1. Shinhan Financial Group Q2 2025 Earnings Analysis: A Mixed Bag

Shinhan Financial Group reported a consolidated net income of KRW 3.0374 trillion in Q2 2025, a 10.6% increase year-over-year. However, this strong performance includes one-off factors such as the reversal of provisions related to Hong Kong H-share ELS, necessitating a closer look at the underlying growth drivers.

- Positives: Solid growth in the banking segment, expansion of non-interest income, stable capital ratio.

- Negatives: Declining profitability at Shinhan Card, risks related to Shinhan Capital’s PF exposure.

2. Key Business Strategies: Digital Transformation and Future Growth Engines

Under its long-term vision of ‘Customer-centric, Leading Shinhan,’ Shinhan is focusing on securing future growth engines through digital innovation and strengthening its senior/wealth management businesses. Achieving 27.5 million MAU highlights its progress in enhancing digital competitiveness.

3. Investment Strategy: Maintaining the ‘HOLD’ Rating and Key Monitoring Points

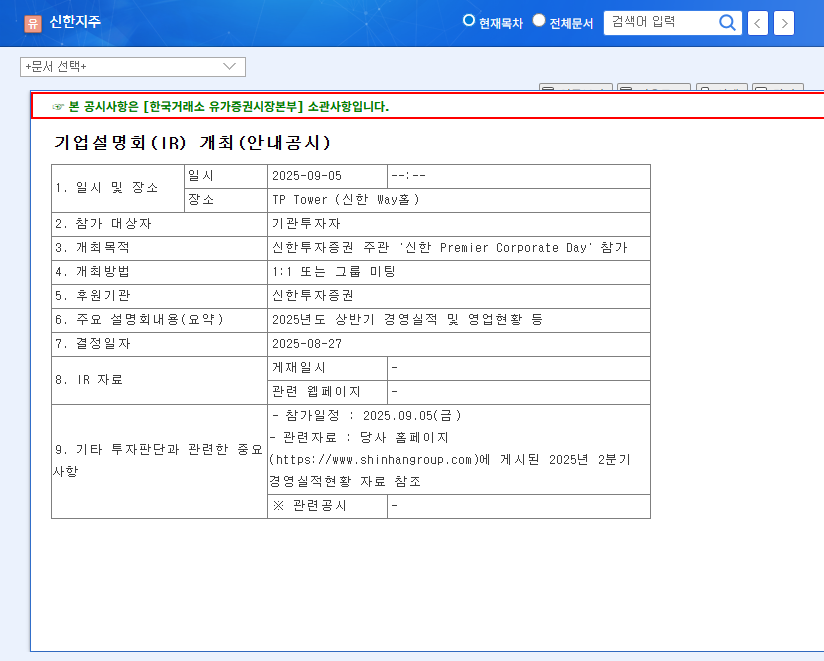

The current investment rating is ‘HOLD.’ Despite positive earnings momentum, factors like declining profitability at Shinhan Card, real estate PF risks, and macroeconomic uncertainties warrant caution. Closely monitor future growth strategies and risk management plans presented at upcoming IR events.

- Key Monitoring Points: Shinhan Card’s profitability improvement strategies, Shinhan Capital’s PF risk management, performance of AI/digital new businesses, and the impact of macroeconomic variables.

Frequently Asked Questions

How did Shinhan Financial Group perform in Q2 2025?

Shinhan Financial Group reported a consolidated net income of KRW 3.0374 trillion in Q2 2025, a 10.6% increase year-over-year.

Why is the investment rating ‘HOLD’?

Despite strong earnings, the ‘HOLD’ rating is maintained due to factors such as declining profitability at Shinhan Card, risks associated with Shinhan Capital’s PF exposure, and macroeconomic uncertainties.

What are Shinhan Financial Group’s key business strategies?

Shinhan is focusing on securing future growth engines through digital transformation and strengthening its senior/wealth management businesses.