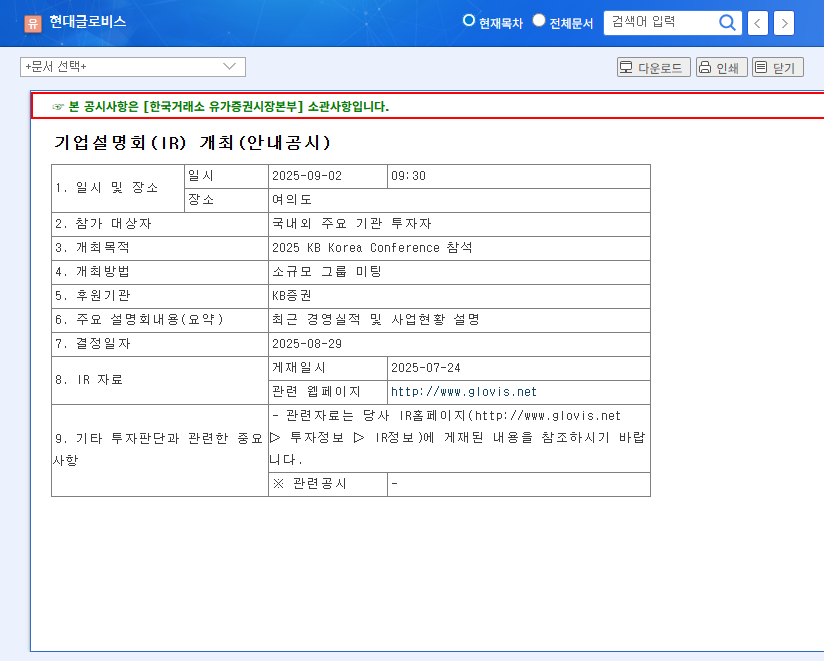

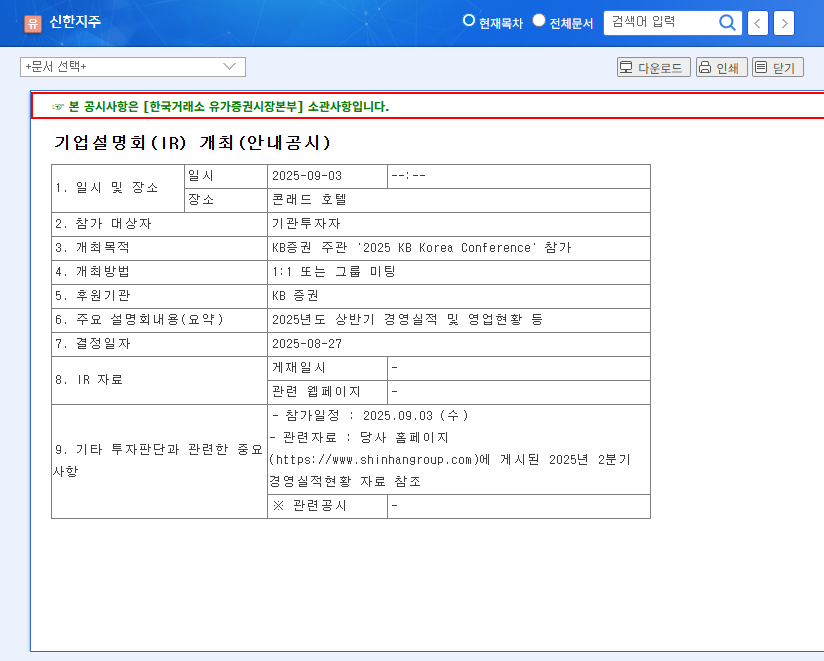

2025 KB Korea Conference Participation: What does it mean?

Hyundai Glovis will present its recent business performance and current status, and communicate directly with investors at the conference. While no new information is scheduled to be released, investors will gain a clearer understanding of Hyundai Glovis’ current situation and future vision.

Hyundai Glovis’ Strong Foundation: Positive Fundamentals

Hyundai Glovis possesses positive fundamental factors such as a stable business structure, continuous sales growth, active investment in future growth engines, solid financial soundness, strengthened ESG management, and shareholder-friendly policies. In particular, investments in future new businesses, such as electric vehicle battery recycling and smart logistics solutions, further enhance its long-term growth potential.

Conference Participation: Impact on Investor Sentiment

This IR activity is expected to solidify the positive evaluation of Hyundai Glovis and improve investor sentiment. Investors will be able to hear clear explanations of the company’s growth strategy, future growth drivers, and potential risks.

Action Plan for Investors

Considering Hyundai Glovis’ fundamentals and future growth potential, the mid-to-long-term investment outlook is positive. However, it is crucial to carefully review the information presented at the conference and potential risk factors before making investment decisions.

Frequently Asked Questions

Will new information be announced at this conference?

No new information is scheduled to be released.

What are Hyundai Glovis’ main businesses?

Hyundai Glovis has a diversified business portfolio including integrated logistics, distribution and sales, and shipping.

What are Hyundai Glovis’ future growth drivers?

Hyundai Glovis is actively investing in electric vehicle battery recycling and smart logistics solutions.