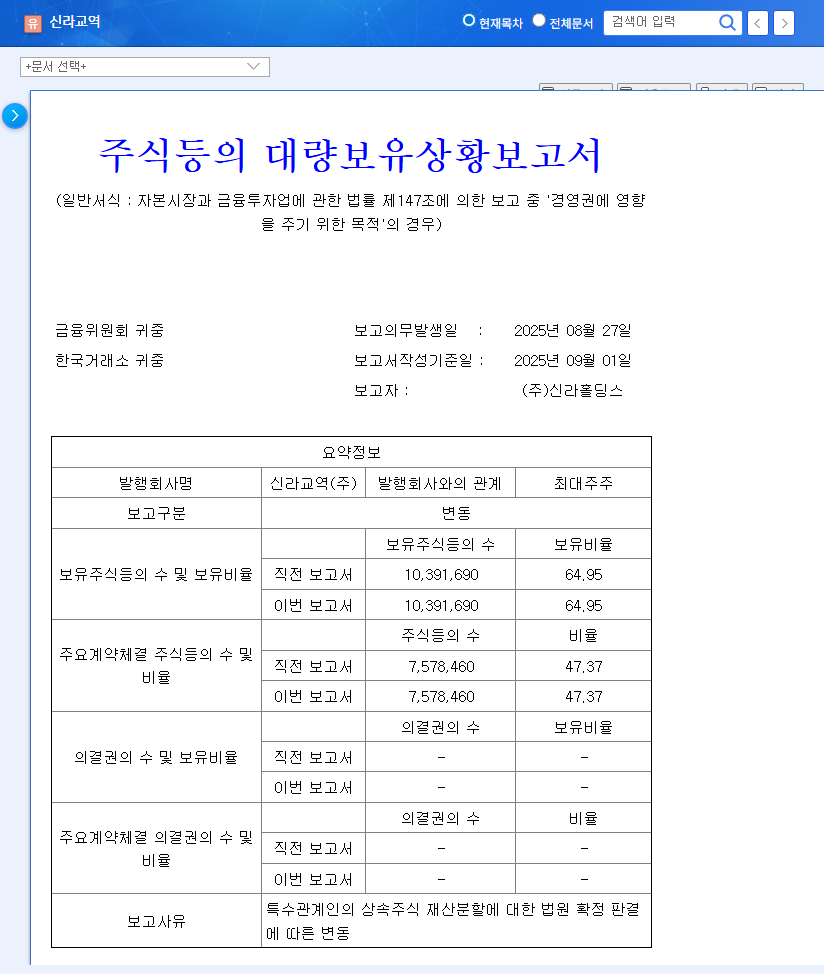

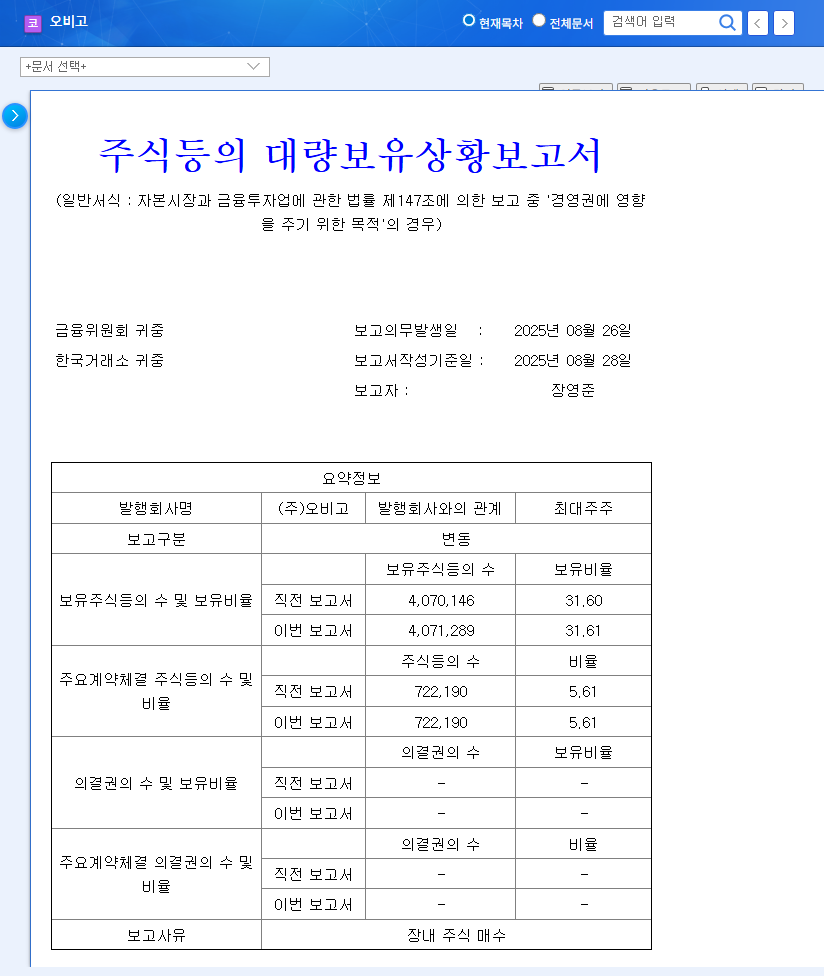

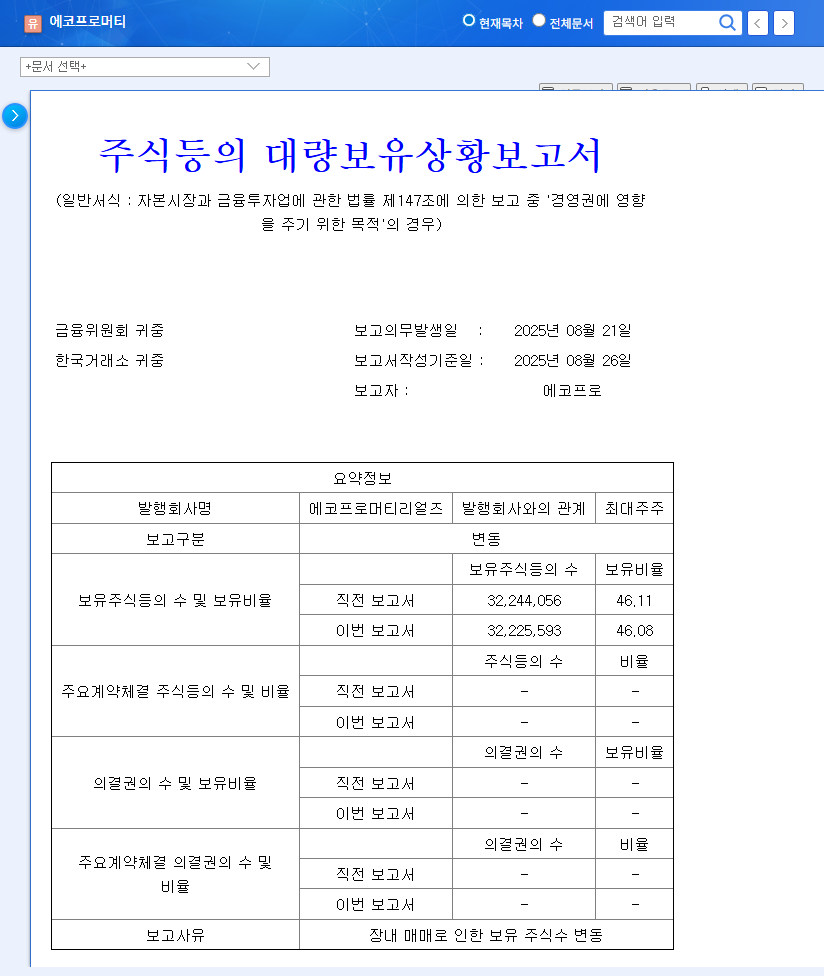

1. What Happened?: Analysis of Shilla Trading’s Shareholding Change Disclosure

On September 1, 2025, Shilla Trading disclosed its ‘Report on the Status of Large Shareholdings’. The key takeaway is the inheritance and redistribution of shares among related parties. While Shilla Holdings maintained its 64.95% stake, there were changes in the shareholdings of related parties, including Park Jae-heung. While no immediate impact on management is expected, continuous monitoring of potential future changes in the ownership structure is necessary.

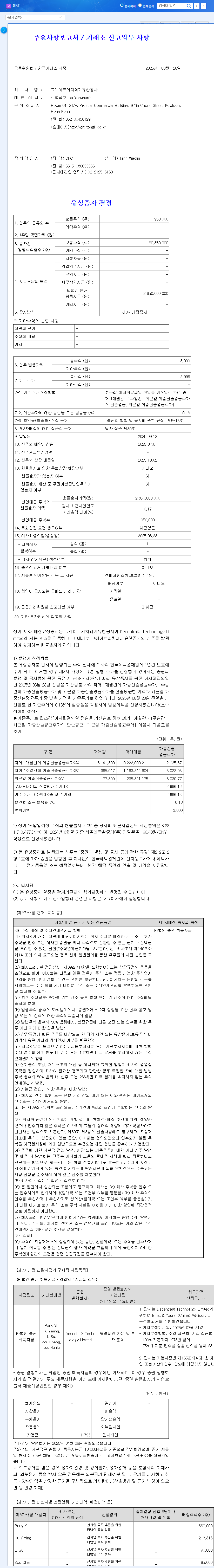

2. Why It Matters: Fundamental Analysis and Market Conditions

Shilla Trading is currently facing a challenging business environment. Declining sales and net losses continue due to poor performance in the pelagic fishing and seafood distribution sectors, and cash flow and financial soundness are also deteriorating. External headwinds such as the global economic slowdown, increasing exchange rate volatility, and rising