatility was also a key concern.

3. Key Takeaways and Outlook: What’s Next?

The core messages of this IR were the earnings improvement outlook, the strategy to maximize synergy effects from the Doosan Mottrol acquisition, and the company’s vision for future growth. The stock’s direction will likely depend on whether the company delivered positive messages that met market expectations. Management’s firm commitment to growth and presentation of a concrete action plan will play a crucial role in improving investor sentiment.

- Positive Scenario: A positive earnings outlook and the presentation of a concrete growth strategy could improve investor sentiment, leading to a potential stock price increase.

- Negative Scenario: If performance falls short of market expectations or the future outlook is uncertain, the stock price could decline.

4. Action Plan for Investors

Investors should thoroughly review the IR materials and related analysis reports, carefully evaluating the company’s medium to long-term growth potential. An investment strategy focused on the company’s fundamentals and future value, rather than short-term stock price fluctuations, is recommended.

Frequently Asked Questions

What are Doosan Bobcat’s main businesses?

Doosan Bobcat’s primary businesses are construction equipment and hydraulics. They recently strengthened their hydraulics business segment through the acquisition of Doosan Mottrol.

What were the key takeaways from this IR?

Key takeaways include the outlook for earnings improvement, synergy effects from the Doosan Mottrol acquisition, and strategies for securing future growth engines.

What should investors be aware of?

Investors should consider external risk factors such as the global economic slowdown and raw material price volatility. They should also carefully analyze the speed and sustainability of the company’s earnings improvement.