1. What Happened? GnC Energy Signs $10 Million Contract for Emergency Generators in the Philippines

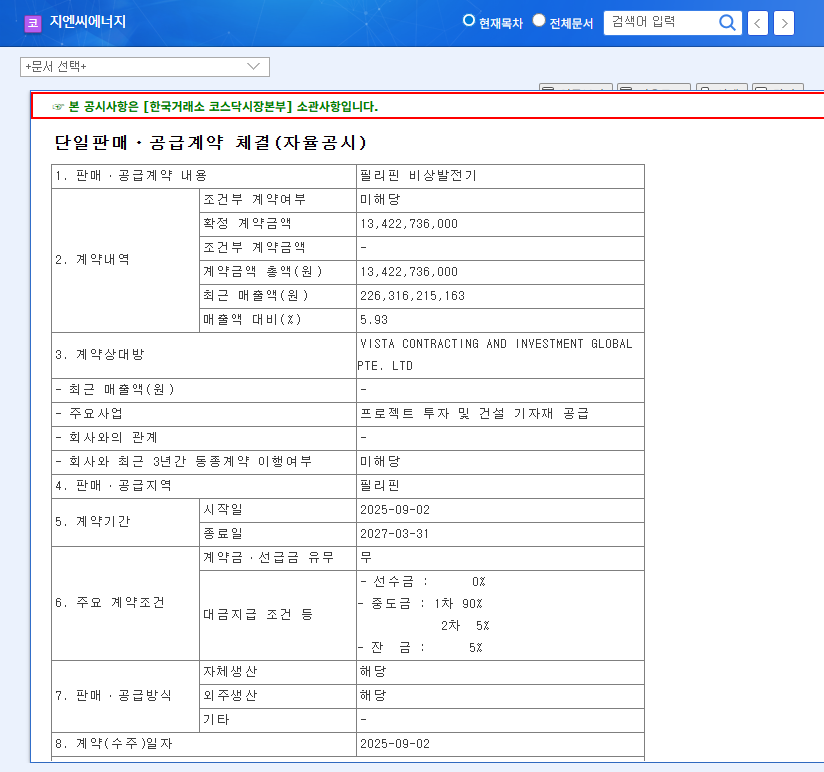

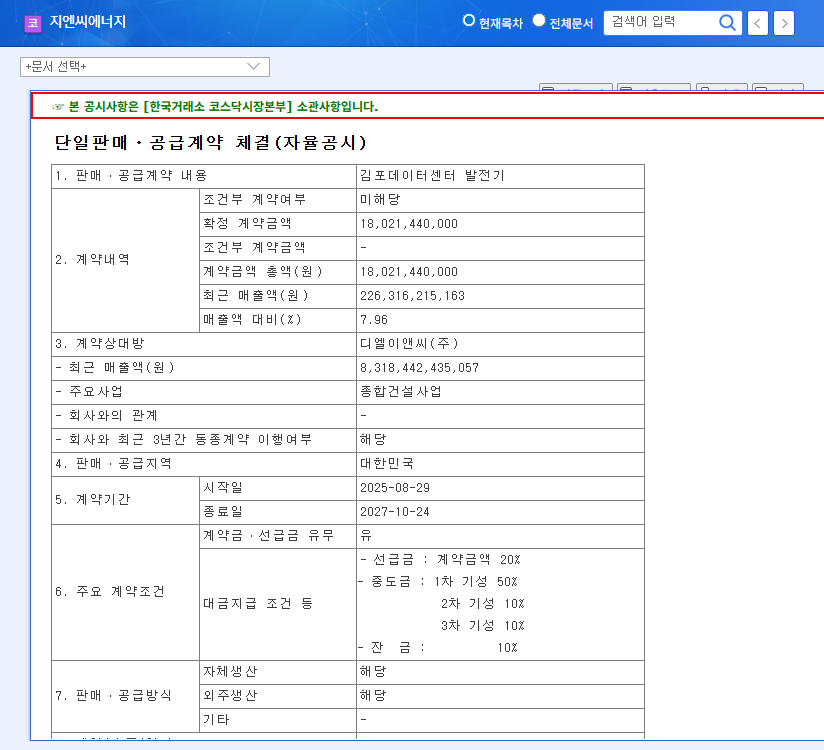

GnC Energy announced on September 3, 2025, that it has signed a $10 million contract with VISTA CONTRACTING AND INVESTMENT GLOBAL PTE. LTD to supply emergency generators to the Philippines. The contract period runs from September 2, 2025, to March 31, 2027, totaling 1 year and 7 months. This represents 5.93% of GnC Energy’s total sales.

2. Why Does it Matter? Overseas Expansion and Expected Performance Improvement

This contract is a key component of GnC Energy’s overseas expansion strategy. Considering the recent decline in sales within the generator business segment, this contract serves as an important indicator of growth potential in overseas markets. It aligns with the company’s strategy of securing sustainable growth drivers through strengthening its renewable energy business and expanding its overseas presence.

3. So What? Expected Short-Term Stock Price Momentum and Long-Term Growth Driver

This contract is expected to have a positive impact on the stock price in the short term. The $10 million contract will not only contribute to increased sales but is also expected to help secure long-term growth drivers by increasing the likelihood of additional overseas orders. The current KRW/USD exchange rate of around 1,391 is also expected to have a positive impact on the KRW value of the contract. However, long-term stock price trends will depend on overall business performance and changes in the macroeconomic environment.

4. What Should Investors Do? Continuous Monitoring and Maintaining a Long-Term Perspective

- Monitor Contract Implementation: Continuously check the successful implementation of the contract.

- Profitability Analysis: Analyze the actual profitability of the contract.

- Monitor Macroeconomic Changes: Analyze the impact of macroeconomic changes such as exchange rates and raw material prices.

- Maintain a Long-Term Perspective: It is important to make investment decisions based on the company’s long-term growth potential rather than reacting to short-term stock price fluctuations.

FAQ

How will this contract impact GnC Energy’s financial status?

The $10 million contract is expected to positively affect sales growth and improve cash flow. In particular, it can contribute to improving the performance of the generator business segment, which has been sluggish recently.

What is the outlook for GnC Energy’s stock price?

This contract can provide positive momentum for the stock price in the short term. However, the long-term stock price can be affected by various factors such as the company’s performance, the macroeconomic environment, and market conditions. Continuous attention and analysis are required.

What is GnC Energy’s overseas business expansion strategy?

GnC Energy has a strategy to expand its overseas business by strengthening its renewable energy business and entering emerging markets, including Southeast Asia. This contract is part of this strategy, and more active overseas market entry is expected in the future.