1. What Happened?

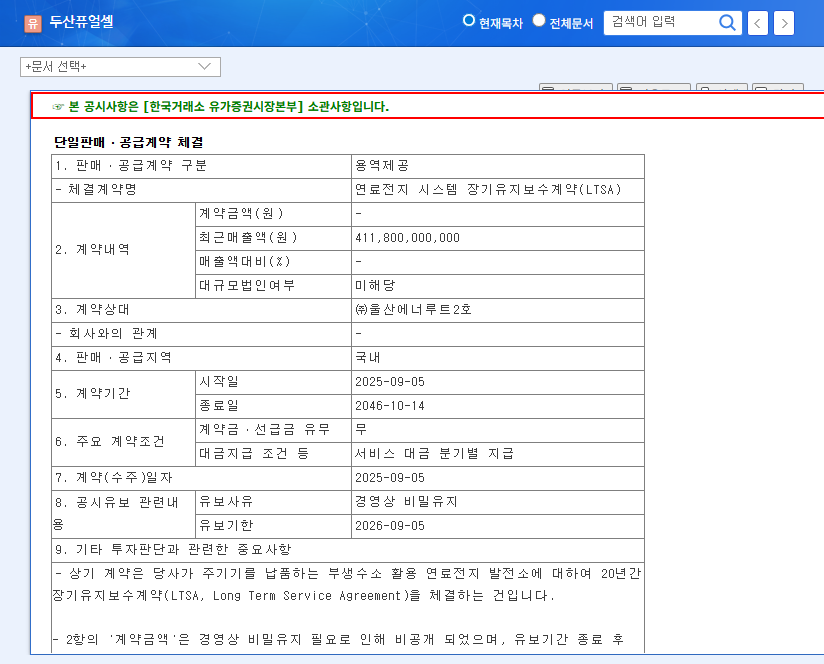

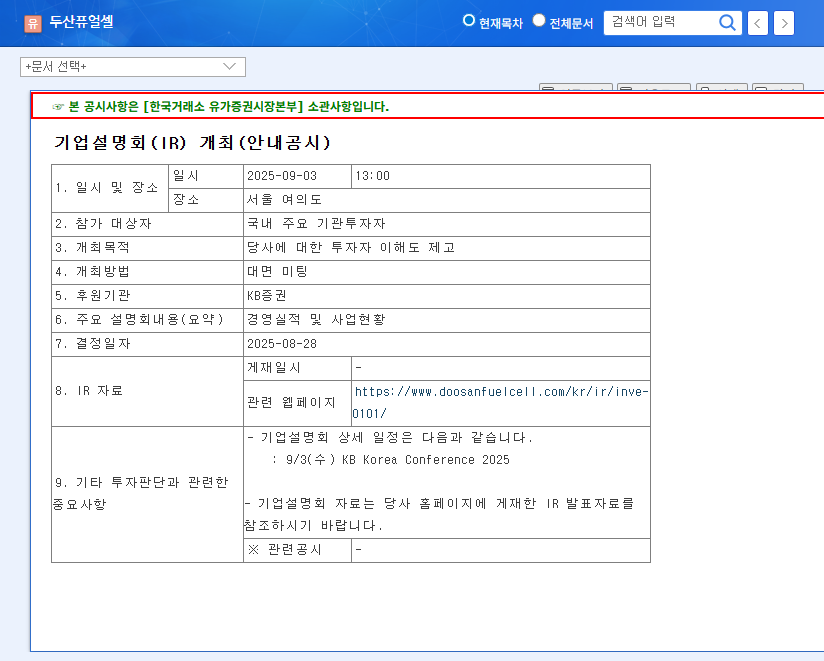

Doosan Fuel Cell signed a 21-year LTSA with Ulsan Enerute No. 2, commencing September 5, 2025, and ending October 14, 2046. The financial details of the contract were not disclosed.

2. Why Does It Matter?

This contract is positive for Doosan Fuel Cell, securing long-term revenue and strengthening customer relationships. Predictable revenue streams contribute to the company’s stability. However, the lack of disclosed financial details makes it difficult to assess the immediate financial impact.

3. So, What Should You Do?

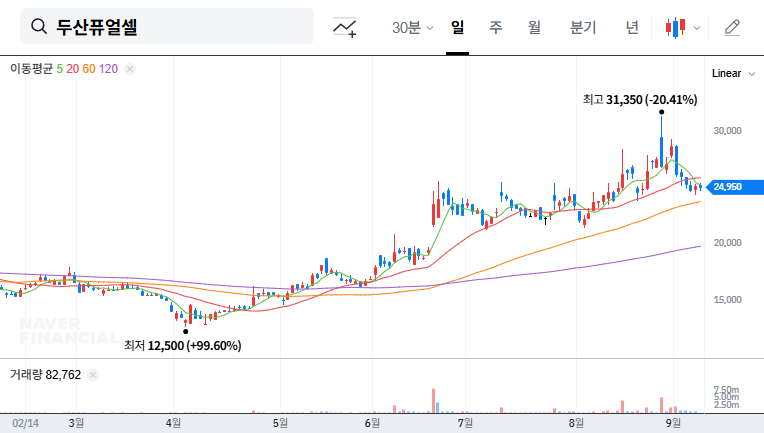

A cautious approach is recommended in the short term. While the long-term contract is a positive sign, the company’s deteriorating profitability, increasing inventory, and financial burdens revealed in the 2025 semi-annual report remain key challenges. A long-term perspective requires close monitoring of Doosan’s efforts to improve profitability, inventory management, new business performance, and financial health.

4. Investor Action Plan

- Short-term: Monitor stock performance and macroeconomic factors while remaining cautious.

- Long-term: Base investment decisions on the company’s ability to demonstrate fundamental improvements, financial stabilization, and successful new business ventures. Consider both the growth potential of the hydrogen industry and potential increased competition.

Frequently Asked Questions

Will this contract positively impact Doosan Fuel Cell’s stock price?

It could have a positive short-term impact, but significant gains are unlikely without fundamental improvements. Long-term stock performance hinges on the company’s ability to address underlying issues.

What are Doosan Fuel Cell’s biggest challenges currently?

Declining profitability, high inventory levels, and a weakened financial structure are key concerns. The deterioration of operating cash flow requires immediate attention.

Should I invest in Doosan Fuel Cell?

A wait-and-see approach is currently recommended. It’s prudent to assess the company’s progress in improving fundamentals and restoring financial health before making any investment decisions.