1. What was discussed at the EcoPro BM IR event?

The core of this IR event was ‘securing future growth engines’ and ‘securing financial stability.’ EcoPro BM presented an aggressive growth strategy by announcing the expansion of its next-generation battery materials portfolio and its plans to expand North American and European CAPA. However, at the same time, efforts must be made to address concerns about declining net profit and financial soundness.

2. Why should we pay attention to EcoPro BM now?

EcoPro BM succeeded in turning to profit in the first half of 2025, signaling an improvement in profitability. In addition, it is securing future growth engines through the development of next-generation battery materials such as single crystal, LMR, and LFP, and global CAPA expansion. These can be attractive factors for investors.

3. So, how should investment decisions be made?

Before making an investment decision, both positive and negative factors must be considered. While a return to profitability and securing growth engines are positive, risks such as declining net profit, deteriorating financial soundness, and intensifying competition also exist. Carefully analyze the financial soundness improvement measures and market competitiveness strengthening strategies presented at the IR, and make prudent investment decisions considering your investment propensity and goals.

4. Action plan for investors

- Carefully check IR materials and related news

- Refer to expert analysis reports

- Analyze the company’s financial indicators and growth strategies

- Consider your investment objectives and risk tolerance

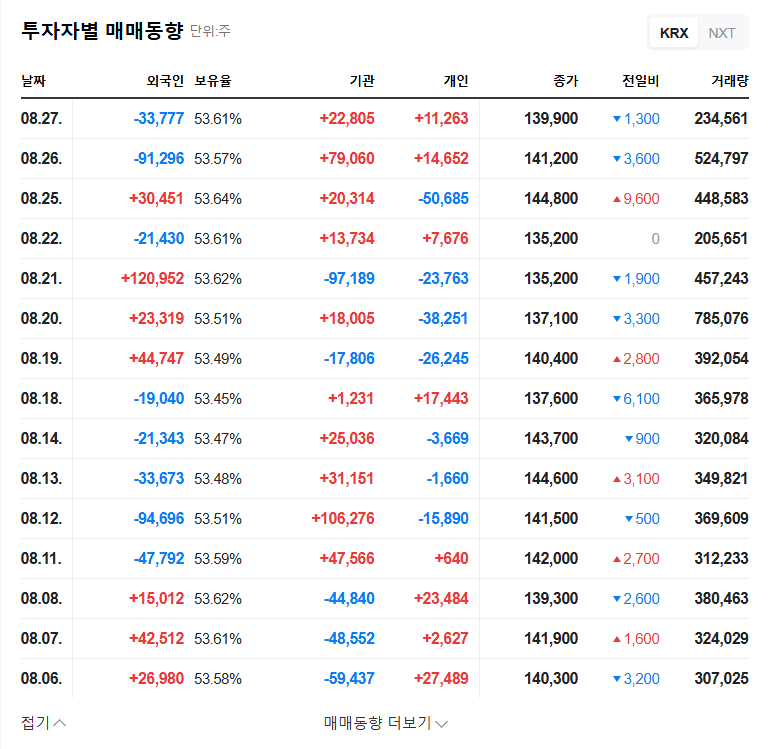

Q: What are EcoPro BM’s earnings for the first half of 2025?

A: Consolidated revenue was approximately KRW 1.4095 trillion, showing stable growth, but operating profit turned to black at KRW 51.2 billion, while net profit decreased to KRW 24.3 billion.

Q: What is EcoPro BM’s main growth strategy?

A: In addition to high-nickel NCA and NCM cathode materials, the company is expanding its portfolio of next-generation battery materials such as single crystal, LMR, and LFP, and is strengthening its global market competitiveness through overseas CAPA expansion in North America and Europe.

Q: What are the precautions for investing in EcoPro BM?

A: Risks such as declining net profit, increasing debt ratio, volatility of raw material prices, and intensifying competition should be considered.