What Happened? Decoding the Stake Increase

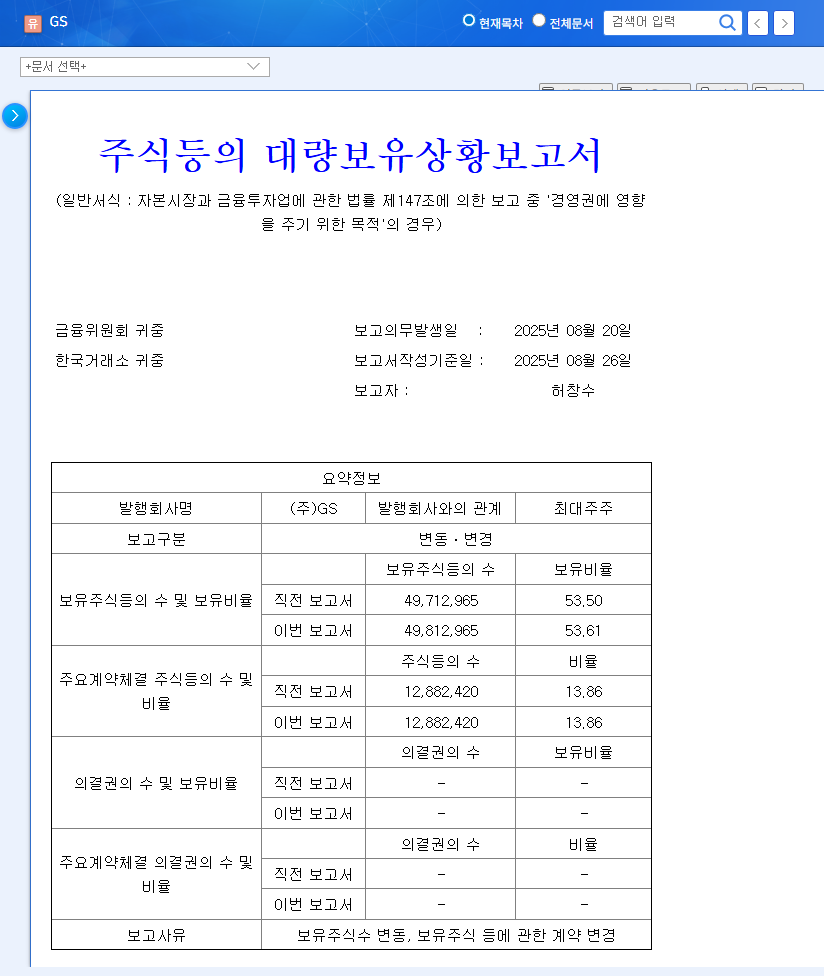

Chairman Huh Chang-soo and related parties increased their stake in GS Holdings from 53.50% to 53.61%, a 0.11%p increase. This was achieved through inheritance and open market purchases.

Why Does It Matter? The Significance of Stake Changes

Stake increases can signify more than just a change in numbers. They can signal increased management control, commitment to shareholder value, and strengthened responsible leadership, especially when initiated by major stakeholders.

GS Holdings: Fundamentals and Future Outlook

GS Holdings boasts a diversified portfolio across energy, retail, construction, and chemicals, with strong subsidiaries like GS Caltex and GS Retail contributing to stable revenue streams. However, macroeconomic uncertainties and oil price volatility remain key risk factors for investors.

- Strengths: Diversified portfolio, strong subsidiaries, stable financials

- Weaknesses: Macroeconomic uncertainties, oil price volatility

Investor Action Plan: What Should You Do?

The stake increase can be viewed as a positive sign, reinforcing management stability. However, investment decisions should be based on a comprehensive analysis of GS Holdings’ portfolio, financials, and the broader macroeconomic environment. Continuous monitoring of stake changes by major shareholders and related parties is crucial.

How will Chairman Huh’s increased stake affect GS Holdings’ stock price?

While the increase signifies positive management stability, the small change in ownership is unlikely to have a dramatic immediate impact on the stock price. In the long term, reinforced management control could contribute to increased shareholder value.

What are GS Holdings’ main businesses?

GS Holdings operates across diverse sectors, including energy, retail, construction, and chemicals. Key subsidiaries include GS Caltex, GS Retail, GS Construction, and GS EPS.

What should investors consider when evaluating GS Holdings?

Investors should consider macroeconomic uncertainties, oil and commodity price volatility, and increasing competition. Monitoring stake changes by major shareholders and related parties is also important.