What Happened? M2i Acquires 21.11% Stake in SMcore

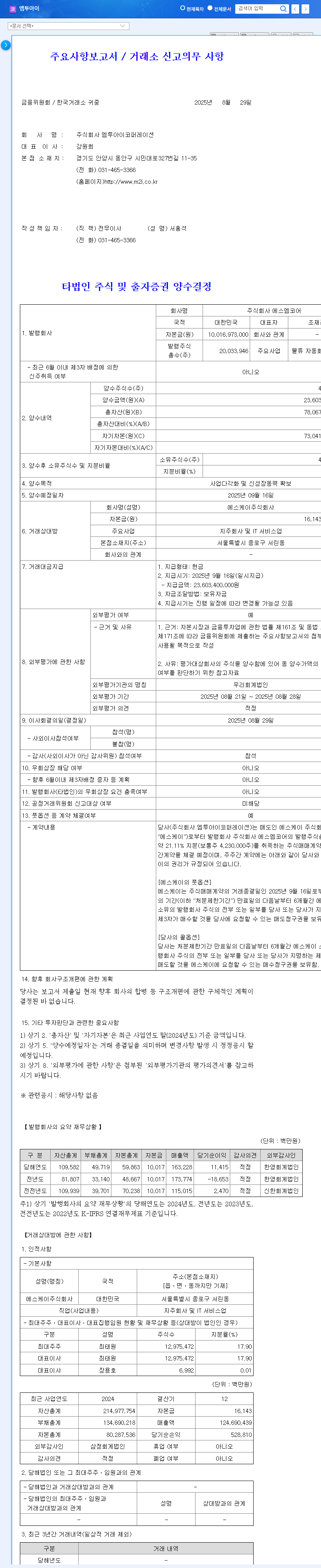

On August 29, 2025, M2i announced its acquisition of a 21.11% stake in SMcore, a logistics automation solutions provider, for 23.6 billion KRW. The acquisition is expected to be completed on September 16, 2025.

Why the Acquisition? Diversification and New Growth Engines

M2i aims to expand its smart factory solutions business into the logistics automation sector and secure future growth engines. The company anticipates enhanced competitiveness as a total smart factory solutions provider by leveraging synergies between smart factory and logistics automation technologies.

What’s Next? Potential Benefits and Risks

- Potential Benefits:

- Business diversification and new revenue streams

- Synergies between smart factory and logistics automation

- Stable acquisition based on a solid financial structure

- Potential Risks:

- Post-merger integration (PMI) risks

- Uncertainty regarding synergy realization

- Potential need for additional funding

What Should Investors Do? A Balanced Investment Strategy

While M2i’s acquisition of SMcore presents long-term growth potential, potential risks exist. Investors should carefully consider both the positive aspects and risk factors before making investment decisions. Closely monitoring the realization of synergies following the M&A will be crucial.

Frequently Asked Questions

What is M2i?

M2i is a smart factory solutions provider, offering services such as data collection and analysis on manufacturing sites and building production management systems.

What is SMcore?

SMcore is a logistics automation solutions provider, offering advanced logistics systems and robotics technology.

What is the purpose of this acquisition?

M2i acquired SMcore for business diversification and securing new growth engines. The goal is to become a total smart factory solutions provider by leveraging the synergy between smart factory and logistics automation technologies.