1. What Happened? Contract Termination Adds to Existing Financial Woes

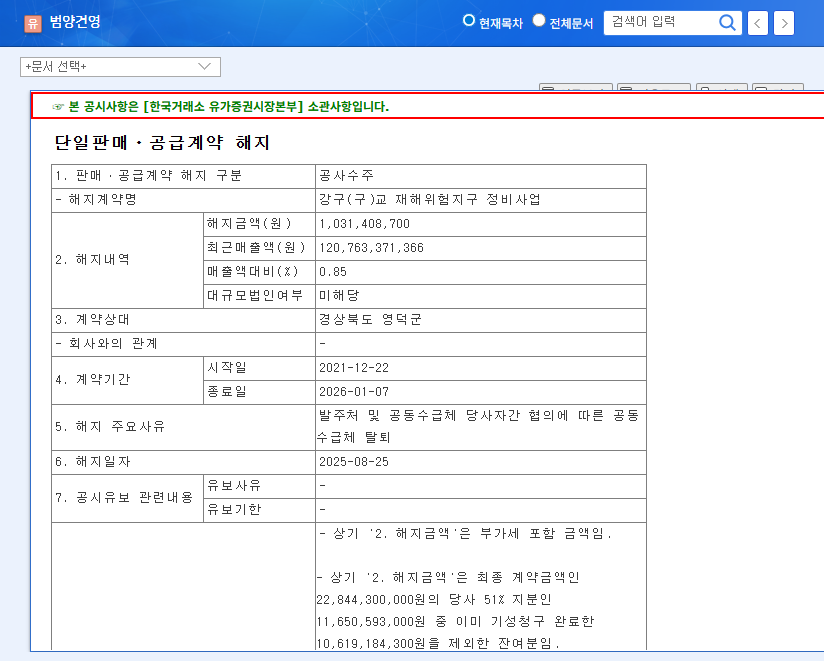

Bumyang Construction terminated its contract for the ‘Ganggu Bridge Disaster-Prone Area Maintenance Project,’ resulting in a ₩1 billion loss (0.85% of revenue). While seemingly insignificant, this event exacerbates the company’s already fragile financial position.

2. Why is this a Problem? Pre-existing Financial Instability Magnifies the Impact

Bumyang Construction is facing significant financial challenges, including substantial losses from investments in related companies, deteriorating financial health of its largest shareholder, continuous poor operating performance, and high debt ratios. The contract termination adds another layer of complexity to an already dire situation.

- Investment Losses: Accumulated losses from investments in related companies have reached approximately ₩21.5 billion.

- Largest Shareholder’s Financial Deterioration: Declining equity and increasing net losses raise concerns about the company’s ability to secure funding.

- Poor Operating Performance: Declining sales, operating losses, and net losses highlight the company’s weak fundamentals.

- High Debt and Liquidity Issues: The company faces serious liquidity challenges due to high debt ratios and low current ratios.

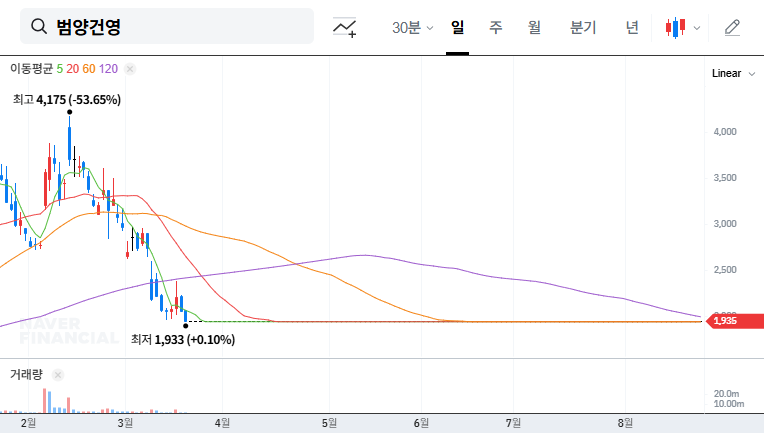

3. What are the Implications? Negative Investor Sentiment and Potential Stock Decline

The contract termination is likely to further dampen investor sentiment, potentially leading to additional downward pressure on the stock price. The challenging macroeconomic environment, including a downturn in the construction sector, global economic uncertainty, and a weakening Korean Won, further complicates the outlook for Bumyang Construction.

4. What Should Investors Do? Exercise Extreme Caution – Reduce Holdings or Consider Speculative Buy with High Risk Tolerance

Investing in Bumyang Construction carries significant risk. Reducing holdings is recommended. For investors considering a speculative buy, extreme caution is advised. Closely monitor the company’s restructuring plans, potential support from its largest shareholder, and future contract acquisitions.

Q: What is the current investment recommendation for Bumyang Construction?

A: Investing in Bumyang Construction carries significant risk. Reducing holdings is recommended. A speculative buy should only be considered with extreme caution and a high risk tolerance.

Q: What are the main challenges facing Bumyang Construction?

A: The company faces substantial losses from investments in related companies, deteriorating financial health of its largest shareholder, continuous poor operating performance, and high debt and liquidity issues.

Q: What is the impact of the contract termination on Bumyang Construction?

A: The contract termination exacerbates the company’s existing financial vulnerabilities, potentially leading to further declines in revenue and profitability, increased project uncertainty, and negative investor sentiment.