1. Ecoprime Divests 1.2% Stake in HJ Heavy Industries: What Happened?

Ecoprime Marine Pacific, which held a 57.79% stake in HJ Heavy Industries for ‘management influence,’ reduced its stake to 56.59% by selling 1 million shares on August 29, 2025.

2. HJ Heavy Industries Fundamental Analysis: Hidden Opportunities and Risks

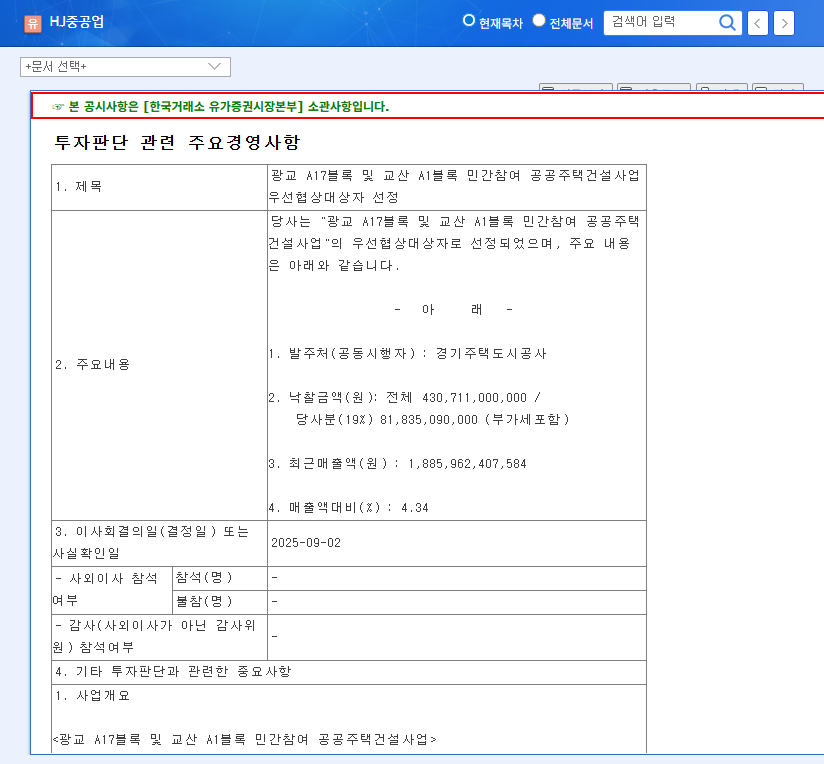

- Positive Factors: The construction segment’s robust growth and ample order backlog are positive.

- Negative Factors: High debt ratio, capital impairment, and weak profitability in the shipbuilding division pose ongoing risks. Volatility in raw material prices and intensifying competition also require attention.

3. Impact of Divestment on Stock Price

- Short-term Impact: The news of the sale could dampen investor sentiment, putting downward pressure on the stock price. However, the limited scale of the divestment might contain the decline.

- Mid-to-Long-term Impact: Ecoprime’s further stake changes and HJ Heavy Industries’ financial improvement will determine the stock’s future trajectory.

4. Action Plan for Investors

- Closely monitor the financial improvement plans and their execution.

- Continuously check the shipbuilding division’s profitability improvement efforts and order status.

- Watch Ecoprime’s future moves and the impact of macroeconomic variables.

- Be mindful of short-term stock volatility and make investment decisions based on the company’s fundamental changes from a mid-to-long-term perspective.

FAQ

Why did Ecoprime sell its stake?

The official reason hasn’t been disclosed, but various possibilities are being speculated, such as changes in investment strategy or securing cash. It’s necessary to watch Ecoprime’s future moves.

What is the status of HJ Heavy Industries’ capital impairment?

HJ Heavy Industries continues to be in a state of capital impairment due to accumulated losses over three consecutive fiscal years. Financial restructuring is urgent.

Should I invest in HJ Heavy Industries?

Investment decisions should be made with caution. Short-term stock volatility is expected, and in the mid-to-long term, financial improvement and the recovery of profitability in the shipbuilding segment will be important criteria for judgment.