Iljin Power and Doosan Enerbility’s $17.6M Deal: What Happened?

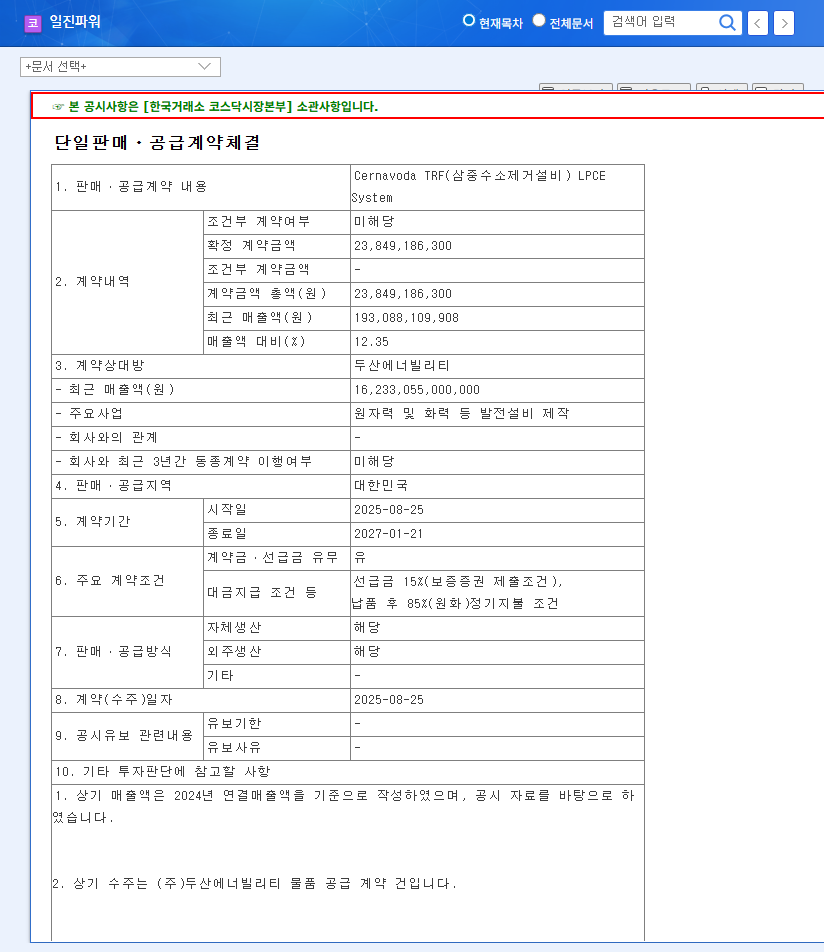

Iljin Power signed a $17.6 million contract with Doosan Enerbility on August 25, 2025, to supply Cernavoda TRF (Tritium Removal Facility) LPCE System. This represents 12.35% of Iljin Power’s 2024 revenue and will run until January 21, 2027.

What’s the Significance and Background of the Contract?

This contract showcases Iljin Power’s capabilities in the nuclear power sector. Doosan Enerbility is a leading plant company in Korea and a key client of Iljin Power. Supplying core components for nuclear power plants is expected to contribute not only to short-term sales growth but also to securing long-term growth momentum. It’s particularly significant as it could signal a recovery in the underperforming nuclear business segment. However, with Iljin Power’s recent struggles with profitability and subsidiary performance, it remains to be seen whether this contract will translate into substantial growth.

So, What Should Investors Do?

While this contract is a positive sign, investors should proceed with caution. Several factors need consideration, including contract profitability, volatility in the nuclear industry, and fluctuations in exchange rates and raw material prices. Maintaining a ‘Neutral’ investment outlook based on existing fundamental analysis, investors should closely monitor the following:

- Concrete profitability and implementation of the contract

- Potential for additional orders in the nuclear business

- Performance and revenue contribution of new businesses (fuel cells, nuclear fusion)

- Improvement in overall profitability indicators

Frequently Asked Questions

What is the value of this contract?

$17.6 million, representing 12.35% of Iljin Power’s 2024 revenue.

Who is the counterparty to the contract?

Doosan Enerbility, a leading plant company in Korea.

What is the main content of the contract?

Supply of Cernavoda TRF (Tritium Removal Facility) LPCE System.

What is the investment outlook?

Positive, but investors should proceed with caution considering profitability and other factors. The investment outlook is ‘Neutral’.