1. Hana Financial Group IR: What’s it about?

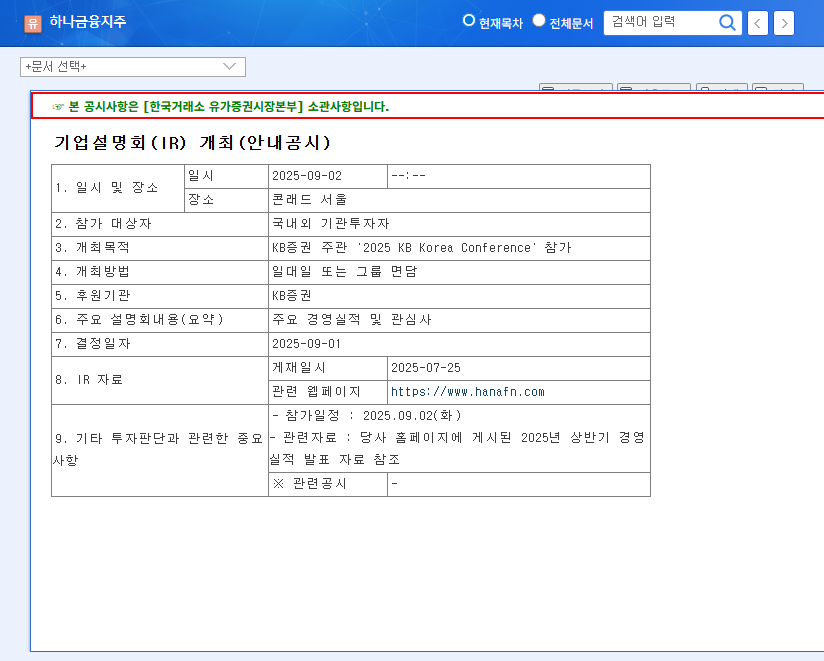

On September 2nd, 2025, Hana Financial Group will participate in the ‘2025 KB Korea Conference’ to present its business performance and future plans. Addressing the recent slump and presenting future growth strategies are key tasks.

2. Why is it important?

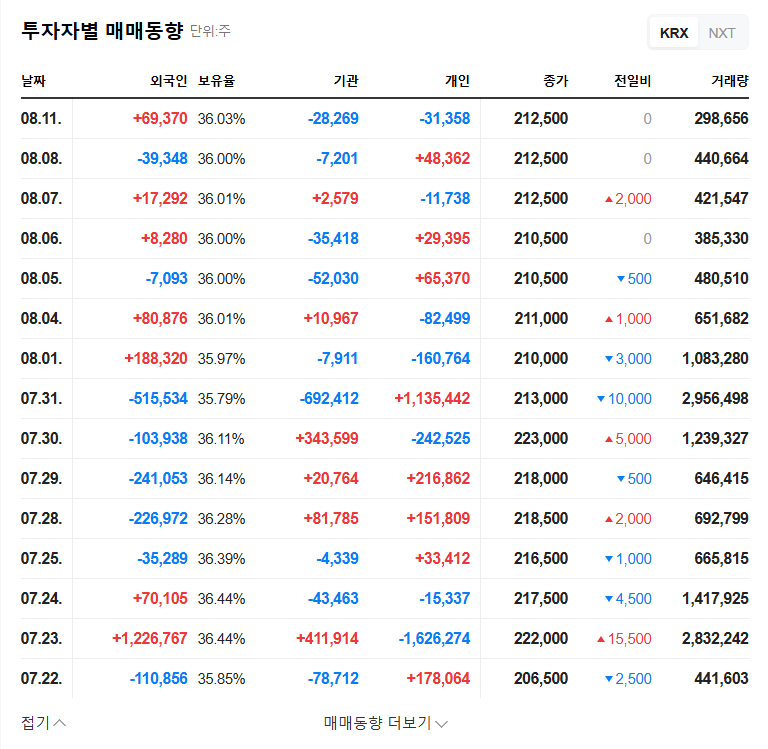

Hana Financial Group has been struggling with losses for the past two years. Increasing debt ratio and deteriorating profitability are raising concerns among investors. This IR is a crucial opportunity to alleviate these concerns and restore investor confidence.

3. Hana Financial Group’s Current Status and Outlook

- Financial Status: Continued losses in 2024 with revenue of KRW 928 billion, operating loss of KRW 131 billion, and net loss of KRW 125 billion. Worsening debt ratio and declining profitability.

- Market Environment: Continuing volatility in interest rates and exchange rates, and increasing global economic uncertainty are expected to create a challenging business environment.

- Key IR Objectives: Needs to clearly present strategies for improving performance, strengthening financial soundness, and shareholder return policy.

4. What should investors do?

Investors should carefully analyze the IR presentation to assess the company’s future growth potential. In particular, they should focus on the concreteness of the performance improvement strategy, the effectiveness of the financial soundness strengthening plan, and the sustainability of the shareholder return policy.

Frequently Asked Questions

When is Hana Financial Group’s IR scheduled?

It is scheduled for September 2nd, 2025.

How has Hana Financial Group’s recent performance been?

The company has been recording losses since 2023, and the losses widened in 2024.

What should investors pay attention to during the IR?

Investors should closely examine the strategies for performance improvement, strengthening financial soundness, and shareholder return policy.