What is the Share Buyback?

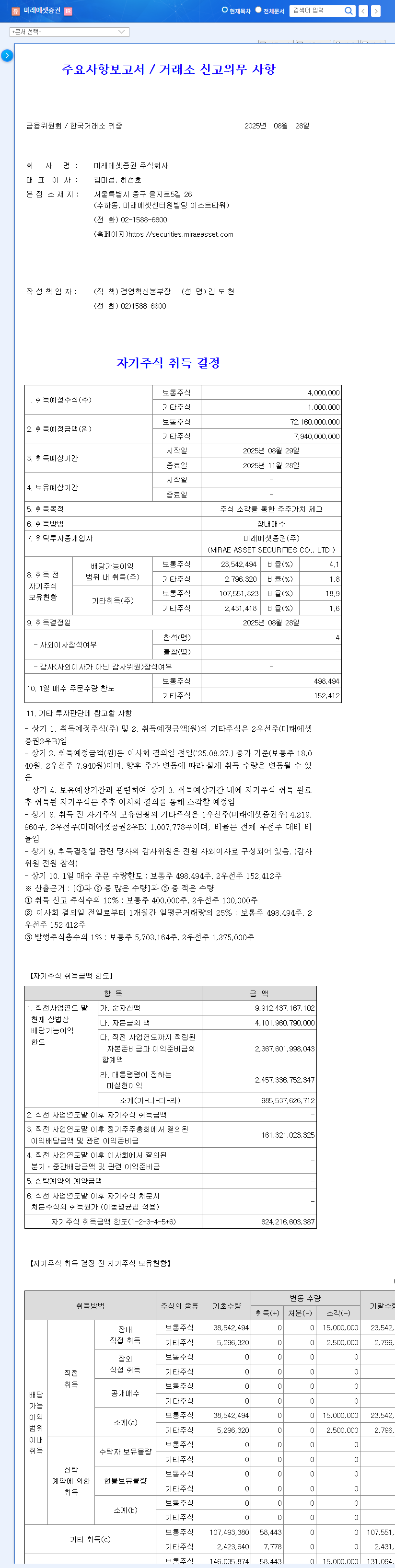

Mirae Asset Securities plans to repurchase 4 million common shares and 1 million preferred shares through market purchases, totaling approximately KRW 80.1 billion. These shares will then be retired.

Why the Buyback Decision?

The official purpose is to enhance shareholder value. Share buybacks reduce the number of outstanding shares, increasing earnings per share (EPS) and book value per share (BPS). This move is also interpreted as a response to the recent decline in stock price and a signal of management’s commitment to boosting investor confidence and share value.

What Will Happen as a Result?

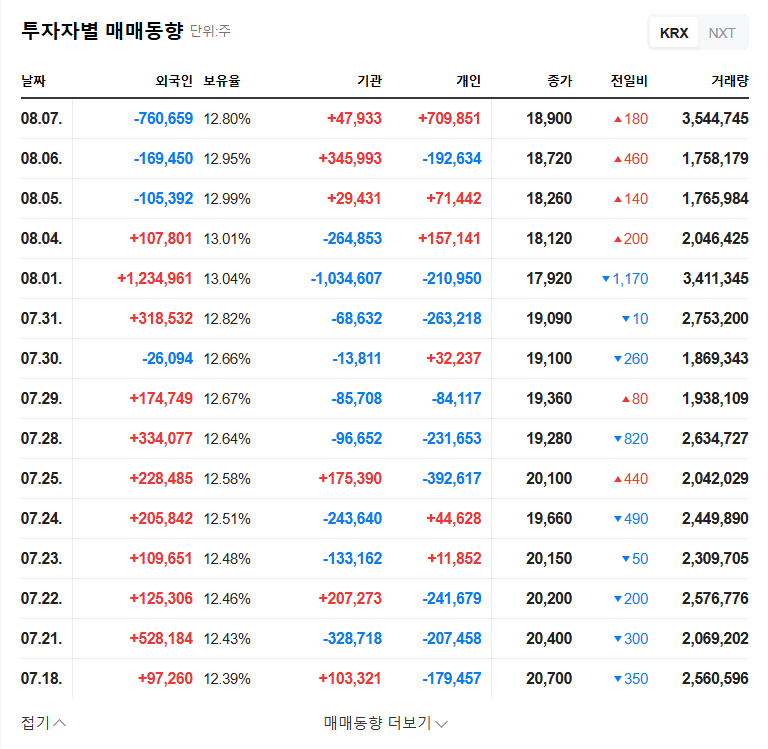

This share buyback is likely to be perceived as a positive signal by the market. It suggests management believes the current stock price is undervalued and could contribute to improved investor sentiment. Furthermore, given the company’s robust financial position, the buyback is not expected to significantly impact financial stability.

