1. Decoding the NPS’s HMM Stake Change

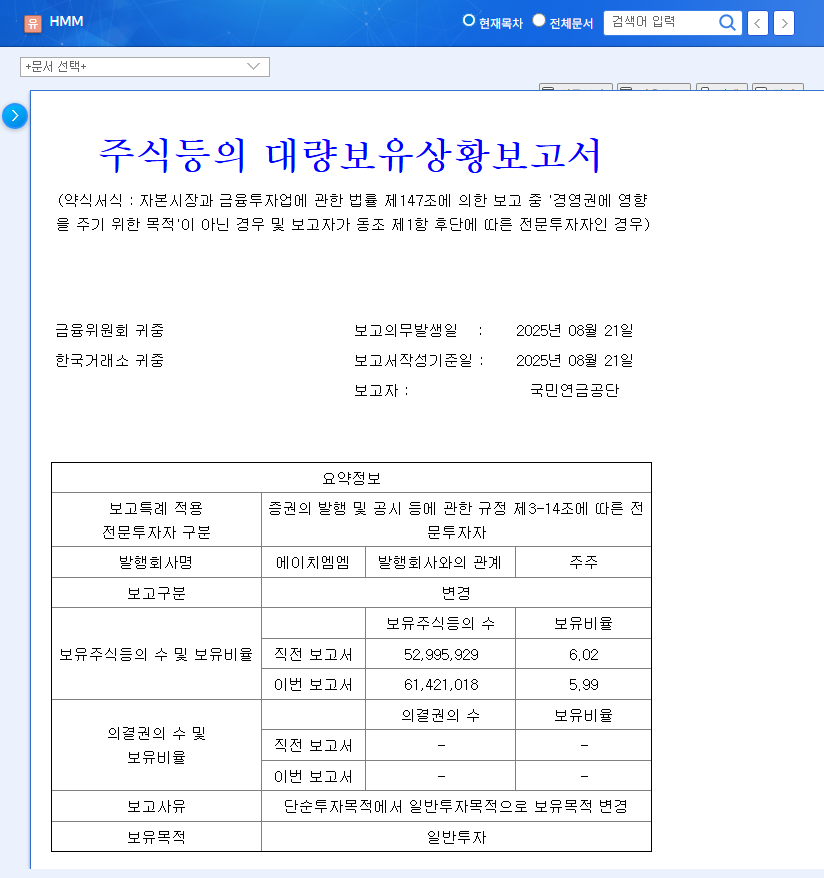

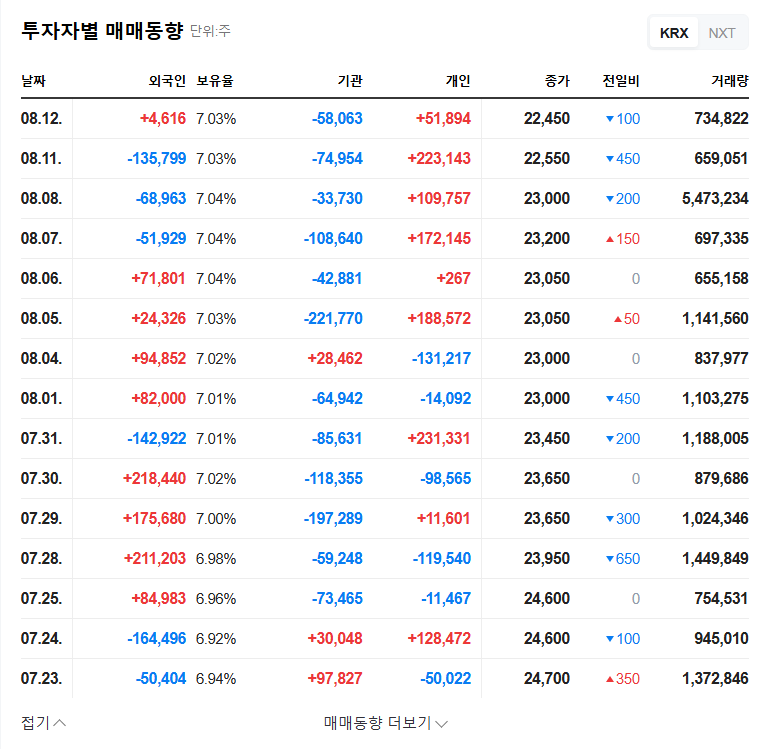

The NPS slightly reduced its stake in HMM from 6.02% to 5.99%. However, the more significant change is the shift in holding purpose from ‘simple investment’ to ‘general investment.’ While this doesn’t imply direct management involvement, it can be interpreted as a willingness to maintain investment from a mid- to long-term perspective rather than a simple sell-off. Although the change in stake is minimal and expected to have a limited short-term impact on stock price, it could positively influence long-term investor sentiment.

2. HMM Fundamentals: A Mixed Bag

HMM’s first-half 2025 earnings saw declines in sales and operating profit due to falling container freight rates, but net profit increased thanks to strong performance in the bulk segment and cost-cutting efforts. The recovery of the container market will be crucial for HMM’s future earnings. Positive factors include the strong performance of the bulk segment and investment in eco-friendly vessels, while negative factors include weak container freight rates and volatility in oil prices and exchange rates.

3. Macroeconomic Factors: Shaping HMM’s Future

Fluctuations in international oil prices and exchange rates can directly impact HMM’s profitability. Other macroeconomic uncertainties, such as the possibility of US interest rate hikes and a slowdown in the Chinese economy, also warrant attention. The declining trend in the CCFI index, which reflects the container market, is a concern. Conversely, the BDTI index, a bulk market indicator, shows a solid trend, which is a positive sign.

4. Investor Action Plan: Short-Term vs. Long-Term

- Short-term investment: The NPS stake change alone is unlikely to have a significant impact, so a cautious approach is advised, closely monitoring market conditions and earnings announcements.

- Long-term investment: Continuous monitoring of fundamental improvements, such as container market recovery, sustained bulk segment performance, and the effects of eco-friendly investments, is essential. The NPS’s ‘general investment’ can be interpreted as a positive sign, but it is important to verify whether it translates into actual management performance.

Frequently Asked Questions

What does the NPS’s ‘general investment’ mean?

‘General investment’ can encompass various activities beyond simple stock holding, including efforts to enhance corporate value. However, it doesn’t signify direct management involvement, and further confirmation is needed regarding specific activities.

What is the HMM stock forecast?

Stock price volatility is expected depending on various factors such as container market recovery, sustained bulk segment performance, and changes in the macroeconomic environment. While short-term stock price prediction is difficult, the improvement in fundamentals will be a key variable in the mid- to long-term.

How can I invest in HMM?

You can open a stock trading account and buy HMM shares. Before investing, it’s essential to conduct thorough research, including company analysis and understanding market conditions.