Hanmi Semiconductor IR: What to Expect

Hanmi Semiconductor will present its outlook on the AI (HBM) semiconductor market, its roadmap for next-generation HBM TC Bonders and Hybrid Bonders, and the potential for demand expansion within the overall memory semiconductor market, including HBM. Building on strong 2025 half-year results, the company is poised to further elevate expectations for future growth.

Hanmi Semiconductor: Beneficiary of AI Chip Market Growth

Hanmi Semiconductor leads the market by providing essential equipment for AI semiconductor production, including DUAL TC BONDER and 6-SIDE INSPECTION equipment. The roadmap for next-generation HBM (HBM4, HBM5) and Hybrid Bonders (HB) serves as a key indicator of future growth potential. Furthermore, Hanmi is actively seeking new revenue streams through business expansion, including EMI Shield equipment.

The IR Presentation: Implications for Investors

The positive market outlook and next-generation technology roadmap to be presented at the IR are expected to boost investor confidence and positively impact stock prices. The solid 2025 half-year results will reaffirm the company’s stable growth trajectory.

Investor Action Plan

- Review IR Materials: Carefully examine the presented information to inform your investment decisions.

- Analyze Market Trends: Assess the growth trajectory of the AI semiconductor market and the competitive landscape to develop an investment strategy.

- Consult Expert Opinions: Refer to analyst reports to minimize investment risks.

Frequently Asked Questions (FAQ)

What is Hanmi Semiconductor’s main business?

Hanmi Semiconductor’s core business revolves around producing essential equipment for AI semiconductor manufacturing, particularly HBM. This includes DUAL TC BONDER and 6-SIDE INSPECTION equipment. They are also actively investing in the development of next-generation HBM and Hybrid Bonders, as well as new ventures like EMI Shield equipment.

What are the key topics of this IR?

The IR will cover the outlook for the AI (HBM) semiconductor market, the roadmap for next-generation HBM TC Bonders and Hybrid Bonders, and the potential for demand expansion within the broader memory semiconductor market, including HBM.

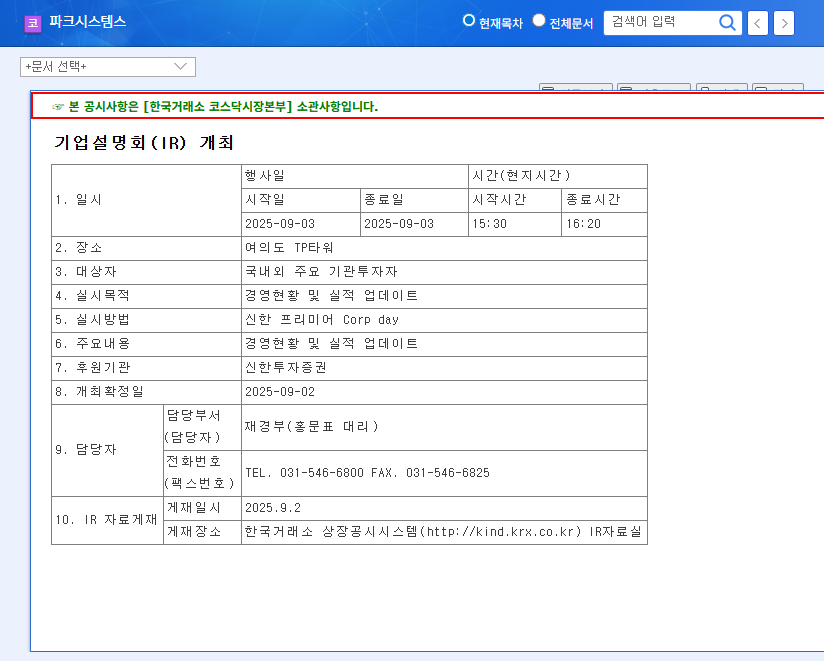

How can I participate in the IR?

You can participate in the IR by attending the ‘KIS Global Investors Conference 2025’. For further details, please contact Hanmi Semiconductor’s IR department or the conference organizers.