What Happened?

On September 8, 2025, MS Autotech’s CEO, Song Hye-seung, significantly increased their stake from 0% to 46% for the purpose of influencing management. This was due to stock acquisition from a merger and the signing of a major contract related to held shares.

Why is MS Autotech Struggling?

Since its transition to a holding company structure in 2024, MS Autotech has been facing challenges such as declining profitability and increasing debt ratios. As of the first half of 2025, consolidated revenue decreased by 7.28% year-on-year, and operating profit decreased by 58.5%. Net income recorded a net loss of 478 billion won. On a separate basis, revenue decreased by 90.4%, and the net loss expanded to 458 billion won. This is attributed to factors such as declining sales of global electric vehicle companies and Hyundai Motor Group, as well as the poor performance of its subsidiary, MS AutoSys. External factors such as the rise in the won/dollar exchange rate and increased interest rate volatility are also having a negative impact.

So, What Should Investors Do?

While Song Hye-seung’s increased stake raises hopes for management stabilization, it’s difficult to expect a long-term increase in investment value without addressing the fundamental issue of weakening fundamentals.

- Short-term perspective: Closely monitor subsidiary performance improvements, MS Autotech’s own profitability recovery, and exchange rate and interest rate volatility.

- Mid- to long-term perspective: Evaluate CEO Song Hye-seung’s management strategies and execution, and confirm whether there is a real improvement in corporate value.

Currently, a cautious approach is recommended for investing in MS Autotech. Focus on the recovery of the company’s intrinsic value rather than short-term stock price fluctuations, and carefully observe management changes and business restructuring processes.

Frequently Asked Questions (FAQ)

What is MS Autotech’s main business?

MS Autotech transitioned to a holding company through a spin-off in 2024. Its subsidiary, MS AutoSys, is responsible for the automotive body parts manufacturing business.

Will CEO Song’s stake acquisition positively impact the stock price?

While there are expectations for management stabilization, stock price increases may be limited without fundamental improvements.

Should I invest in MS Autotech?

A cautious approach is recommended. It’s advisable to make investment decisions after carefully reviewing fundamental improvements and management strategies.

