1. Hana Micron IR: What to Expect

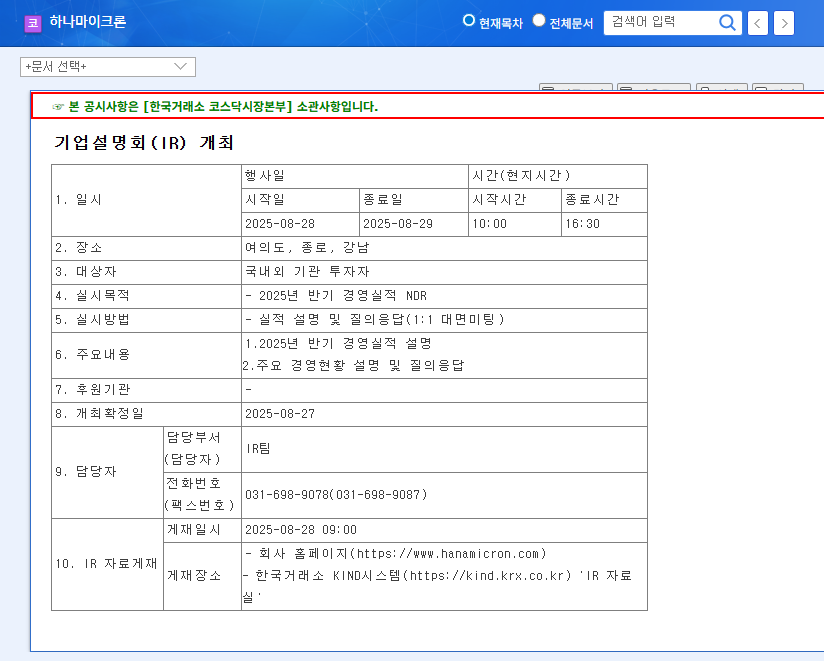

Hana Micron will hold a Non-Deal Roadshow (NDR) on August 28, 2025, to discuss its financial results for the first half of 2025. This IR is a crucial opportunity for the company to transparently communicate its financial status and management performance, enhancing investor understanding.

2. Key Business Performance and Financial Risk Analysis: Why It Matters

Positive Factors: The semiconductor manufacturing division demonstrated robust growth, with revenue and operating profit increasing by 21% and 86%, respectively. Positive technological advancements and improved profitability are also encouraging.

Considerations: Investors should consider the high debt-to-equity ratio (226.85%), increasing inventory, and continued losses in the new technology business financing division.

3. Market Outlook: What’s the Big Picture?

Fluctuations in macroeconomic conditions, including interest rates, exchange rates, and oil prices, are significant variables that could impact Hana Micron’s performance. While interest rates are currently frozen, it’s essential to be aware of potential future changes.

4. Investment Strategies Based on IR Outcomes: What Should Investors Do?

If the IR presents positive business results and a clear plan to address financial risks, it could positively influence investor sentiment. Conversely, if the announcements fall short of market expectations, it could negatively impact the stock price.

5. Investor Action Plan

- Carefully review the IR materials and analyze the management’s presentation and Q&A session to inform your investment decisions.

- Pay close attention to Hana Micron’s plans for strengthening its financial position, future growth drivers, and strategies for navigating macroeconomic variables.

- It’s crucial to take a long-term perspective, evaluating the company’s fundamentals and growth potential before making investment decisions.

What are Hana Micron’s main businesses?

Hana Micron’s core businesses include semiconductor manufacturing, semiconductor materials, and new technology business financing.

What are the key takeaways from this IR?

Key points to watch for include the continued growth of the semiconductor manufacturing division, plans to address the high debt-to-equity ratio, and strategies for achieving profitability in the new technology business.

What should investors be cautious about when considering Hana Micron?

Investors should be mindful of the high debt-to-equity ratio, increasing inventory levels, and the potential impact of changing macroeconomic conditions.