What Happened? Syntekabio Announces ₩10B Convertible Bond Offering

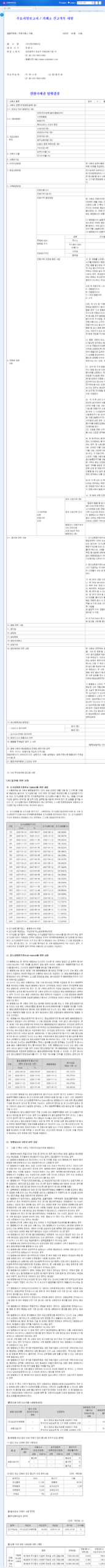

Syntekabio has decided to issue ₩10 billion worth of convertible bonds to Sangsangin Savings Bank and Sejong Industrial. The payment date is September 12, 2025, and the conversion claim period is from September 12, 2026, to August 12, 2028.

Why the Convertible Bond Issuance?

Syntekabio urgently needs funding for the advancement of its AI drug discovery platform and expansion of its data center business. The company has been facing financial difficulties due to continuous operating losses and high debt-to-equity ratio, and this convertible bond issuance is intended to address the short-term liquidity crisis.

What are the Potential Impacts?

Positive Impacts:

- Securing ₩10 billion for R&D investment and new business development

- Expected stabilization of short-term liquidity and operations

Negative Impacts:

- Potential stock dilution upon future conversion to shares

- Concerns about increased financial burden with an already high debt-to-equity ratio (190.47%)

- Inevitable dilution of existing shareholders’ equity

What Should Investors Do?

Investors should proceed with caution. It’s crucial to closely monitor whether the secured funds will translate into tangible business results and how the company plans to improve its financial health. Investment decisions should be made considering the potential impact of the convertible bonds, particularly the possibility of stock dilution upon conversion if the share price rebounds.

Frequently Asked Questions (FAQ)

What are convertible bonds?

Convertible bonds (CBs) are debt securities that can be converted into a predetermined number of shares of the issuing company’s common stock after a specified period.

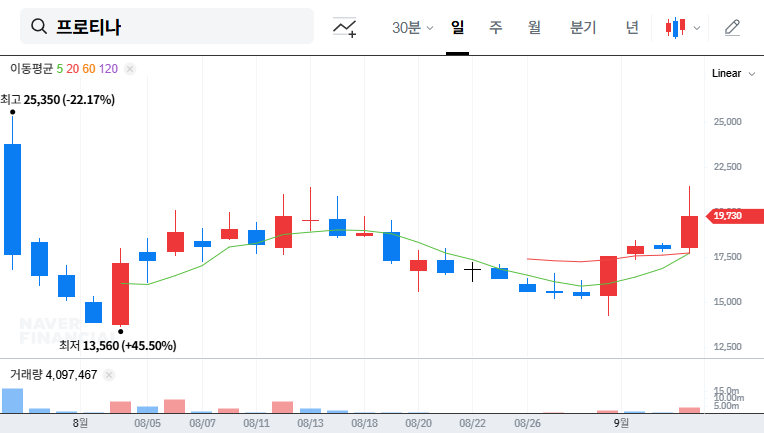

How will Syntekabio’s convertible bond issuance affect its stock price?

In the short term, securing funding could create positive sentiment and potentially drive the stock price up. However, the long-term impact of potential stock dilution upon conversion needs to be considered.

Should I invest in Syntekabio?

Syntekabio possesses technological capabilities in AI drug discovery but faces significant financial instability. Investors should carefully consider these risks and closely monitor the company’s business performance and financial improvement efforts.