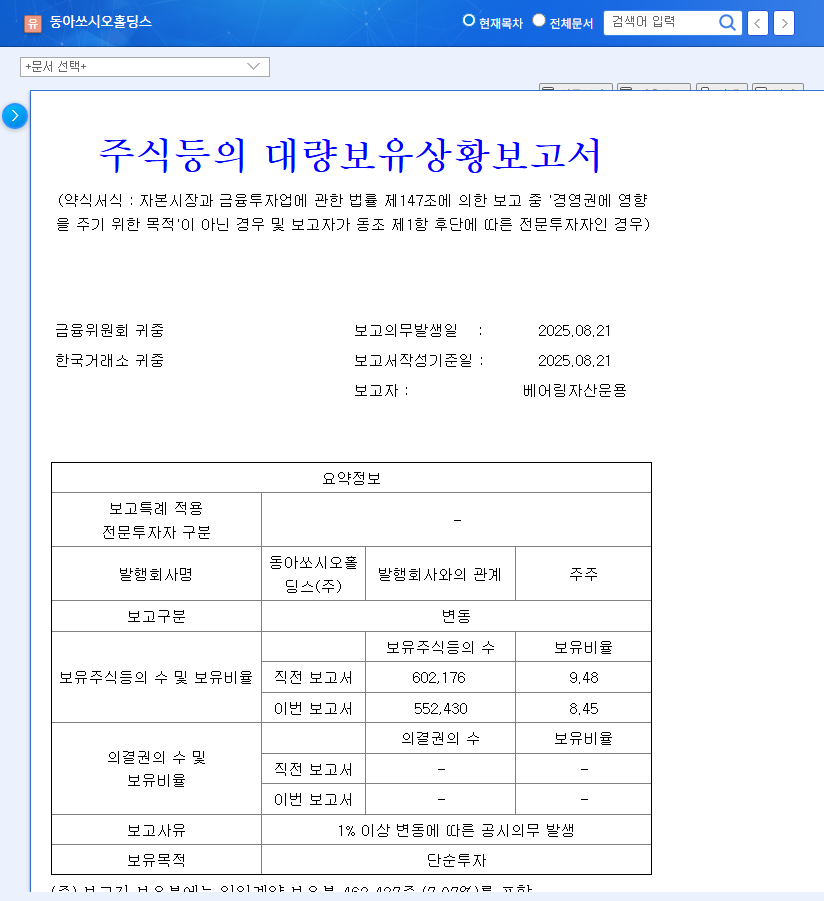

![Wontech Stock Update: Analyzing Recent Ownership Changes and Investment Strategies [September 2025] 대표 차트 이미지](https://note12345.mycafe24.com/wp-content/uploads/2025/09/336570-1.png)

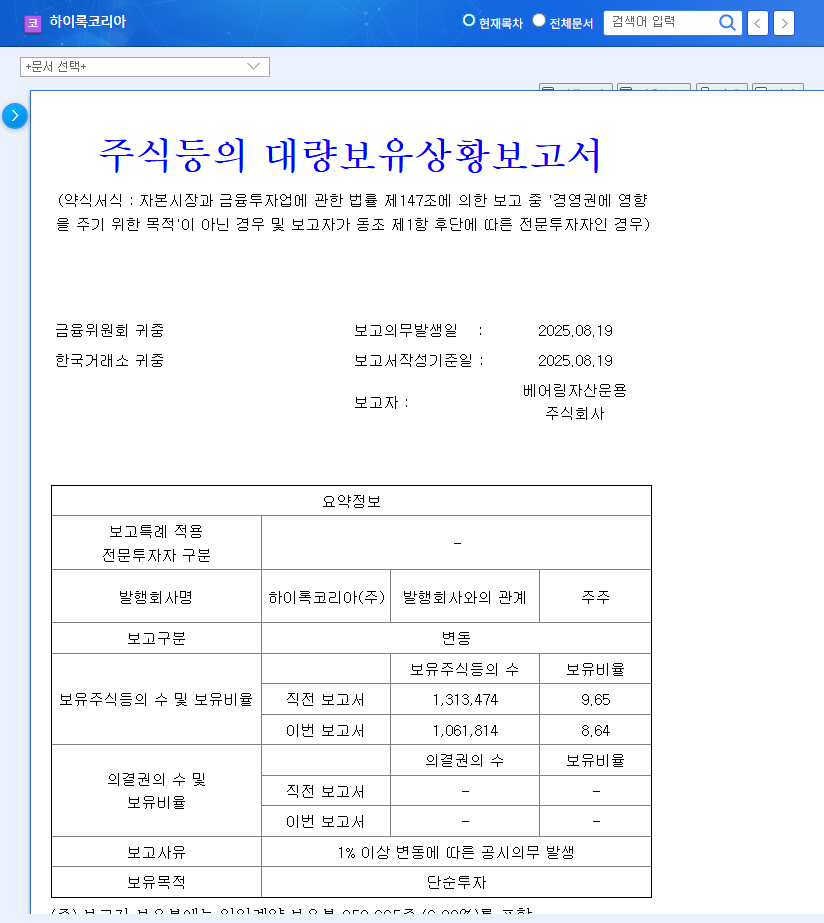

![Wontech Stock Update: Analyzing Recent Ownership Changes and Investment Strategies [September 2025] 관련 이미지](https://note12345.mycafe24.com/wp-content/uploads/2025/09/336570_공시-1.png)

