1. What’s Happening with Hyundai Department Store?

Hyundai Department Store experienced mixed results in the first half of 2025. While the turnaround and robust profitability of the furniture manufacturing division (Zinus) were positive, the sluggish performance of the department store and duty-free divisions remains a challenge. Weakening consumer sentiment and intensified competition are cited as the main causes, with the duty-free division particularly struggling due to changes in inbound tourist spending patterns and increased competition.

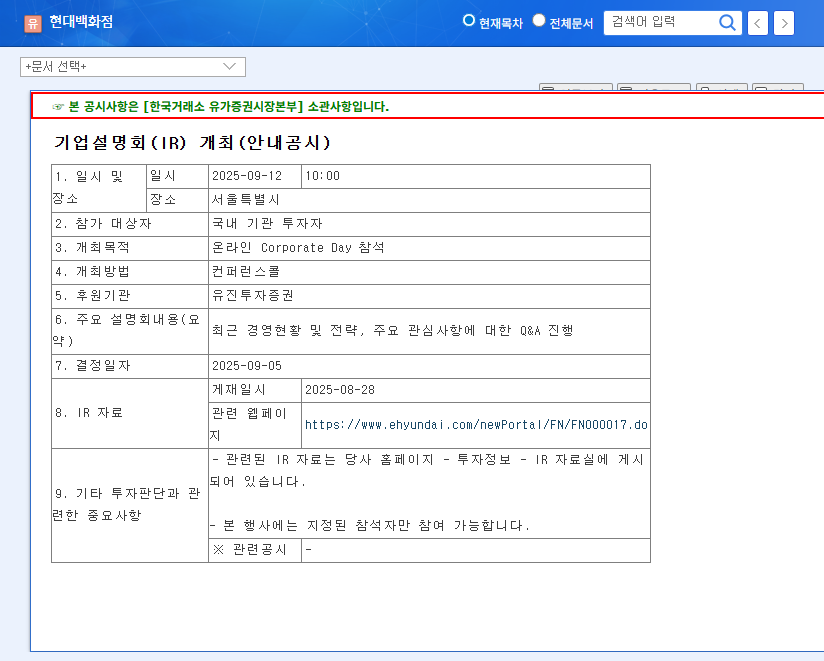

2. Why Does it Matter? – Future Strategies Revealed at the IR

This IR presents a crucial opportunity for Hyundai to outline its strategies for overcoming current challenges and achieving future growth. Investors will focus on innovation strategies for the department store and duty-free divisions, the potential application of Zinus’s success to other business segments, and strategies to address the uncertain macroeconomic environment. The new store opening plan and online channel strengthening strategy will be particularly important indicators of future growth momentum.

3. What Should Investors Do? – Action Plan

Investors should carefully analyze the information presented at the IR and objectively assess the company’s future growth potential. It’s crucial to seek answers to the following questions:

- • What are the specific plans to improve profitability in the department store and duty-free sectors?

- • How will Hyundai apply the Zinus success model to other business segments?

- • What are the strategies to address the volatile macroeconomic environment?

Monitor stock price movements after the IR and gather additional information to continuously adjust your investment strategy.

Frequently Asked Questions (FAQ)

What are Hyundai Department Store’s main business segments?

Hyundai Department Store’s main business segments are department stores, duty-free shops, and furniture manufacturing (Zinus).

What are the key points investors should focus on in this IR?

Key points include innovation strategies for department stores and duty-free shops, applying Zinus’s success to other segments, and strategies to address the macroeconomic environment.

What precautions should investors take when investing in Hyundai Department Store?

Investors should analyze IR information, monitor stock price movements, and gather additional information to adjust their investment strategies accordingly.