1. Hyundai Mobis Q2 Earnings Analysis: Unwavering Growth

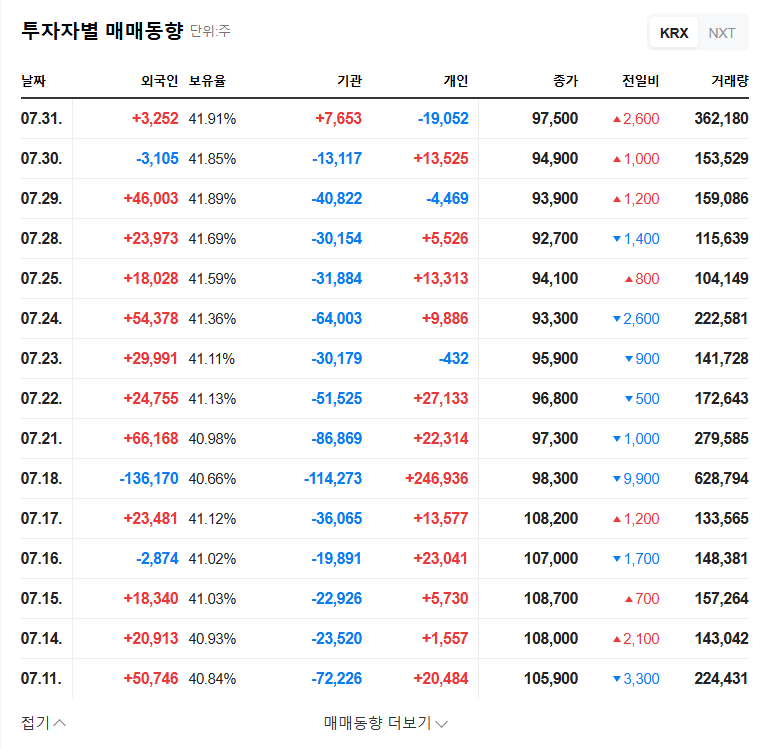

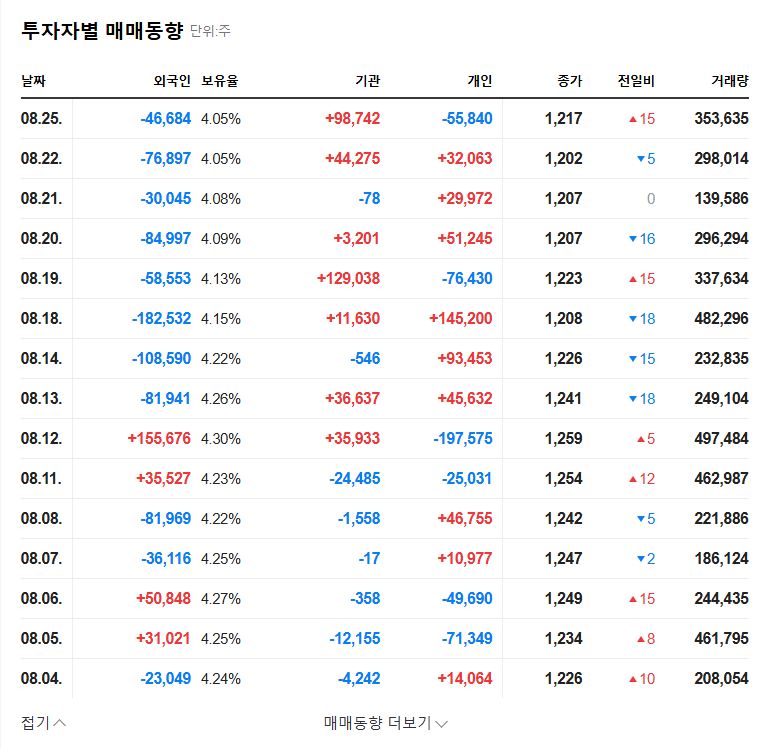

Hyundai Mobis achieved solid results in the first half of 2025, with revenue of KRW 30.6 trillion (+7.6%) and operating profit of KRW 1.6 trillion (+39.7%). Increased vehicle production, rising A/S demand, and the operation of a new North American subsidiary drove this growth.

2. Aggressive Investment in the Future Mobility Market

Hyundai Mobis continues to expand R&D investment in core future mobility technologies such as autonomous driving, IVI, and electrification. Collaborations with Motional, Boston Dynamics, and others are accelerating its efforts to secure future competitiveness. These efforts are expected to contribute significantly to securing a competitive edge in the future market.

3. Positive Outlook, but What are the Potential Risks?

Uncertainties in the global automotive market, exchange rate volatility, and raw material price fluctuations are potential risk factors. However, Hyundai Mobis is equipped to address these risks with its stable financial structure and global business expansion strategy.

