KB Korea Conference 2025: Key Takeaways from Kolmar Korea’s IR

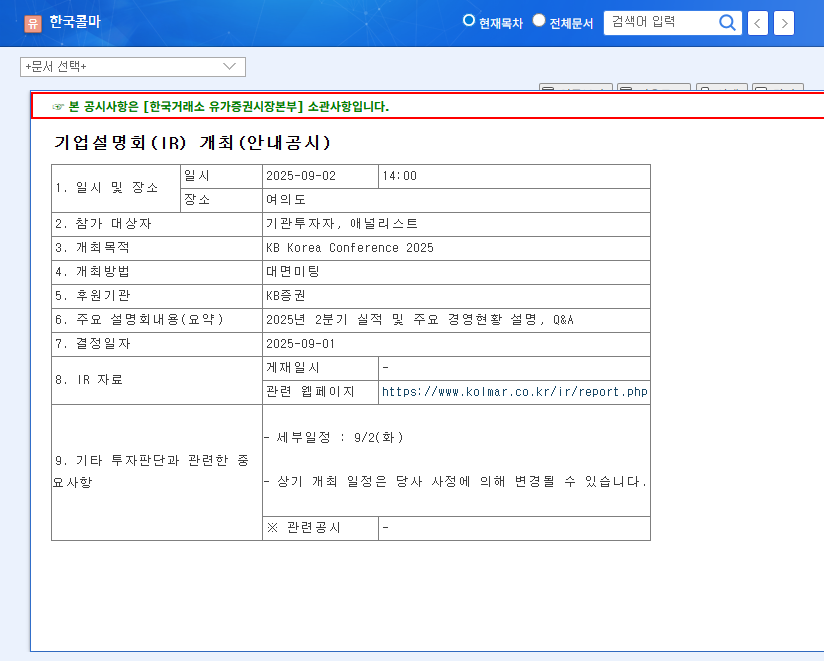

Kolmar Korea held its investor relations (IR) meeting at the KB Korea Conference 2025 on September 2, 2025. The primary focus of the IR was to announce the company’s Q2 2025 earnings and provide an update on key management initiatives.

Solid Fundamentals and Growth Drivers

Kolmar Korea maintains robust fundamentals across its cosmetics ODM, pharmaceuticals (HK inno.N), and packaging businesses. The cosmetics ODM segment has shown consistent growth, while HK inno.N’s ‘K-CAB’ continues to be a key growth driver. The packaging business also contributes to diversification with stable revenue generation.

Future Growth Strategies: R&D Investment and Market Communication

Kolmar Korea is securing future growth engines through continuous R&D investments, focusing on new formulation development and expanding its pharmaceutical pipeline. The company also emphasizes proactive market communication, such as this IR, to build investor confidence and enhance corporate value.

Action Plan for Investors: Key Information from the IR

- Q2 2025 Earnings: Review the detailed financial performance, including revenue, operating profit, and growth rates for each business segment.

- HK inno.N Pipeline: Assess the growth potential by examining the progress of new drug development, clinical trial results, and potential market size.

- Cosmetics ODM Competitiveness: Analyze the sustainable growth potential by reviewing new customer acquisition strategies and new technology development updates.

- Future Growth Strategies: Understand the management’s mid-to-long-term growth plans and strategies for navigating market changes.

IR materials and related information can be found on the Kolmar Korea official website or the DART (Data Analysis, Retrieval, and Transfer System) website.

Frequently Asked Questions

What are Kolmar Korea’s main businesses?

Kolmar Korea operates in cosmetics ODM, pharmaceuticals (HK inno.N), packaging, and H&B businesses.

What were the key takeaways from the IR?

The key highlights included the announcement of Q2 2025 earnings, an overview of key management updates, and a Q&A session with investors.

What is the outlook for Kolmar Korea?

With its solid fundamentals and continuous investment in R&D, Kolmar Korea is expected to show positive growth, particularly in its cosmetics ODM and pharmaceutical segments.