1. What Happened? – Kakao Pay After-Hours Block Deal

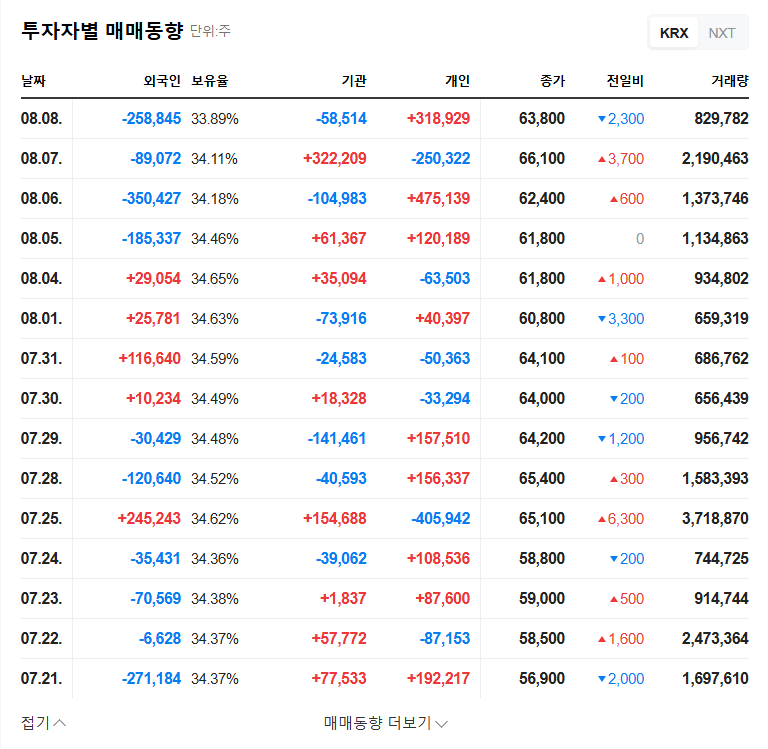

On September 3, 2025, a substantial block deal of Kakao Pay shares, amounting to 2,954,369 shares and approximately ₩153.3 billion, occurred during after-hours trading. The primary participants in this transaction were foreign investors, with large volumes both buying and selling.