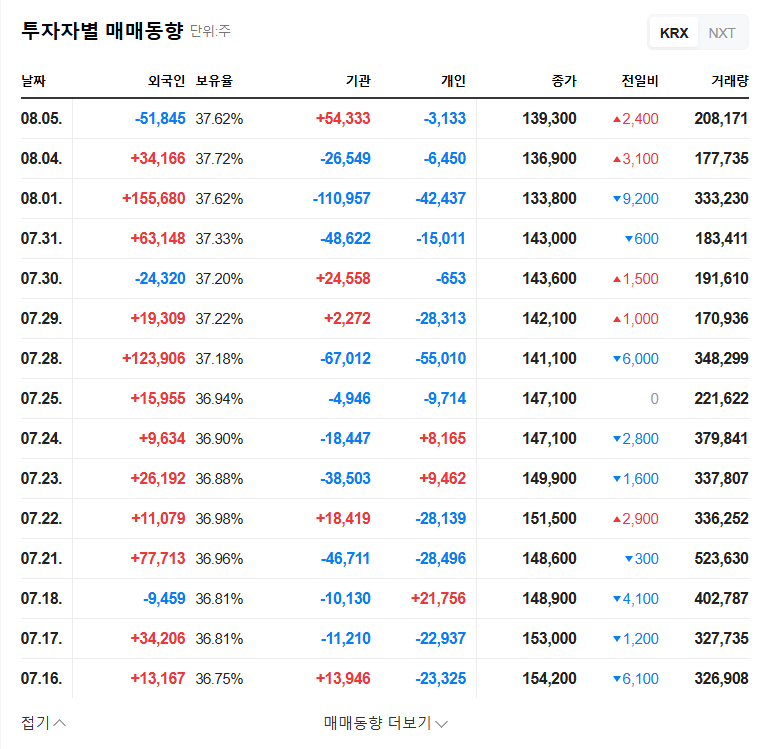

4. Action Plan for Investors

- Considering Hyundai Mobis’ robust fundamentals and future growth potential, the current stock price appears attractive.

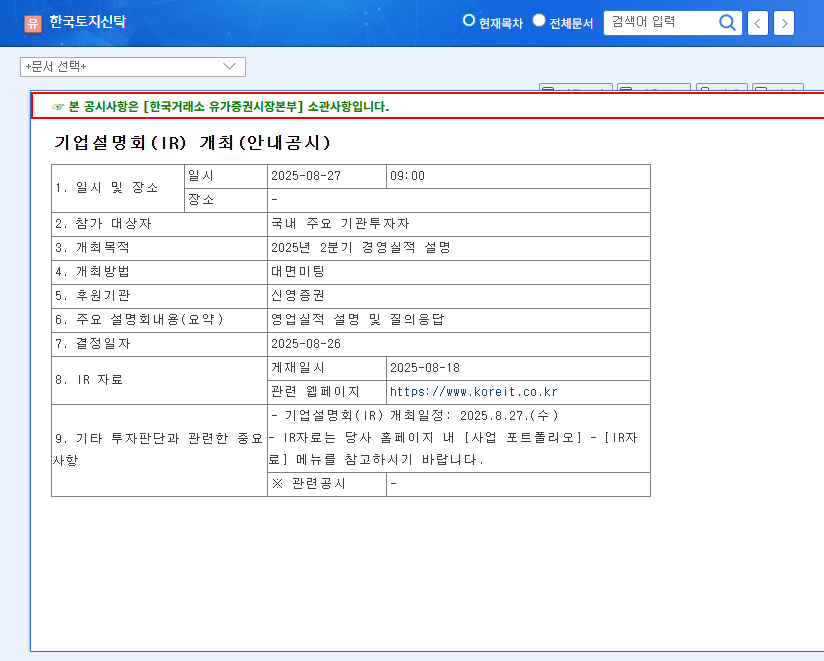

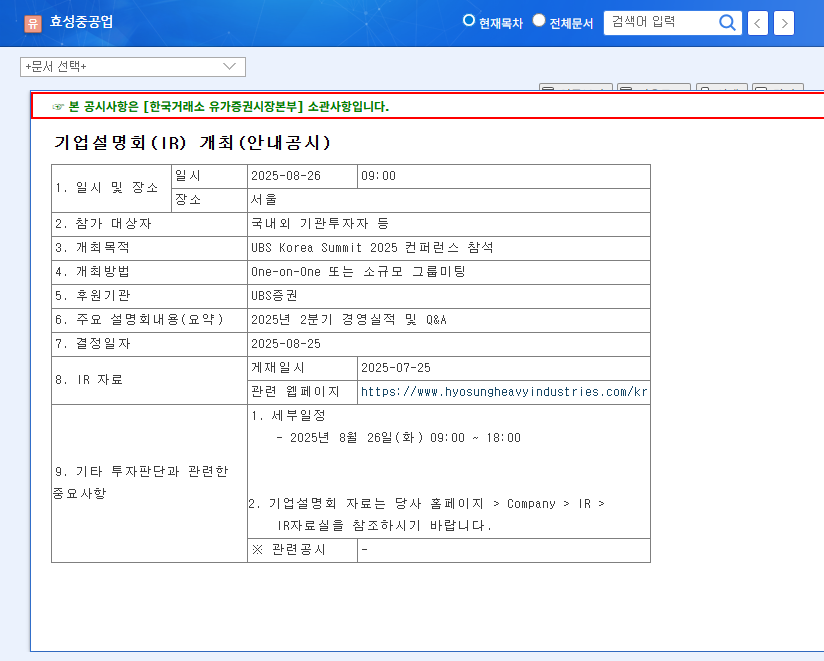

- It is crucial to make investment decisions based on a comprehensive analysis of the IR presentation and market conditions.

- A long-term investment strategy focusing on Hyundai Mobis’ growth potential is expected to be effective.

What are Hyundai Mobis’ main businesses?

Hyundai Mobis’ main businesses include automotive parts manufacturing, A/S parts supply, and module and system production. Recently, the company has been actively investing in the development of future mobility technologies such as autonomous driving and electrification.

How was Hyundai Mobis’ performance in Q2 2025?

Hyundai Mobis recorded revenue of KRW 30.6 trillion (+7.6%) and operating profit of KRW 1.6 trillion (+39.7%) in the first half of 2025, maintaining solid earnings growth.

Should I invest in Hyundai Mobis?

Hyundai Mobis is a company with robust fundamentals and future growth potential, and the current stock price seems attractive. Investment decisions should be made carefully, considering individual investment preferences and market conditions. Referencing the IR presentation and expert analysis can be helpful.