1. SK Hynix After-Hours Trading: What Happened?

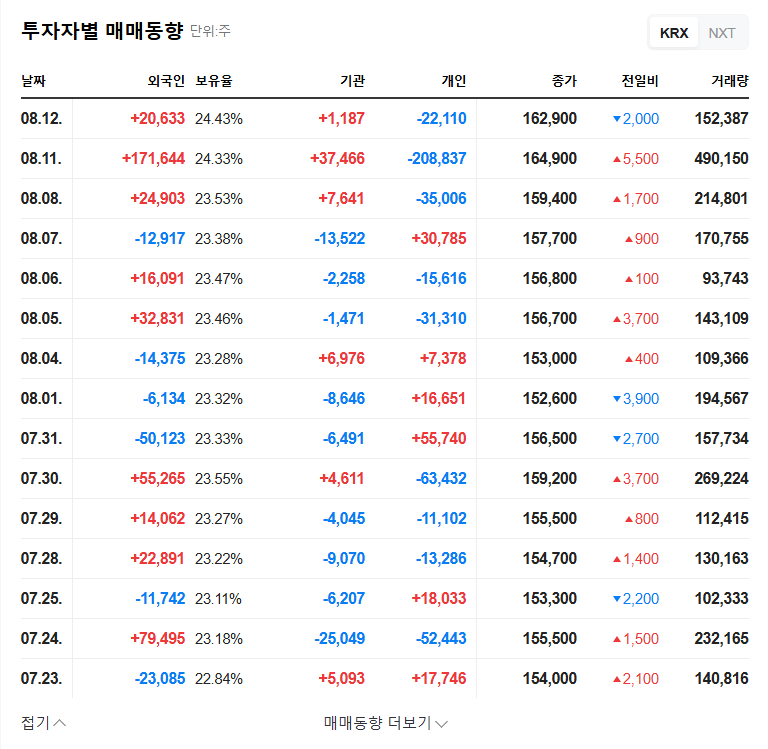

On September 1, 2025, a large block trade of 56,517 shares, approximately ₩14.5 billion, occurred in SK Hynix’s after-hours trading. Foreign investors were particularly active, with significant buy (₩145.7 billion) and sell (₩247.9 billion) orders, resulting in a net sell position.

2. Fundamental Analysis: Why Did This Happen?

SK Hynix’s performance in the first half of 2025 was very positive, driven by the rapid growth of the AI market and surging demand for HBM. Positive factors include technological leadership with HBM3E mass production and HBM4 development, recovery in the DRAM and NAND sectors, maintaining a solid market share, active R&D investment, and a stable financial structure. However, macroeconomic uncertainty and intensifying competition remain potential risk factors.

3. Future Outlook and Investment Strategy: What Should Investors Do?

The net selling by foreign investors in after-hours trading represents a short-term supply burden. However, considering the growth of the AI market and SK Hynix’s strong fundamentals, this could be a buying opportunity. The growth of high-value-added products centered around HBM and the recovery of the DRAM and NAND markets will support SK Hynix’s mid- to long-term growth.

Investment Opinion: Buy

- Strong beneficiary of the AI market

- Solid fundamentals

- Positive macroeconomic environment (expectations of interest rate cuts, etc.)

- Positive interpretation of short-term events (buying opportunity)

Risk factors: Global economic slowdown, geopolitical risks, intensifying competition, increased exchange rate volatility

FAQ

How will the SK Hynix after-hours trading affect the stock price?

It may increase stock price volatility in the short term, but considering the company’s solid fundamentals, the long-term impact is expected to be limited.

What is HBM and why is it important?

HBM (High Bandwidth Memory) is a high-bandwidth memory chip essential for high-performance computing such as AI. SK Hynix, as a leader in the HBM market, is directly benefiting from the growth of the AI market.

Should I invest in SK Hynix?

This report is not intended as investment advice. Investment decisions should be made at your own discretion and responsibility. However, this report presents SK Hynix’s positive fundamentals and growth prospects.