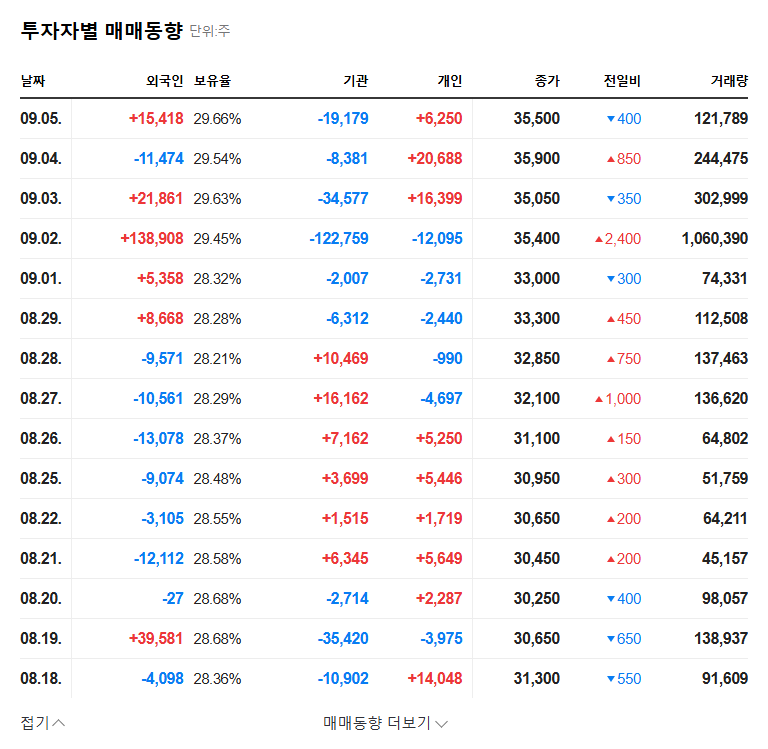

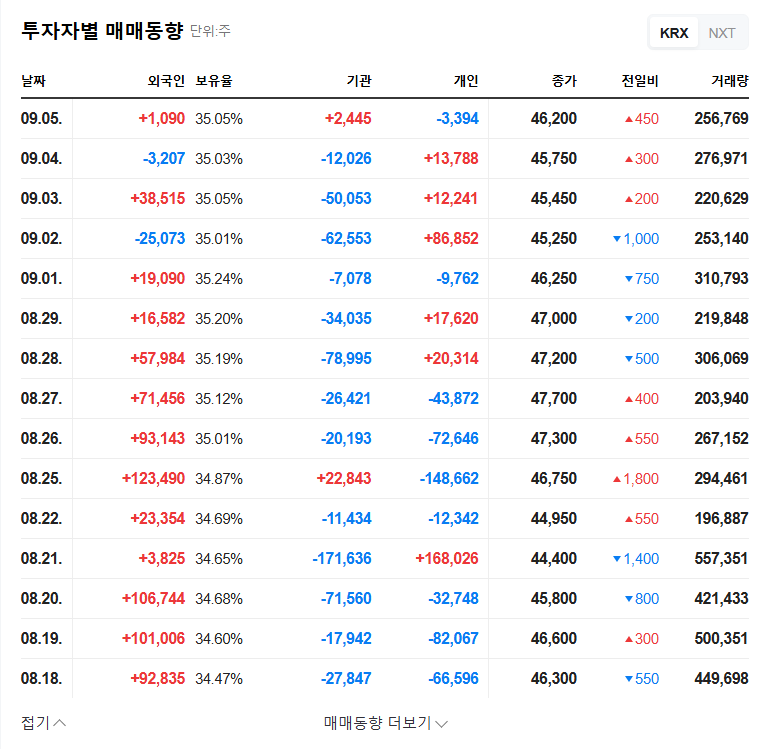

![Wontech Stock Update: Analyzing Recent Ownership Changes and Investment Strategies [September 2025] 관련 이미지](https://note12345.mycafe24.com/wp-content/uploads/2025/09/336570_투자자동향-1.png)