1. What Happened?

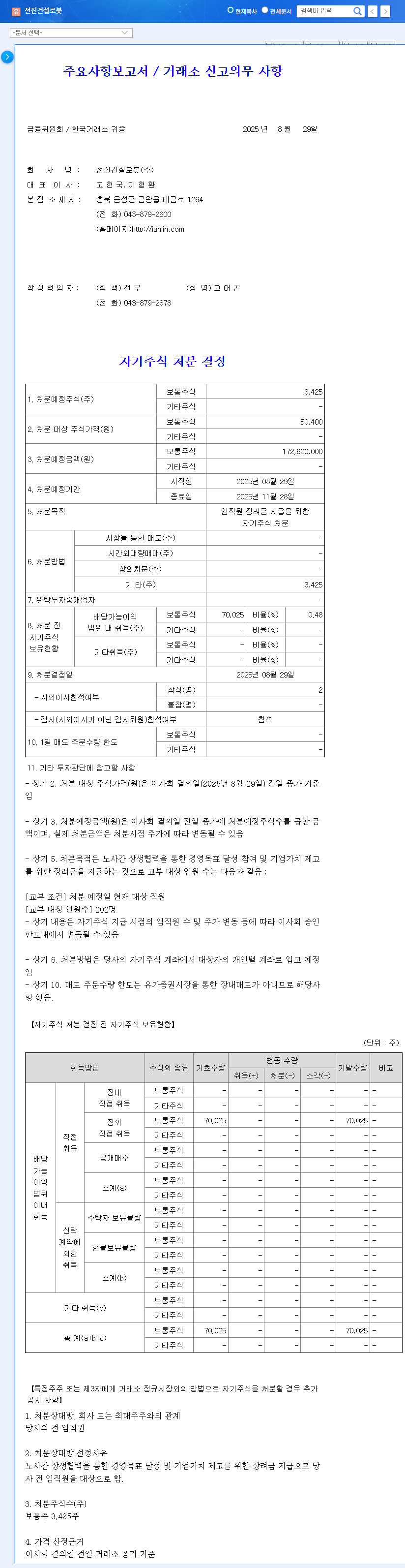

On August 29, 2024, Jeonjin Construction Robot announced the disposal of 3,425 treasury shares, worth approximately ₩200 million, to fund employee incentives.

2. Why the Disposal?

The official reason is to boost employee morale and motivation through incentive payments. This suggests a focus on talent acquisition and retention as the company expands into construction robotics and electrical equipment manufacturing.

3. What’s the Impact on the Stock?

Short-term Impact:

The small scale of the disposal is unlikely to significantly impact the stock price directly. It could even be interpreted positively as a measure to enhance long-term corporate value by boosting employee morale. However, with the stock currently underperforming due to weak earnings and macroeconomic uncertainties, the disposal is unlikely to trigger a short-term rebound.

Long-term Impact:

The long-term impact could be positive, as incentivizing employees may accelerate progress in new business areas. The success of the construction robot and electrical equipment ventures will be key factors influencing the stock’s future trajectory.

4. What Should Investors Do?

We maintain a ‘Neutral’ rating on the stock. Investors should adopt a wait-and-see approach and closely monitor future earnings, progress in new business areas, global construction market trends, and fluctuations in raw material prices and exchange rates. Pay close attention to the next quarterly earnings announcement, updates on new business developments, and shifts in the global construction landscape, as well as raw material price and exchange rate volatility.

Does treasury stock disposal negatively affect the stock price?

The small scale of this disposal is unlikely to directly impact the stock price. It could even enhance long-term corporate value by boosting employee morale.

What is the outlook for Jeonjin Construction Robot?

Short-term challenges include weak earnings and macroeconomic uncertainties. However, the company’s expansion into new business areas offers potential growth opportunities. We maintain a ‘Neutral’ rating.

What should investors watch out for?

Monitor future earnings, progress in new business areas, global construction market trends, and fluctuations in raw material prices and exchange rates.