1. What Happened to WeMade?

WeMade reported dismal H1 2025 earnings, with revenue of ₩258.6B and a net loss of ₩48.9B. The slump in the mobile game sector and slow growth in the blockchain business are cited as the main reasons. Furthermore, the company recently lost a lawsuit filed by former and current employees, requiring it to pay approximately ₩9.9B.

2. Why Did This Happen?

Struggling Game Business: Increased competition in the mobile game market, lack of new titles, and aging of existing IPs are contributing factors. While the ‘Legend of Mir’ IP licensing business generates stable revenue, its contribution to overall sales is minimal.

Uncertainty in Blockchain Business: WeMade is expanding its blockchain business centered around the ‘WEMIX’ platform, but volatility in the cryptocurrency market and regulatory issues hinder significant achievements. The success of ‘Night Crow Global’ will be a crucial factor in the future of this business.

Lost Lawsuit: The lost lawsuit against former and current employees damages the company’s image and adds financial burden.

3. What’s Next for WeMade?

WeMade needs to leverage its ‘Legend of Mir’ IP, expand its licensing business, and focus on developing blockchain games to secure long-term growth engines. It must also strengthen its financial health by managing debt and reducing debt ratios.

4. What Should Investors Do?

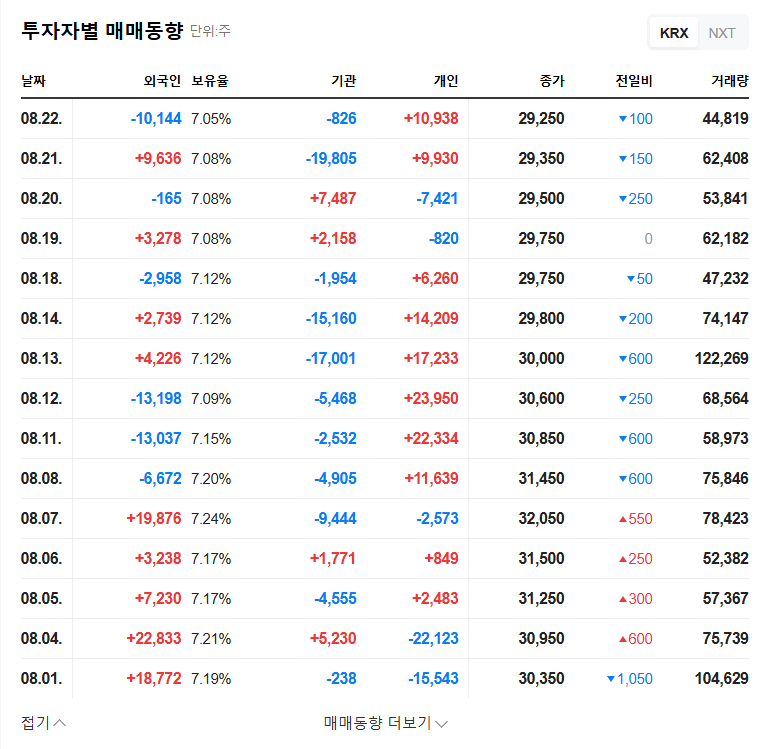

- In the short term, be wary of increased stock volatility. Carefully monitor WeMade’s performance improvement and the outcome of its blockchain business, adjusting investment strategies accordingly.

- In the long term, pay attention to the growth potential of WeMade’s IP power and blockchain business. Consider the success of ‘Night Crow Global,’ new game releases, and improvements in financial health when formulating long-term investment strategies.

Frequently Asked Questions

What are WeMade’s main businesses?

WeMade’s main businesses are game development and publishing, IP licensing, and blockchain.

Why are WeMade’s recent earnings so poor?

Several factors contributed, including increased competition in the mobile game market, lack of new titles, aging of existing IPs, and uncertainty in the blockchain business.

What is the outlook for WeMade?

WeMade is aiming for growth through the expansion of its ‘Legend of Mir’ IP-based business and blockchain game development. The success of ‘Night Crow Global’ will be a critical factor.