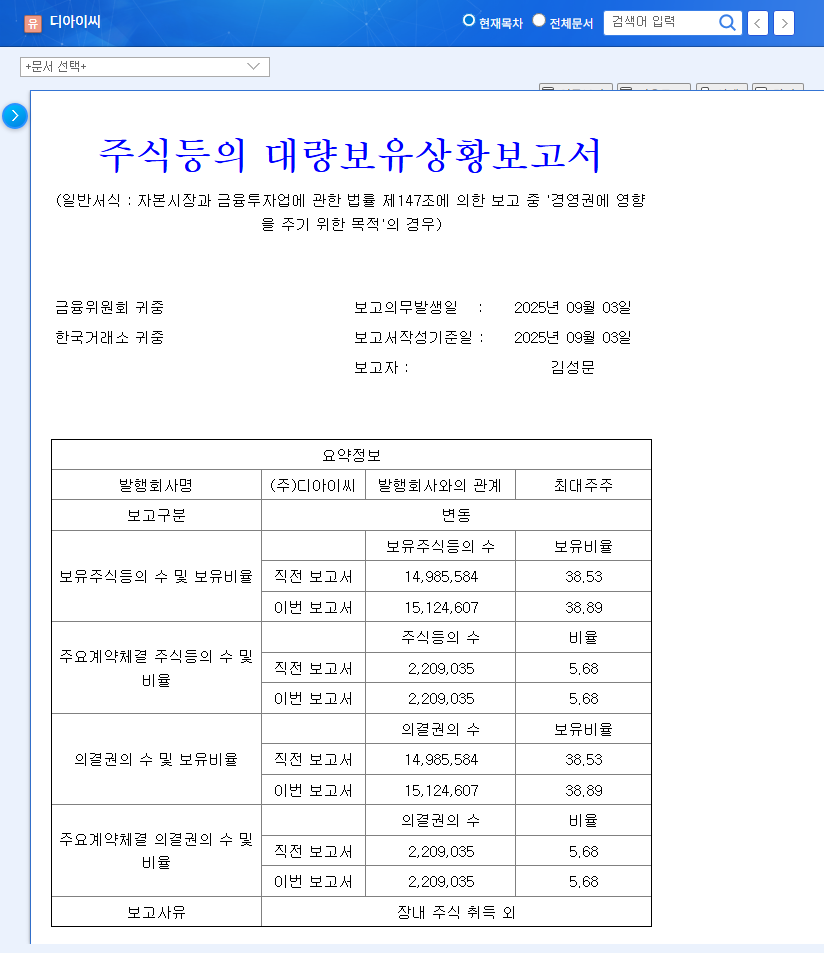

1. What Happened?: CEO Kim Seong-mun Increases Stake in DIC

On September 3, 2025, DIC’s CEO Kim Seong-mun announced through a ‘Report on Large Holdings of Stocks, etc.’ that he increased his stake from 38.53% to 38.89%, a 0.36%p increase. The purpose of the holding was stated as ‘influence on management rights.’

2. Why It Matters: Strengthening Management Control and Market Confidence

This stake increase is interpreted as demonstrating Kim Seong-mun’s intention to strengthen his management control. Although it is a small increase, acquiring additional shares while already holding a substantial stake effectively communicates a firm commitment to management rights to the market. This can provide investors with confidence in a stable management foundation.

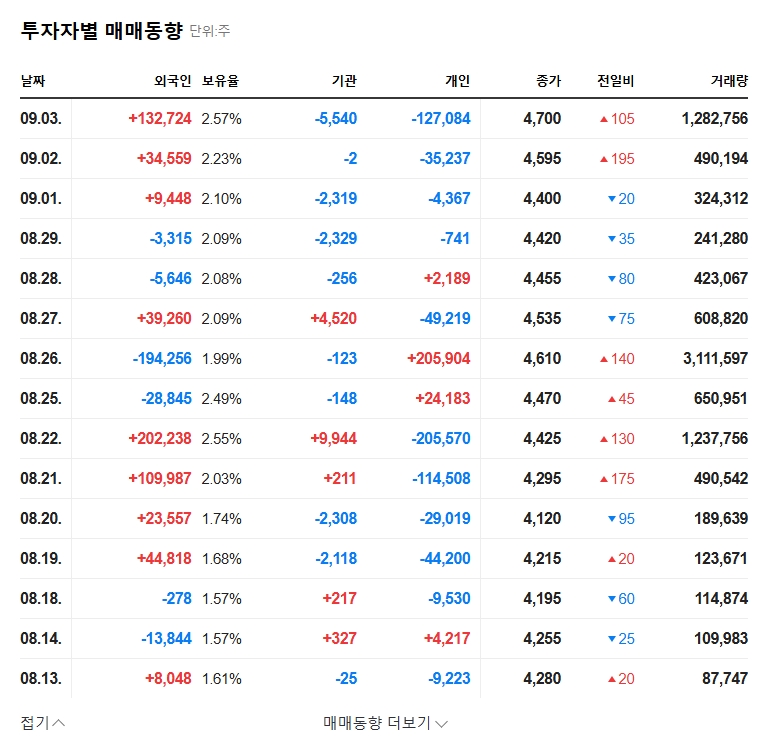

3. What’s Next?: Positive Short-Term Impact, Long-Term Outlook Uncertain

In the short term, there is a possibility of a positive impact on the stock price due to expectations for strengthened management control. However, DIC is currently facing challenges such as deteriorating financial soundness and declining net profit. Therefore, the long-term stock price outlook depends on the growth of the eco-friendly car parts business and improvement in the financial structure.

4. Investor Action Plan: Carefully Analyze Positive/Negative Factors Before Making Investment Decisions

- Positive factors: Growth of eco-friendly car business, increase in major shareholder’s stake

- Negative factors: Decline in net profit, deterioration of financial soundness

Before making investment decisions, investors should closely monitor DIC’s 2025 annual earnings announcement, changes in financial soundness indicators, and the performance of the eco-friendly car parts business.

Will CEO Kim Seong-mun’s stake increase positively impact DIC’s stock price?

While there is a possibility of a positive impact in the short term, the long-term stock outlook depends on the improvement of the company’s fundamentals.

What is DIC’s financial status?

As of the first half of 2025, DIC is showing a trend of declining net profit and deteriorating financial soundness. Caution is advised when investing.

What is the future outlook for DIC?

While there is growth potential in the eco-friendly car parts business, the improvement of the financial structure is a critical variable. Continuous monitoring of future earnings announcements and management strategies is necessary.