Key Takeaways from iM Financial Group’s IR

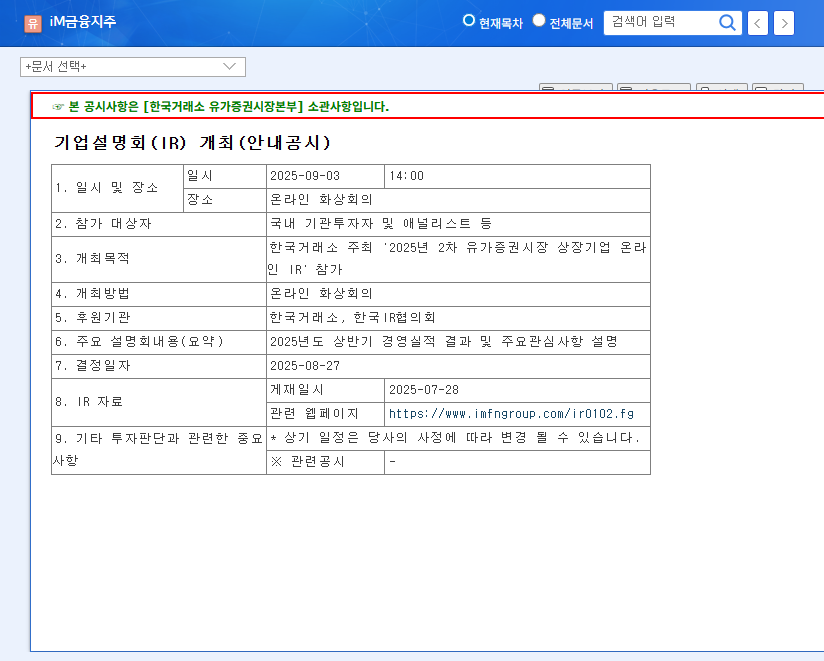

iM Financial Group presented its H1 2025 earnings results and key business strategies for the second half of the year at an online IR session hosted by the Korea Exchange on September 3, 2025. Here’s a summary of the key takeaways:

1. Solid First-Half Performance

- Achieved consolidated net income attributable to controlling interests of KRW 309.3 billion (ROA 0.64%, ROE 10.30%)

- Maintained stable capital adequacy with a BIS capital adequacy ratio of 14.76%

2. Growth Strategies for H2 2025

- Business expansion and enhanced competitiveness following iM Bank’s transition to a commercial bank

- Expected growth for iM Securities driven by changes in capital market regulations and the launch of the NXT alternative trading system

- Pursuit of stable growth through maximizing synergies among subsidiaries

Investment Points and Risk Analysis

Investment Points

- Growth potential driven by iM Bank’s transition to a commercial bank

- Expected benefits for iM Securities from value enhancement and changes in the capital market

- Risk diversification through a diversified business portfolio

Risk Factors

- Global economic slowdown and interest rate volatility

- Potential increase in delinquency rates at iM Capital and vulnerable borrowers at iM Bank

- Intensifying competition in the securities and asset management markets

Action Plan for Investors

Investors considering iM Financial Group should carefully review IR materials and disclosed information, while closely monitoring macroeconomic conditions and changes in the financial market. Critically, analyzing the impact of fluctuations in interest rates, oil prices, and exchange rates on iM Financial Group’s performance, and comparing its competitiveness and growth potential against competitors is essential.

Frequently Asked Questions

What are the main subsidiaries of iM Financial Group?

iM Bank, iM Securities, iM Life Insurance, iM Capital, and iM Asset Management.

When did iM Bank transition to a commercial bank?

iM Bank received approval to transition to a commercial bank in May 2024.

What are the main investment risks associated with iM Financial Group?

Key risks include macroeconomic uncertainty, asset quality management, intensifying competition, overseas business risks, and fluctuations in oil prices and exchange rates.