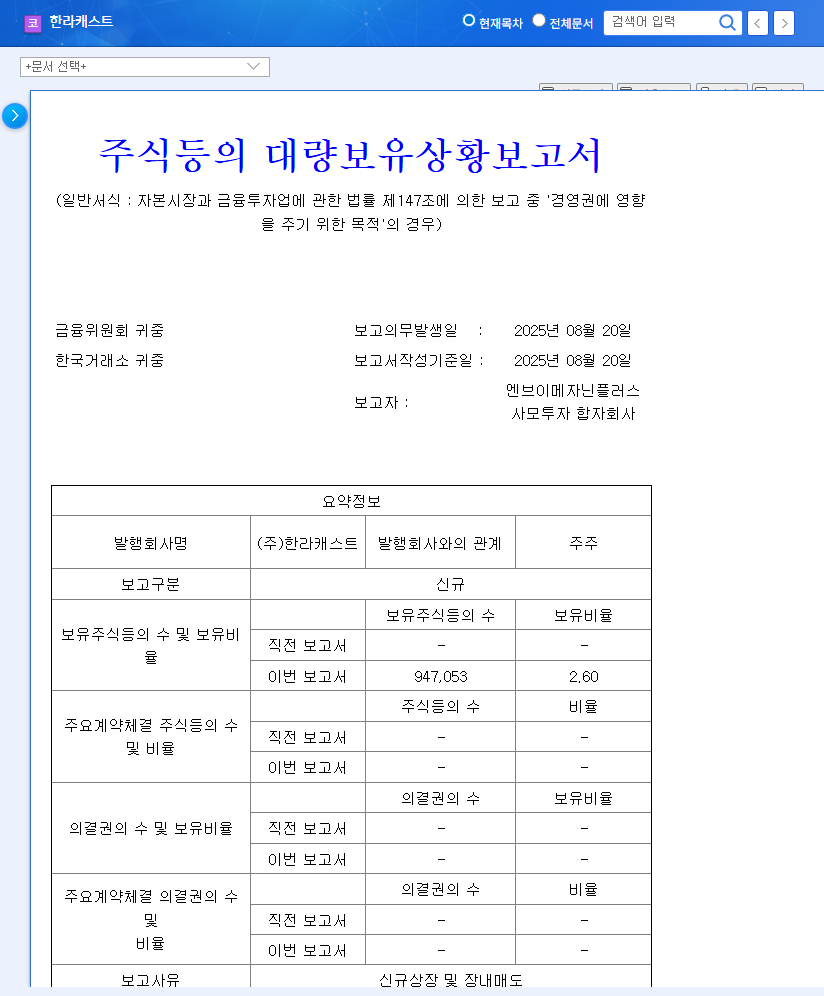

1. What Happened? : Analyzing the Large Holding Report

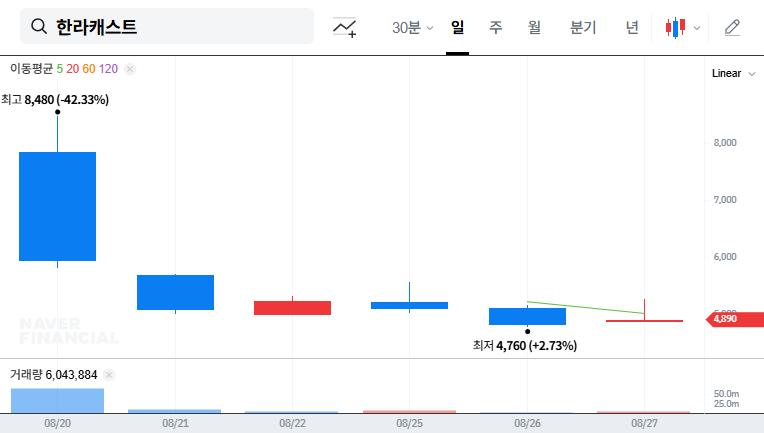

NV Mezzanine Plus Private Equity Partnership sold a portion of its Hanlacast stake. This is interpreted as profit-taking by an early investor and could lead to short-term downward pressure on the stock price. However, the current stake (2.60%) is unlikely to directly impact management control.

2. Why Did This Happen? : Fundamental and Market Environment Analysis

Hanlacast is expanding into promising future industries such as automotive electronics, eco-friendly car parts, and secondary battery materials. However, it also faces financial risks such as high debt ratio, increasing inventory assets, and declining net profit. The strong Korean Won and rising interest rates are also adding pressure.

3. What’s Next? : Future Outlook and Investment Strategy

If the funds secured through the KOSDAQ listing contribute to improving the financial structure and growing new businesses, positive momentum can be generated. However, if fundamental improvements are slow or market conditions worsen, further stock price declines cannot be ruled out.

4. What Should Investors Do? : Action Plan

- Stay Informed: Thoroughly review the company’s disclosures and IR materials for updates on new business progress and financial improvement plans.

- Manage Risk: Carefully consider financial risks and market volatility before making investment decisions.

- Long-Term Perspective: Evaluate the company’s long-term growth potential rather than reacting to short-term stock price fluctuations.

What does the major investor’s stake sale signify?

It’s likely early profit-taking and could negatively impact the stock price in the short term.

What is Hanlacast’s growth strategy?

They are diversifying into promising future industries like automotive electronics, eco-friendly car parts, and secondary battery materials.

What should investors be cautious of when investing in Hanlacast?

Be mindful of financial risks like high debt ratio and increasing inventory, as well as market volatility.

Leave a Reply