1. What’s Happening at Davolink?

Davolink’s Q1 2025 performance can be summarized in one phrase: financial crisis. The debt-to-equity ratio has skyrocketed to 546.35%, accompanied by a ₩15.1 billion operating loss. Adding to the woes is a staggering ₩296.6 billion loss from derivatives.

2. Why the Decline?

The primary culprits are failed derivative investments and increased debt from convertible bond issuance. The underperformance of their core network solutions business further exacerbated the situation. While new business ventures hold long-term potential, they currently add to the financial strain.

3. What’s Next for Davolink?

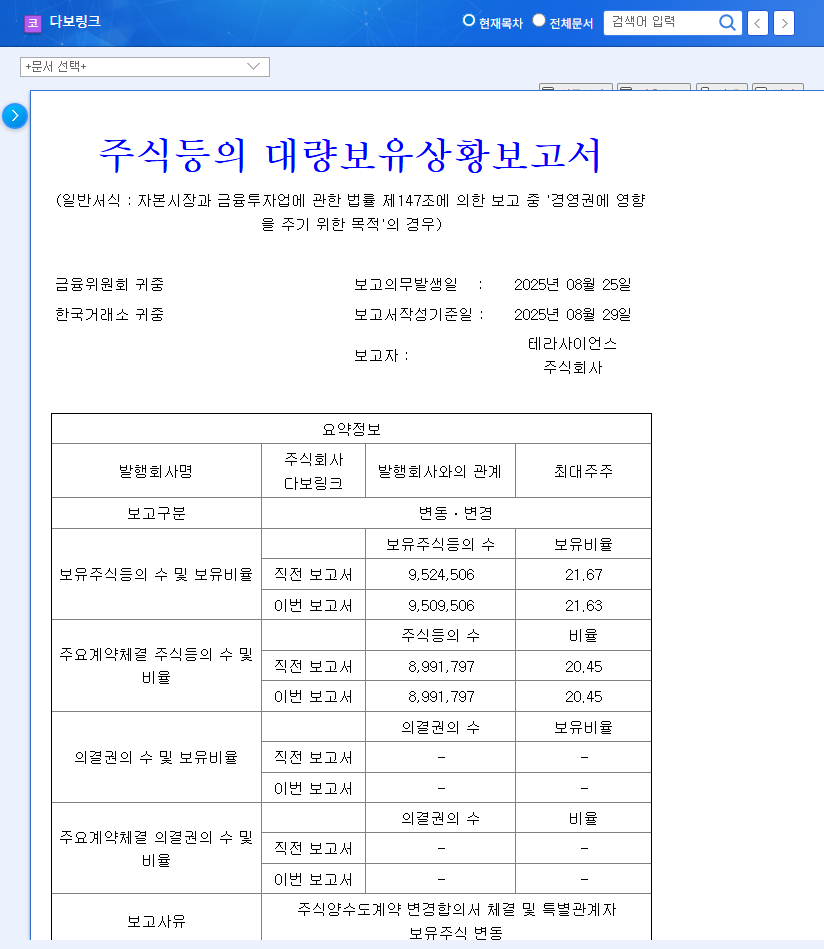

Davolink faces the daunting task of restructuring its finances and revitalizing its core business. While Terascience’s minor stake adjustments are not expected to have a significant immediate impact, continued monitoring is essential. The future stock price hinges on the company’s ability to address these fundamental issues.

4. Investor Action Plan

- Scrutinize financial restructuring plans: Carefully evaluate debt reduction and capital raising strategies.

- Assess the likelihood of operational recovery: Analyze the effectiveness of revenue growth and cost-cutting initiatives.

- Evaluate derivative risk management: Understand the potential for further losses and the company’s risk mitigation plans.

- Monitor new business performance: Track the concrete results and financial contributions of new ventures.

What is Davolink’s main business?

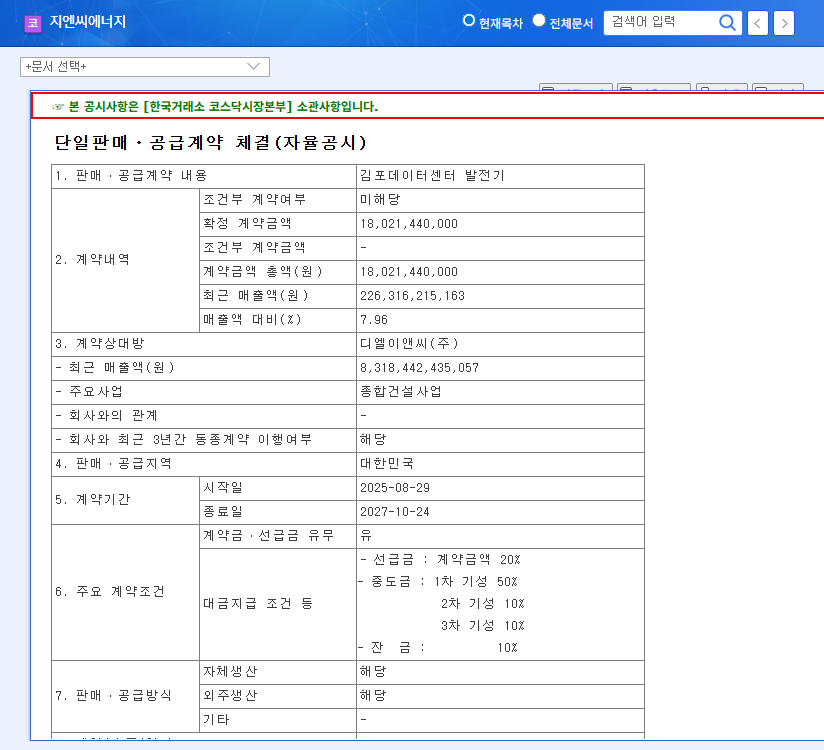

Davolink specializes in network solutions. They are currently pursuing new ventures in superconductors, generators, and renewable energy.

Why did Davolink’s Q1 2025 earnings decline?

The decline is primarily attributed to losses from derivative investments, increased debt from convertible bond issuances, and weakness in their core business.

Should I invest in Davolink?

Davolink is currently facing a serious financial crisis. Before making any investment decisions, thoroughly evaluate their financial restructuring plans, the potential for operational recovery, and their derivative risk management strategies.