- Short-term effect: Potential for stock price rebound.

- Long-term effect: Increased investment attractiveness.

What Should Investors Do?

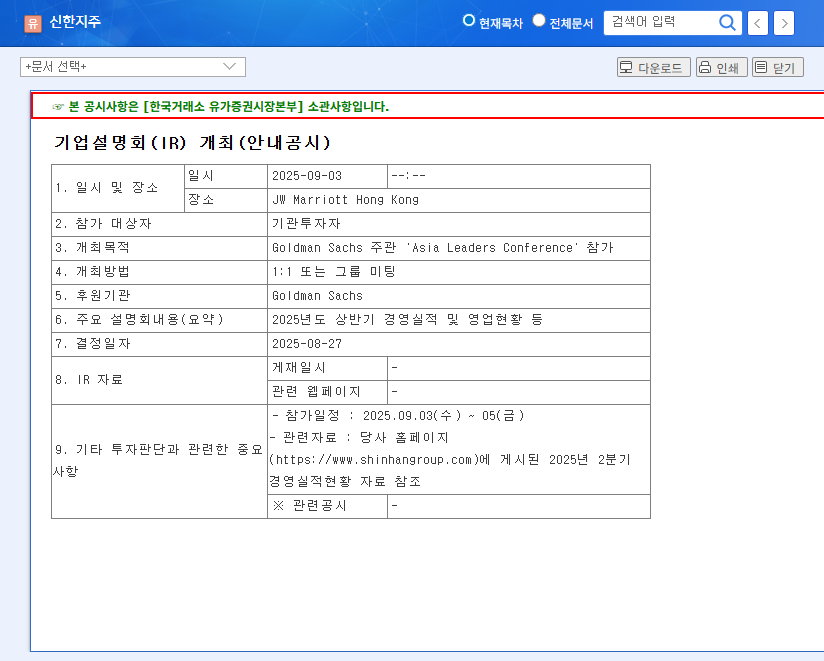

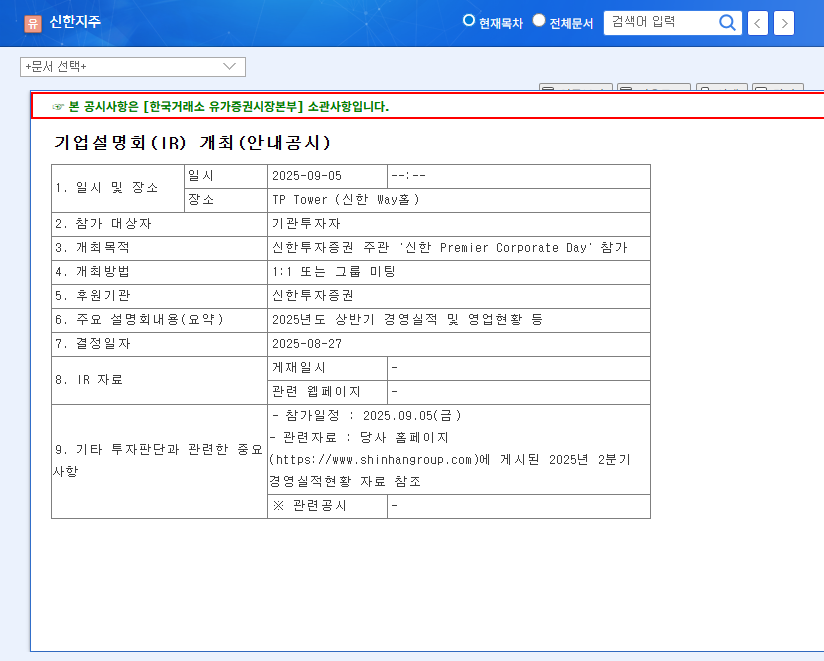

Investors should closely monitor the progress of the share buyback, subsequent stock price movements, and market reactions. It’s crucial to make investment decisions based on a comprehensive consideration of Mirae Asset Securities’ fundamentals, growth drivers (WM/Pension, Global Business, IB, PI, Trading, Security Tokens, Robo-Advisors), and ESG management.

What is a share buyback?

It’s when a company repurchases its own shares and removes them from circulation. This decreases the number of shares available, increasing the value of each remaining share.

What is Mirae Asset Securities’ financial status?

It’s very stable. The company boasts a solid net asset ratio of 2,857.8% (consolidated) and maintains ample liquidity.

What will happen to the stock price after the buyback?

While a short-term price increase can be expected, the actual price movement will depend on various market factors.