2. Why Did This Happen? – Analyzing the Block Deal

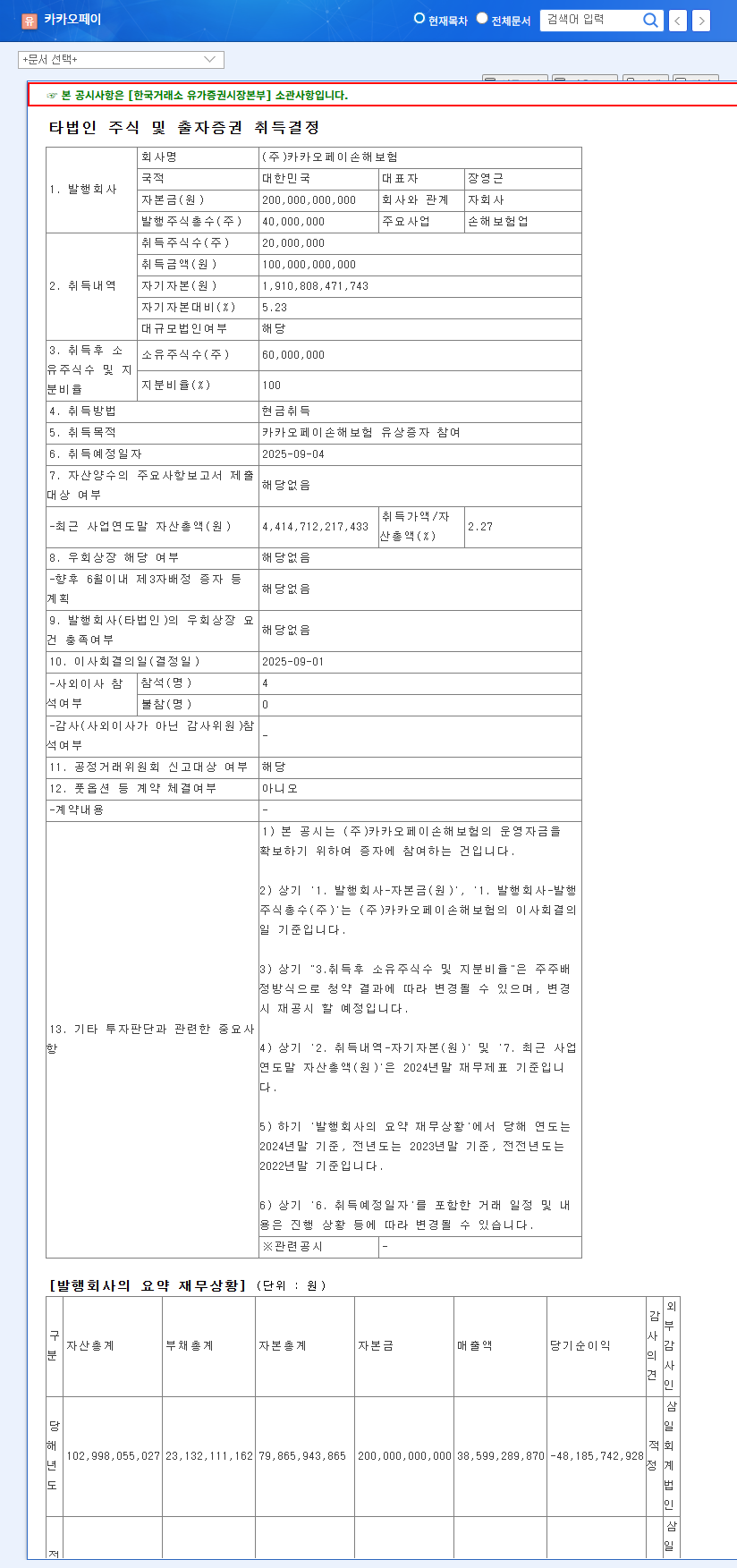

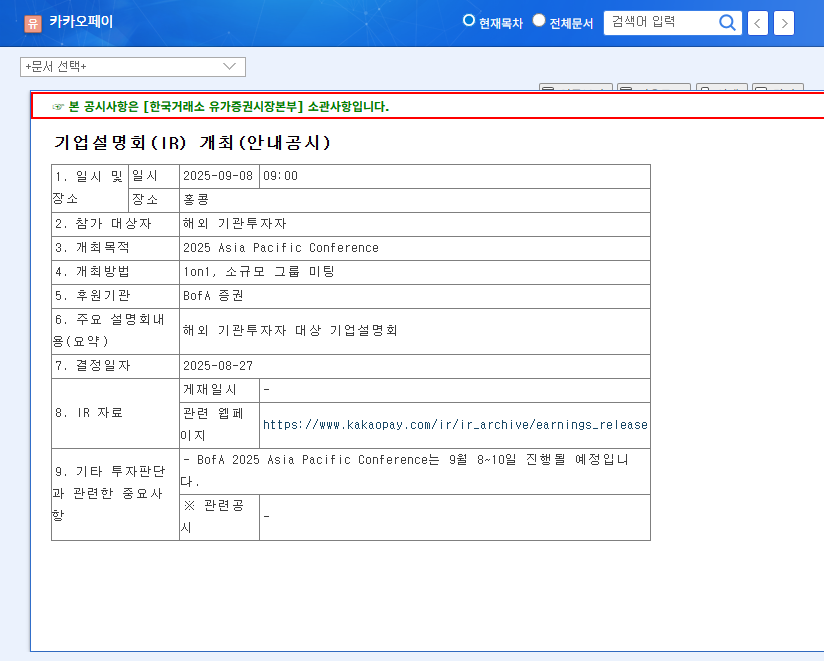

The after-hours block deal likely reflects portfolio adjustments by institutional or large-scale investors. The substantial involvement of foreign investors warrants a closer examination of their trading patterns. Currently, there are no identified factors directly impacting Kakao Pay’s fundamentals. The revised semi-annual report of Kakao Pay Securities has minimal impact on the company’s fundamentals, and the high net capital ratio of 949.02% demonstrates robust financial health.

3. What’s Next? – Market Impact and Future Outlook

While this block deal may introduce short-term volatility in Kakao Pay’s stock price, the long-term outlook remains positive. South Korea’s base interest rate remains steady at 2.50%, with the US and Europe also maintaining a hold stance, limiting interest rate-related uncertainty. Kakao Pay’s stock price has generally been on an upward trend, and the surge in trading volume in June 2025 indicates a positive market response. However, the large-scale trading patterns of foreign investors should be closely monitored as they could be a crucial indicator for future price direction.

4. What Should Investors Do? – Investment Strategy

- Short-term investors: Pay close attention to the opening price and intraday movements on the next trading day and be cautious of volatility. A wait-and-see approach is recommended.

- Long-term investors: Considering Kakao Pay’s solid fundamentals, a positive long-term outlook can be maintained. Continuous monitoring of foreign investor trends and company-related news is crucial.

Frequently Asked Questions (FAQ)

What is an after-hours block deal?

It refers to a large-scale stock transaction that occurs outside of regular trading hours. It often involves institutional investors and is frequently conducted as a block deal.

How will this block deal affect Kakao Pay’s stock price?

It may increase stock price volatility in the short term, but the long-term impact is expected to be limited, as there is no significant change in Kakao Pay’s fundamentals.

How should investors respond?

Short-term investors should be wary of volatility, and long-term investors are advised to continuously monitor Kakao Pay’s fundamentals and foreign investor trends.