1. What Happened?

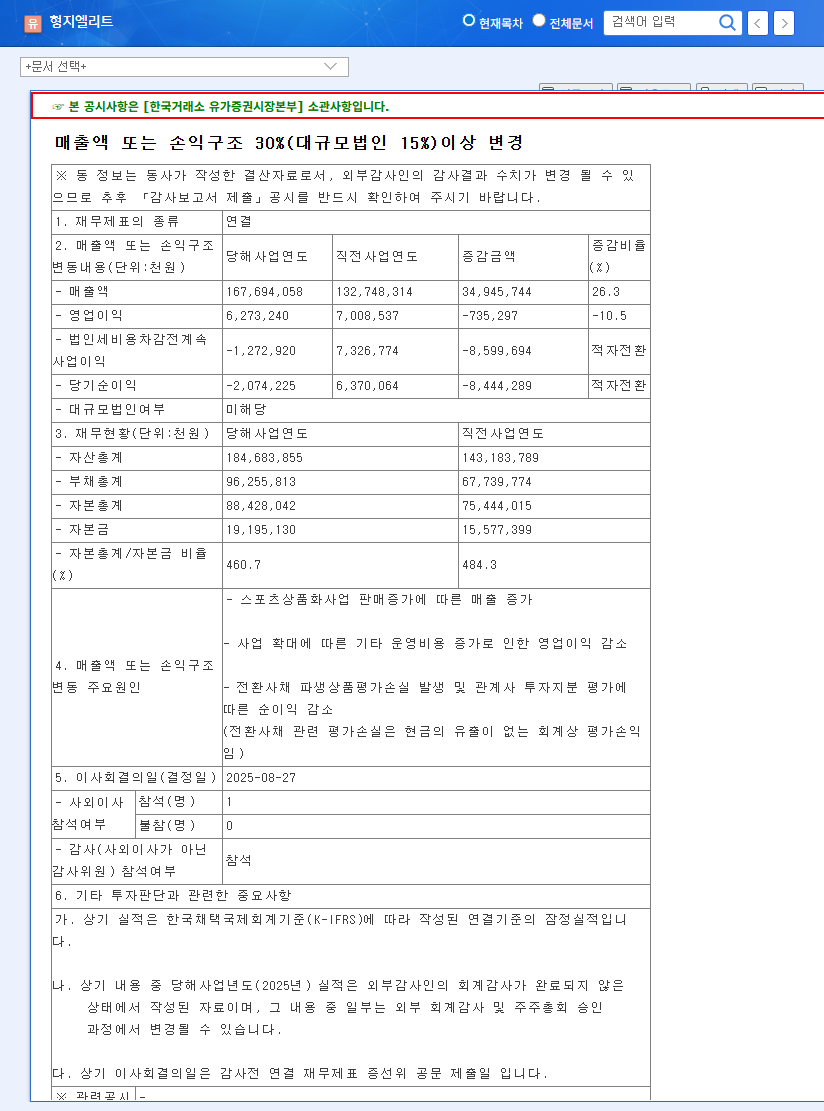

Hyungji Elite announced a change of more than 30% in sales or profit structure on August 27, 2025. While the recent quarter’s sales reached 58.4 billion KRW due to strong sales in the sports merchandising business, operating profit decreased to 6 billion KRW, and net income turned negative to -0.2 billion KRW.

2. Why Did This Happen?

- Sales Increase Factor: Increased sales in the sports merchandising business (professional sports teams, broadcasting content goods, etc.)

- Operating Profit Decrease Factor: Increased operating costs due to business expansion, increased cost of goods sold, increased SG&A expenses

- Net Loss Factor: Valuation loss on convertible bond derivatives (accounting valuation profit/loss), valuation loss on investments in affiliates

While the B2B business showed solid growth, the sluggish performance of the Elite student uniform business and increased costs for new investments and business expansion are analyzed as the main causes of the decline in profitability.

3. So What Should We Do?

Hyungji Elite is currently in a situation where growth and risk coexist. Investors should carefully consider the following factors when making investment decisions.

- Positive Factors: Growth momentum of the sports merchandising business, stable revenue base of the B2B business

- Negative Factors: Challenges in cost control and profitability improvement, intensifying competition in the Elite business, inventory burden, possibility of increased financial leverage, macroeconomic uncertainty

Investment Opinion: Hold – It is advisable to wait and see until clear momentum for earnings improvement is confirmed.

4. Investor Action Plan

- Monitor cost control and profitability improvement in future quarterly earnings

- Monitor changes in the competitive landscape of the Elite business and the company’s response strategies

- Identify new partnerships and product development trends in the sports merchandising business

- Confirm the temporary nature of the valuation loss on convertible bond derivatives and monitor improvements in financial soundness indicators

Frequently Asked Questions

What are Hyungji Elite’s main businesses?

Hyungji Elite operates B2B business and sports merchandising business, centering on the student uniform brand ‘Elite’.

What are the key takeaways from this earnings announcement?

While sales increased due to the growth of the sports merchandising business, operating profit and net income decreased and turned negative due to increased costs and accounting losses.

What should investors pay attention to?

Investors should pay close attention to cost control, profitability improvement, Elite business competitiveness, inventory management, and financial soundness.