1. What Happened? : Understanding the Insider Stock Purchase

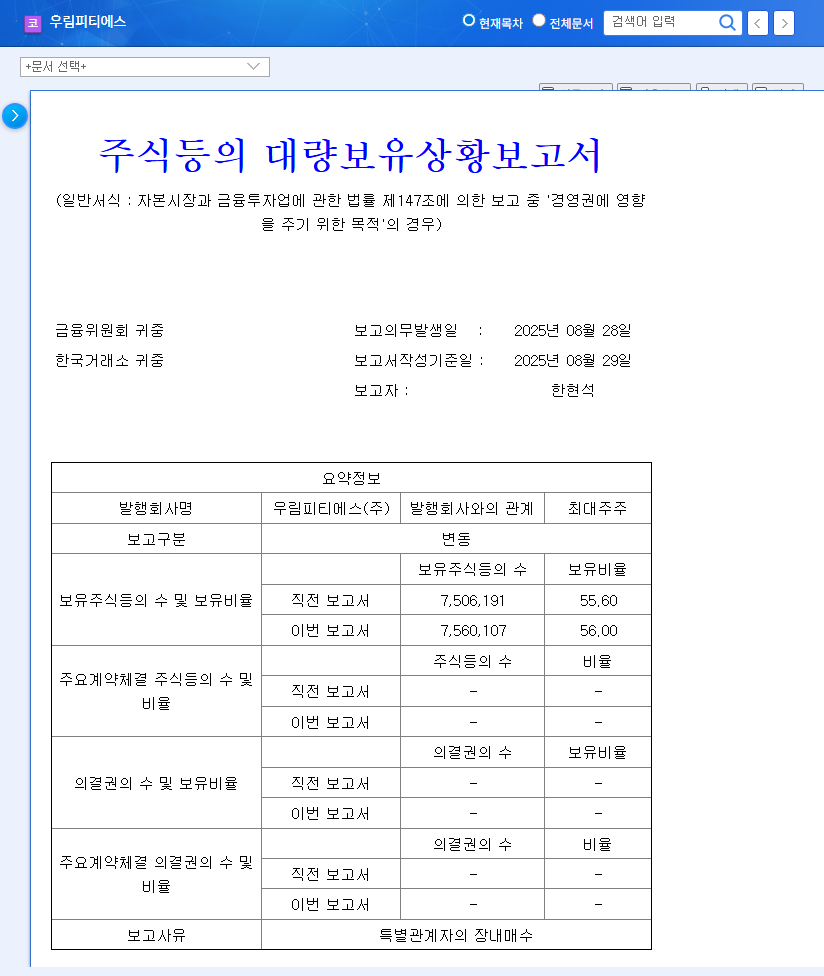

On August 29, 2025, insiders Hyunsuk Han and Minju Han increased their stake in Woolim PTS by 0.40%, bringing their total ownership to 56%. Notably, this purchase comes at a time when the company is facing financial headwinds.

2. Why? : Analyzing the Reasons Behind the Purchase

A positive interpretation could be a demonstration of commitment to strengthening management control and confidence in future growth drivers. The company’s active investments in new businesses like robotics and defense, along with increased R&D spending, are positive indicators. However, a more cautious approach is warranted. The stock purchase amidst declining performance raises concerns about potential stock manipulation or short-term price boosting.

3. So What? : Impact on Investors

This insider buying could improve investor sentiment and create upward momentum for the stock price. However, sustained growth is unlikely without tangible performance improvements. The potential for stock manipulation adds another layer of uncertainty.

4. Investor Action Plan

Investors should proceed with caution. Focus on the company’s fundamentals and long-term growth potential rather than short-term price fluctuations. Closely monitor upcoming earnings releases and management activities, paying particular attention to the progress of new business ventures.

Frequently Asked Questions

Is insider buying always a good sign?

Not necessarily. While it can signal management confidence and commitment, it’s crucial to consider the context. In struggling companies, it could indicate attempts to manipulate stock prices or create a short-term boost.

What is the outlook for Woolim PTS?

Investments in new businesses like robotics and defense, along with increased R&D, are positive. However, tangible performance improvements are essential for long-term success. Monitor future earnings and new business developments closely.

What should investors consider?

Focus on long-term growth potential rather than short-term price movements. Consider the company’s fundamentals, management actions, and market conditions before making investment decisions.