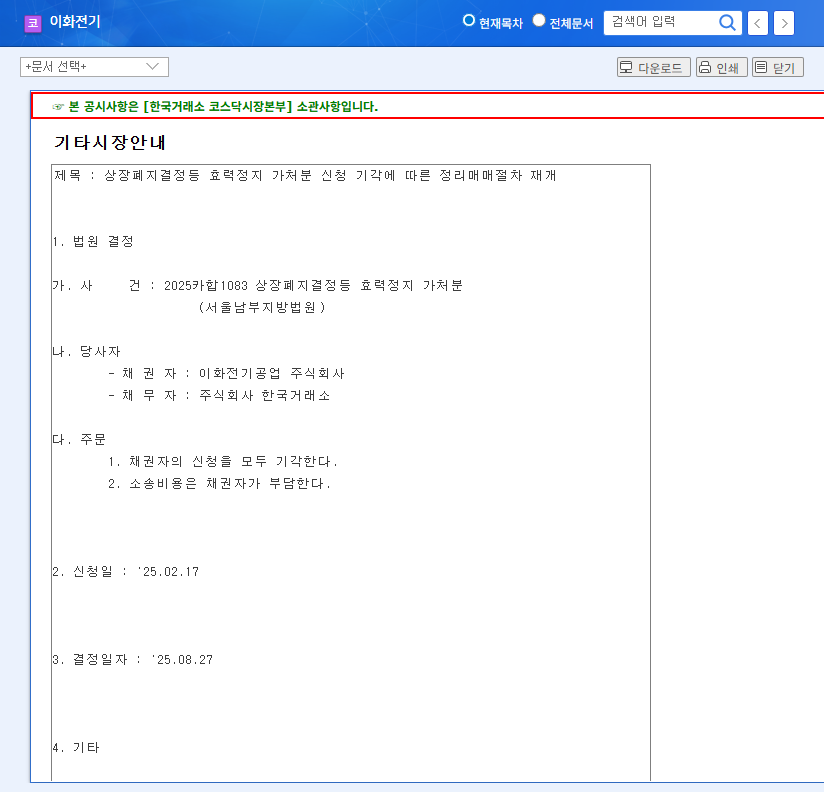

What Happened?

E-Hwa Electric faced delisting due to a ‘disclaimer of opinion’ from its auditor for the 2023 fiscal year. With the dismissal of the injunction, the delisting process and liquidation trading have become inevitable. Liquidation trading will occur from September 1st to 9th, 2025, after which the company will be delisted.

Why Did This Happen?

The primary cause is the deterioration of fundamental corporate factors, including three consecutive years of declining sales and management instability. Sales in the first half of 2025 decreased by 54.6% compared to the same period of the previous year, and despite a return to operating profit, the substantial decline in sales indicates minimal actual improvement. Frequent changes in CEOs also exacerbated management instability.

What Should Investors Do?

- Current Investors: As stock price volatility is expected to be extreme during the liquidation trading period, it is best to sell immediately to minimize losses.

- Potential Investors: Absolutely refrain from investing. The risk of delisting is extremely high, and the possibility of recovering investments is slim.

Investor Action Plan

Closely monitor stock price fluctuations during the liquidation trading period and thoroughly review the company’s disclosed information. Although the possibility of recovering asset value after delisting is very low, it is essential to continuously monitor relevant information. Investment decisions should be made cautiously and at your own risk.

Q: How long will E-Hwa Electric’s liquidation trading last?

A: It will last from September 1st to September 9th, 2025.

Q: Is it okay to invest during the liquidation trading period?

A: It is extremely risky. Investment is not recommended in a situation where delisting is almost certain.

Q: What happens to the stock after delisting?

A: Trading is halted, and you may receive a distribution of residual value based on the company’s asset liquidation process, but the value may be very low or non-existent.