1. What Happened?

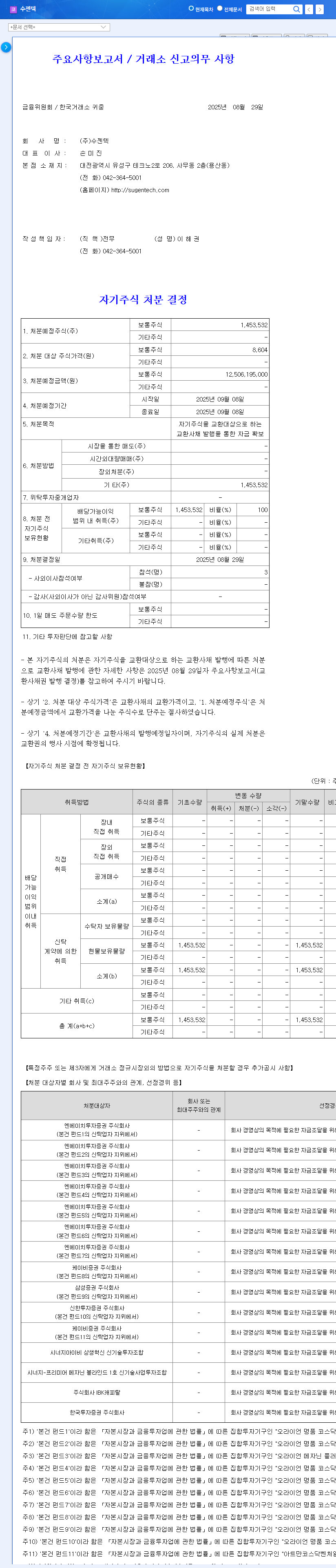

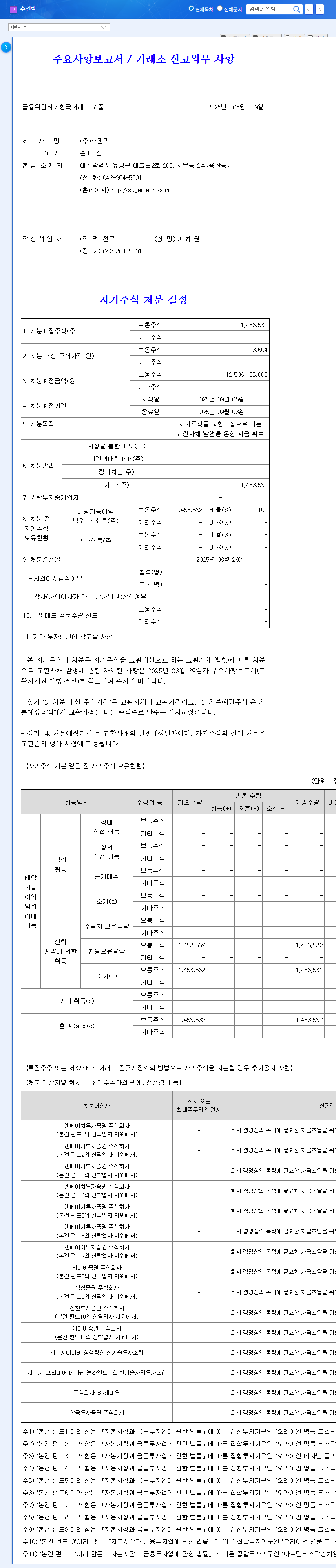

Sugentech announced on August 29, 2025, its decision to dispose of treasury stock. The company plans to raise ₩12.5 billion by selling 1,453,532 common shares (8.68% of total shares outstanding) to fund convertible bond issuance.

2. Why the Funding?

Sugentech recorded weak performance in the first half of 2025, with revenue of ₩5.062 billion and an operating loss of ₩8.86 billion. The decline in sales of COVID-19 diagnostic kits is cited as the main reason. This funding is likely needed for continued R&D investment, new business expansion, and improving financial structure.

3. What’s the Impact on the Stock Price?

- Short-term Impact: While increased liquidity is positive, the potential for stock dilution due to convertible bond issuance, combined with the company’s poor performance, could put pressure on the stock price. A wait-and-see approach is expected in the short term.

- Long-term Impact: If the funds are effectively utilized for growth drivers like R&D and overseas expansion, positive momentum can be expected. However, the efficiency of fund management and earnings improvement will be key to the stock’s future direction.

4. What Should Investors Do?

- Closely monitor the specifics of the fund utilization plan, the feasibility of the growth strategy, and trends in earnings improvement.

- Pay attention to the impact of changes in the macroeconomic environment on Sugentech.

How will Sugentech’s treasury stock disposal affect its stock price?

It could put downward pressure on the stock price in the short term, but the long-term impact will depend on how effectively the funds are used.

How does Sugentech plan to use the funds?

The funds will be used for R&D investment, new business expansion, and improving the company’s financial structure.

What is the outlook for Sugentech’s future earnings?

The company has been experiencing sluggish performance since the decline in COVID-19 diagnostic kit sales, but there is potential for improvement depending on the success of new business ventures.