What Happened?

On August 26, 2025, HLB Panajin CEO Kim Seong-gi reduced his stake from 5.38% to 4.98%. He disposed of a total of 14,000 shares through on-market sales from late July to August. This brings Kim Seong-gi’s stake below 5%, reducing his future disclosure obligations.

Background and Impact of the Sale

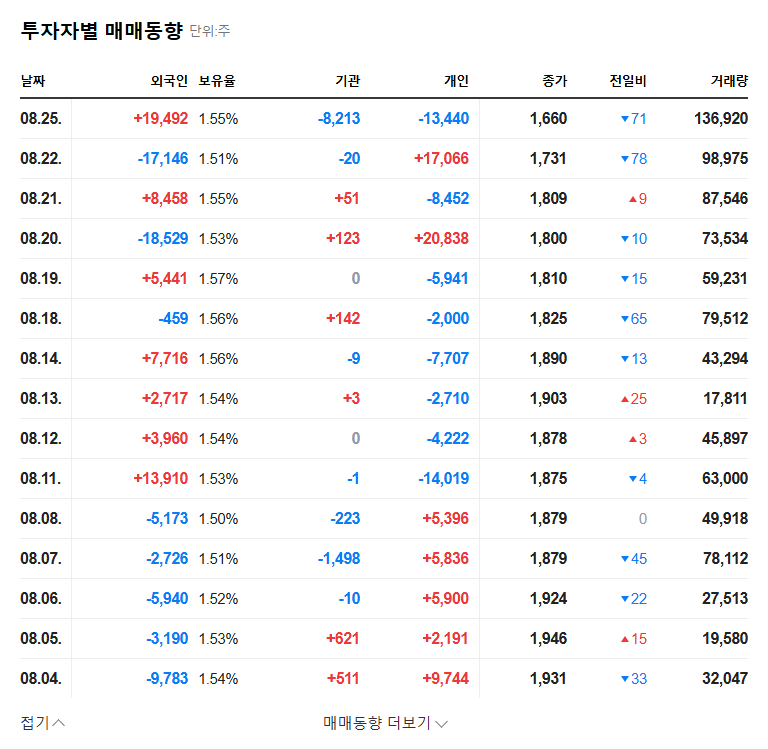

This stake sale could put pressure on the stock price in the short term. A major shareholder’s selling can lead to an increase in market supply and negatively impact investor sentiment. However, it’s important to remember that this has no direct impact on the company’s fundamentals. HLB Panajin’s core molecular diagnostics business and financial status remain unchanged.

So, What Should Investors Do?

Rather than being swayed by short-term stock price fluctuations, investors should focus on HLB Panajin’s long-term growth potential. The robust molecular diagnostics business, continuous R&D investment, and business diversification through the acquisition of Biosquare remain HLB Panajin’s strengths. Investors should closely monitor future stake changes by major shareholders, changes in the company’s management activities, and industry trends to formulate their investment strategies.

Frequently Asked Questions

Is Kim Seong-gi’s stake sale a negative signal for the company’s future?

Not necessarily. Stake sales can occur for various reasons, including personal financial management. As it doesn’t directly impact the company’s fundamentals, it’s crucial to focus on the company’s long-term growth potential rather than overreacting to short-term stock price fluctuations.

What are the key investment points for HLB Panajin?

Key investment points include the growth potential of the PNA-based molecular diagnostics business, continuous R&D investment, and business diversification through the acquisition of Biosquare. However, investors should be aware of risks such as continued net losses and high selling, general and administrative expenses.