interest rates are also adding pressure. However, the growth potential of some business segments (dining, canned tuna) and efforts to improve the financial structure can be positive factors.

3. What To Do: Investment Strategy

The event itself is expected to have a limited impact on stock prices in the short term. However, considering the deteriorating fundamentals and external uncertainties, a cautious approach to investment is necessary. Careful investment decisions should be made by closely monitoring the recovery of key business segments, changes in macroeconomic indicators, and the company’s efforts to strengthen its business competitiveness.

4. Investor Action Plan: Step-by-Step Guide

- Step 1: Observe and Gather Information – Continuously monitor fundamental improvements and changes in the external environment.

- Step 2: Check Key Indicators – Look for signs of recovery in the pelagic fishing and seafood distribution sectors.

- Step 3: Risk Management – Establish a risk management strategy for macroeconomic volatility, including exchange rates, oil prices, and interest rates.

- Step 4: Maintain a Long-Term Perspective – Focus on the company’s long-term growth potential without being swayed by short-term stock price fluctuations.

Q: How will Shilla Trading’s recent shareholding change affect its stock price?

A: This change in shareholding is due to inheritance within the major shareholder group and is expected to have a limited impact on stock price in the short term. However, it’s crucial to make investment decisions based on a comprehensive consideration of fundamentals and market conditions.

Q: What are Shilla Trading’s core businesses?

A: Shilla Trading engages in various businesses including pelagic fishing, seafood distribution, steel, dining, and canned tuna. The recent poor performance of the pelagic fishing and seafood distribution sectors is a major concern.

Q: What should investors be aware of when considering investing in Shilla Trading?

A: It’s important to closely monitor signs of fundamental improvement, changes in the external environment, recovery of key business segments, and establish a risk management plan for macroeconomic volatility. Investments should be considered from a long-term perspective.