1. What’s the Iraq Firetruck Deal About?

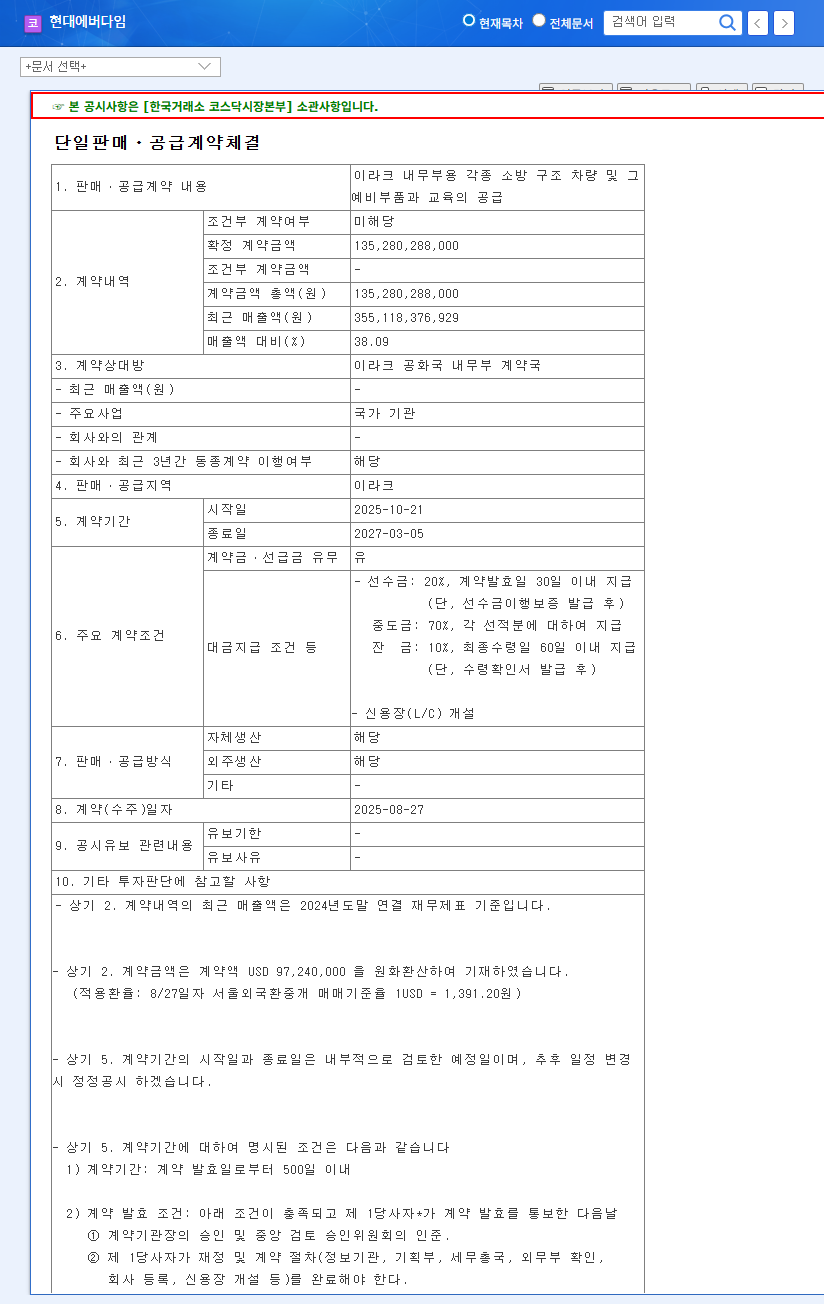

Hyundai Everdigm inked a $100 million contract with the Iraqi Ministry of Interior to supply various fire rescue vehicles, spare parts, and training. The contract period runs from October 2025 to March 2027, approximately 1 year and 4 months.

2. Why is This Deal Important?

This contract signifies more than just revenue growth for Hyundai Everdigm.

- Financial Improvement: It’s expected to be a stepping stone to recovering from recent sluggish performance and improving profitability.

- Overseas Expansion: The deal strengthens Everdigm’s presence in the Middle East and increases the likelihood of future orders.

- Business Diversification: It helps establish a stable growth foundation through expansion into new areas beyond existing businesses.

3. What’s the Impact of the Deal?

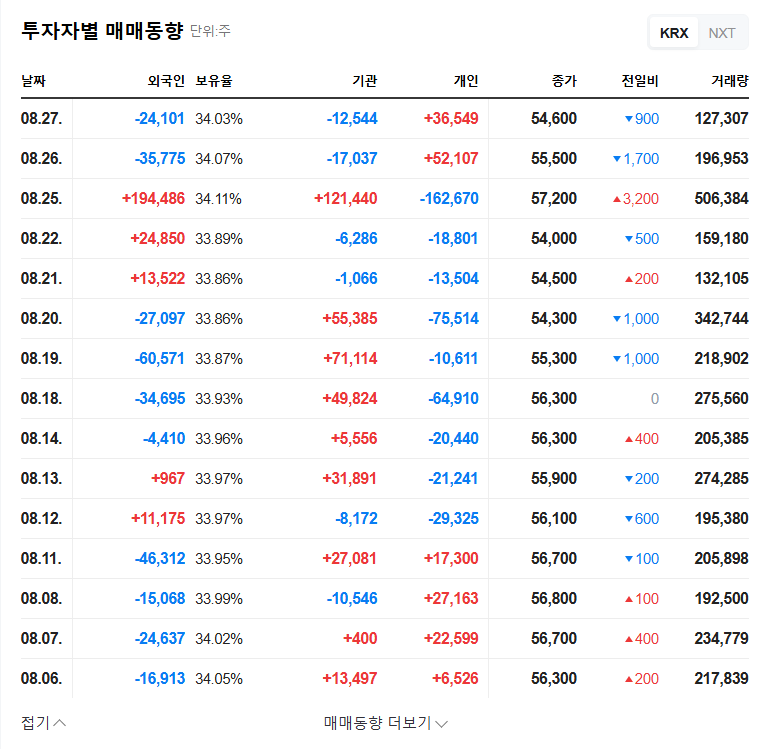

The contract is anticipated to positively influence Hyundai Everdigm’s stock price. Investors may raise their expectations for future earnings improvement and overseas market expansion. However, risk factors such as political instability in Iraq and exchange rate fluctuations should also be considered.

4. Investor Action Plan

Investors should make informed decisions by considering both the positive impacts and potential risks of this contract. It’s crucial to analyze the company’s long-term growth potential rather than being swayed by short-term stock price fluctuations.

Frequently Asked Questions

What is the contract value?

$100 million.

Who is the counterparty to the contract?

The Iraqi Ministry of Interior’s contracting authority.

What is the impact of this contract on the stock price?

It is likely to have a positive impact on the stock price in the short term. However, investment decisions should always be made cautiously.