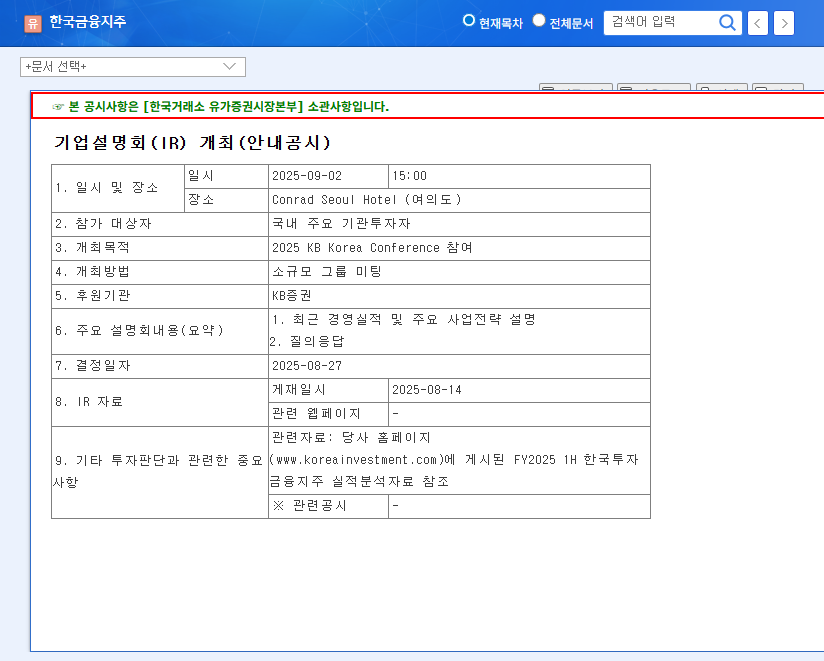

1. The IR Event: What to Expect

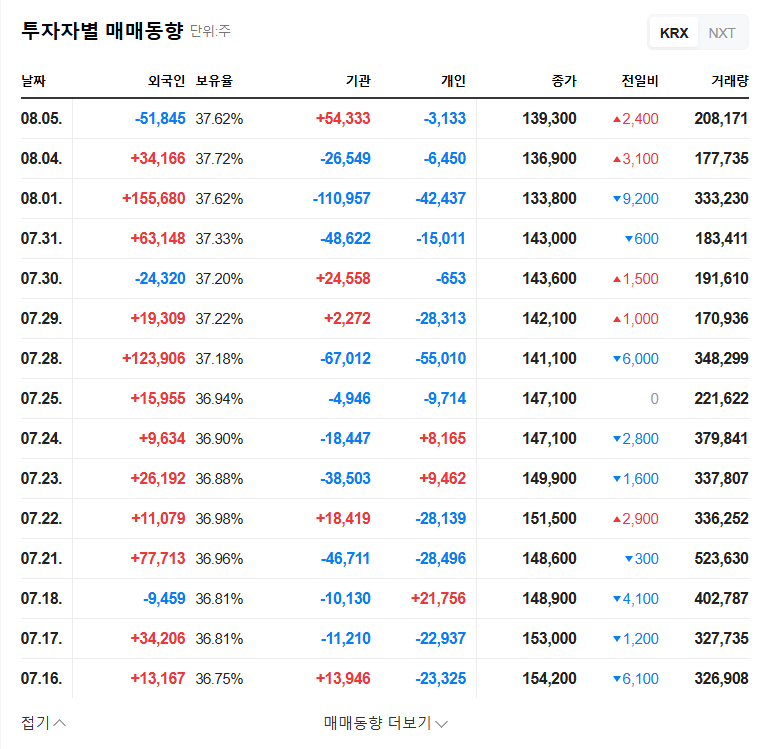

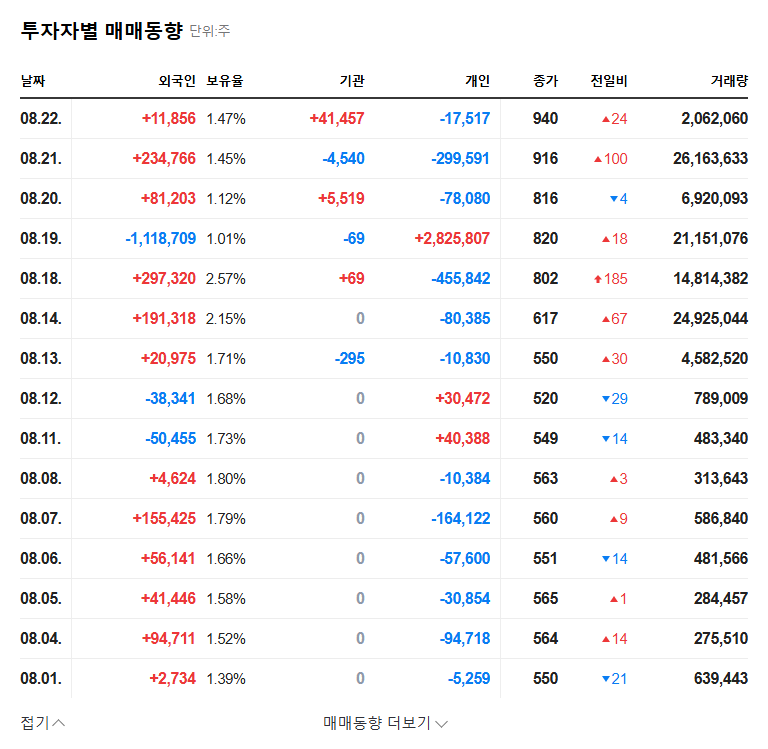

Korea Investment Holdings will hold its IR session on September 2, 2025, at 3:00 PM. The company will present its latest business performance and key strategies, followed by a Q&A session with investors. The market anticipates detailed information on the drivers behind the strong H1 2025 results and insights into future growth engines, making this IR a must-watch for investors.

2. Fundamental Analysis: Reasons for Optimism

Korea Investment Holdings exhibits positive fundamentals, underpinned by a robust business foundation, a diversified portfolio, and sound financial health.

- Securities: Balanced performance across IB, asset management, and PI, enhanced by digital transformation.

- Asset Management: Steady AUM growth and strong competitiveness in the ETF and private equity fund markets.

- Other Financial Businesses: Diversified portfolio including savings banks, capital, and real estate trust.

- New Businesses: Future growth potential through venture capital and accelerator investments.

- Robust Financial Structure: High capital adequacy ratio and stable liquidity management.

However, ongoing monitoring of asset quality related to PF loans and macroeconomic uncertainties remains crucial.

3. IR Impact and Investment Strategy: What to Do

This IR is expected to positively impact Korea Investment Holdings’ corporate value and improve investor sentiment. Clear explanations of growth strategies and future outlook can enhance investor confidence. However, careful consideration of market dynamics and risk management strategies for PF loans is necessary.

4. Action Plan for Investors:

- Carefully review the IR materials and management presentations.

- Consult market analysis reports and expert opinions.

- Consider your investment objectives and risk tolerance.

Frequently Asked Questions (FAQ)

What are the key topics of this IR?

The IR will cover the H1 2025 earnings results, future business strategies, and plans to enhance competitiveness across key business units.

What are the main businesses of Korea Investment Holdings?

Korea Investment Holdings operates a variety of financial businesses including securities, asset management, savings bank, capital, real estate trust, and venture capital.

What are the key investment considerations?

Investors should consider potential risk factors such as asset quality related to PF loans and macroeconomic uncertainties.