1. What Happened?

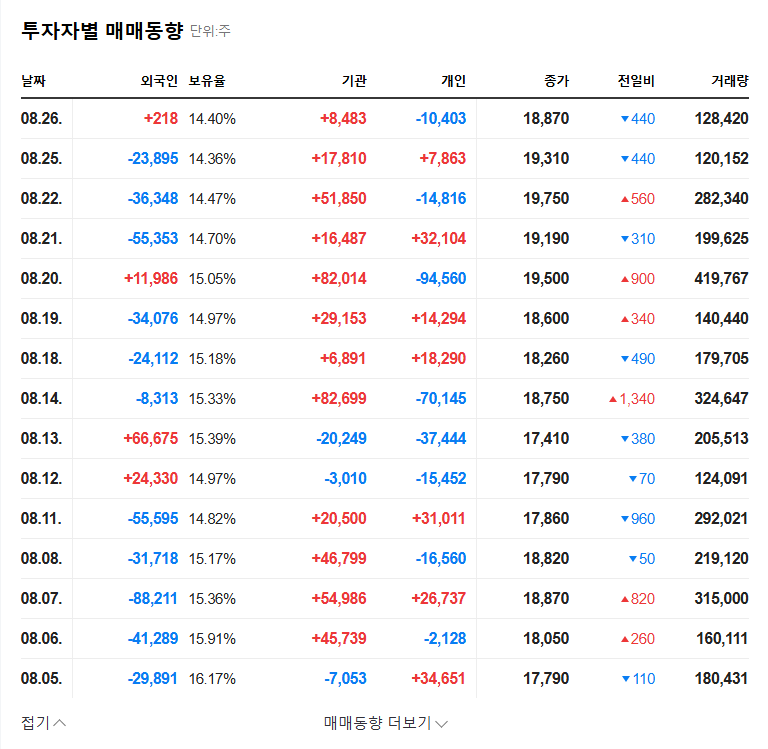

A significant transaction of 712,000 shares, totaling KRW 190.8 billion, took place in SK Hynix after-hours trading on August 28, 2025. Foreign investors were the primary buyers, with a net purchase of KRW 206.5 billion.

2. Why Did This Happen?

SK Hynix achieved excellent results in the first half of 2025, driven by the growth of the AI market and its leading position in the HBM market. The company achieved remarkable performance with sales of KRW 22.2 trillion and operating profit of KRW 9.2 trillion in Q2. Positive factors include its technological leadership in next-generation memory with mass production of 12-layer HBM3E and HBM4 sample shipments, and stable financial soundness. However, potential risk factors such as declining NAND ASP and global economic uncertainty exist.

3. What’s Next?

This large purchase by foreign investors is interpreted as a positive signal for SK Hynix’s growth potential. Considering the growth of the AI market and SK Hynix’s HBM technology competitiveness, the company has high long-term growth potential. Although short-term stock price volatility may occur, the outlook is positive from a medium- to long-term perspective. Continuous monitoring of macroeconomic indicators such as the won/dollar exchange rate, interest rates, and raw material prices, as well as the NAND market situation and intensifying competition, is necessary.

4. What Should Investors Do?

SK Hynix is a key beneficiary of the AI era, with high long-term growth potential. However, investment should always be approached with caution. It is crucial to monitor macroeconomic conditions and market volatility and develop an investment strategy that aligns with your investment style and goals.

What is SK Hynix’s main business?

SK Hynix primarily manufactures memory semiconductors, specifically DRAM and NAND flash. Recently, the company has been focusing on high-performance memory businesses, such as HBM (High Bandwidth Memory), in response to the growth of the AI market.

What is HBM?

HBM (High Bandwidth Memory) is a high-performance memory semiconductor used in AI, supercomputers, and other applications that require high-speed processing of large amounts of data.

What are the key factors to consider when investing in SK Hynix?

Investors should consider the volatility of the semiconductor market, intensifying competition, and changes in the macroeconomic environment. In particular, NAND flash price fluctuations and global economic uncertainty are factors to watch closely.