SM Veccell Stake Change Analysis: What Happened?

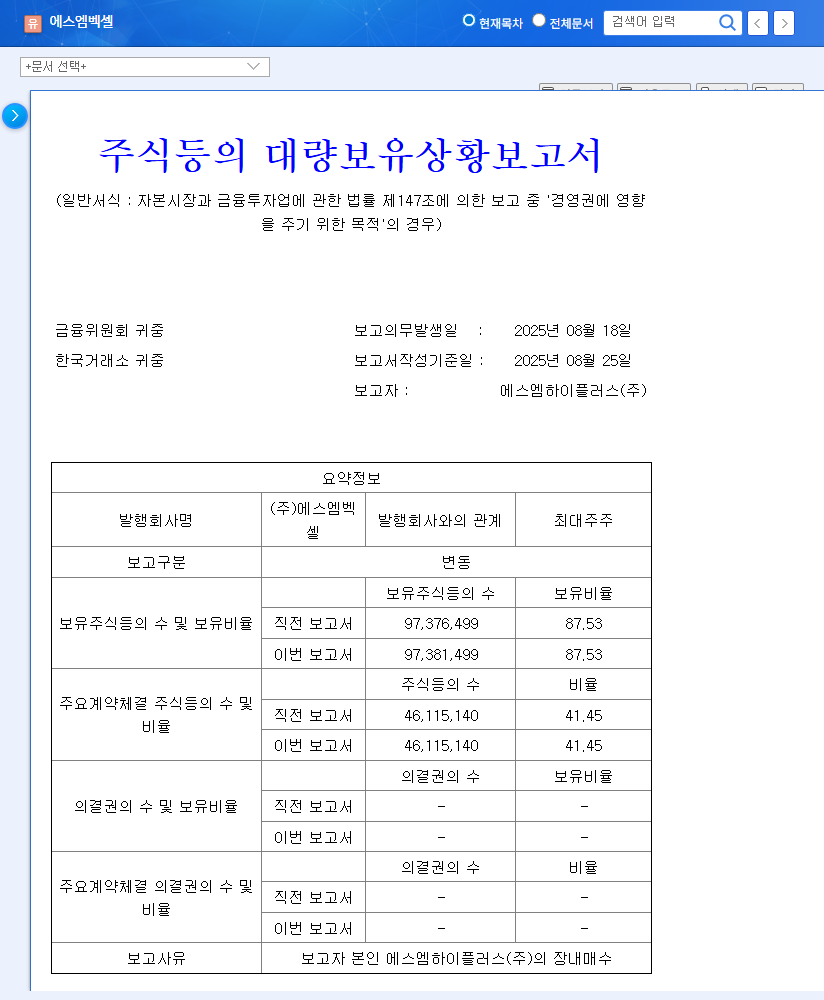

SM High Plus Co., Ltd. acquired an additional 5,000 shares of SM Veccell, maintaining an 87.53% stake and demonstrating its commitment to strengthening management control. This is not just about maintaining the stake, but a signal to the market of its commitment to responsible management and confidence in future growth.

Why Does This Stake Change Matter?: Synergy with EV Battery and Auto Parts Industry Growth

SM Veccell is securing growth momentum through its eco-friendly auto parts and EV battery businesses. The rapid growth of the EV battery market and the expansion of the eco-friendly car market are further increasing SM Veccell’s growth potential. In this context, the largest shareholder’s increased stake is an important signal of the company’s commitment to stable management and future investment.

What’s Next?: Stock Outlook and Investment Strategy

In the short term, the largest shareholder’s stake purchase could improve investor sentiment. In the medium to long term, improved management stability and earnings improvement due to the expansion of the EV battery and auto parts businesses are expected. However, a cautious investment approach is necessary due to risk factors such as volatility in the automobile market and intensifying competition in the battery market.

Action Plan for Investors: What to Watch For

- Short-term perspective: Pay attention to the market reaction and changes in supply and demand following the change in the largest shareholder’s stake.

- Medium to long-term perspective: Continuously monitor the growth of the EV battery and auto parts businesses, new contract signings, and technological development achievements.

- Risk management: Understand changes in the macroeconomic environment and competitor trends, and diversify your investment portfolio to manage risk.

What are SM Veccell’s main businesses?

SM Veccell operates in auto parts, secondary batteries, and ampule batteries for defense. They are particularly focused on and pursuing growth in eco-friendly auto parts and secondary batteries.

How will this stake purchase affect the stock price?

In the short term, it may positively impact investor sentiment. However, due to the already high stake, the direct impact on the stock price may be limited. In the medium to long term, it is expected to contribute to corporate value growth by strengthening management stability and expanding businesses.

What should I be aware of when investing in SM Veccell?

Volatility in the automobile market, intensifying competition in the battery market, and macroeconomic uncertainties can act as risk factors. These factors should be carefully considered before making investment decisions.