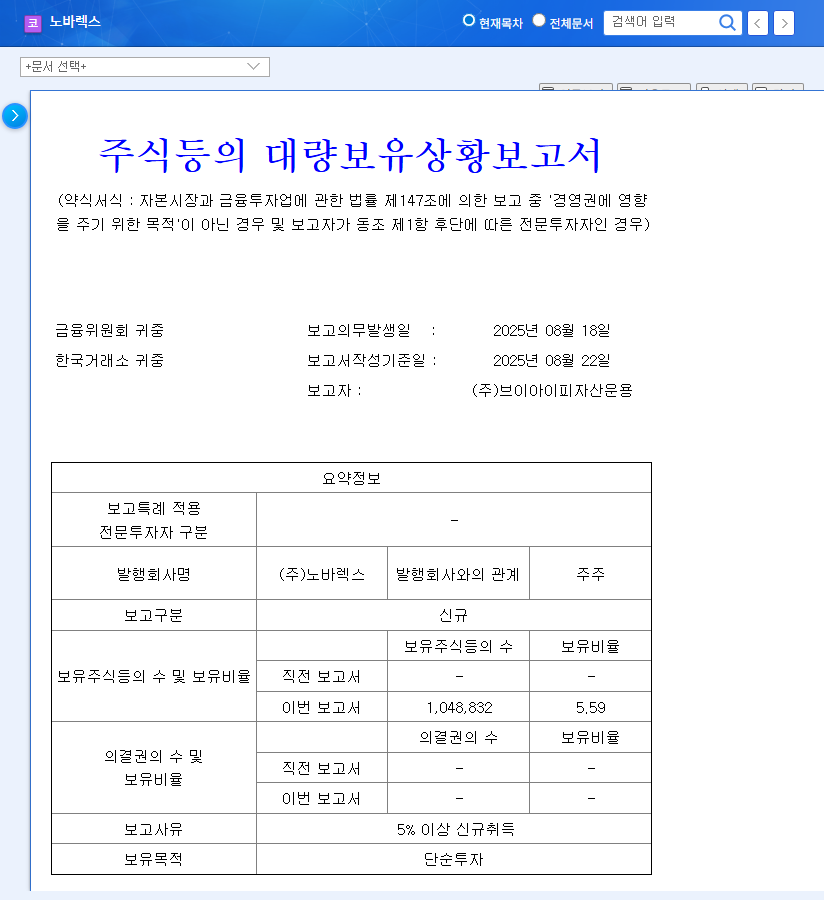

1. What Happened?: Institutional Investors Acquire 5% Stake in NovaRex

An asset management company recently acquired 5.59% of NovaRex’s shares, becoming a major shareholder. While stated as a simple investment, the market is analyzing its implications from various angles.

2. Why It Matters: NovaRex Company Value Analysis

NovaRex is a leader in the health functional food ODM/OEM market, holding the largest number of individually recognized ingredients in Korea. Consistent R&D investment and winning the $50 million Export Tower award demonstrates its global competitiveness. Recent half-year results show robust growth with significant increases in both sales and operating profit compared to the same period last year. Solid financial health also provides stability for investors. However, raw material prices and exchange rate volatility can act as risk factors and should be monitored.

3. What’s Next?: Analyzing Positive/Negative Impacts

- Positive Impacts: Institutional investment can provide momentum for stock price increases and improve investor sentiment. It also raises expectations for potential management participation by the institutional investor.

- Negative Impacts: The possibility of short-term stock price declines due to profit-taking and increased competition should also be considered.

4. What Should Investors Do?: Investment Strategy

Considering NovaRex’s strong fundamentals and the growth of the health functional food market, it appears to be an attractive investment. Institutional investment supports this positive outlook and is likely to improve investor sentiment and provide momentum for stock price increases. However, continuous monitoring of changes in the macroeconomic environment is necessary. Investors should pay attention to future changes in the institutional investor’s stake, second-half earnings, and new technology development achievements.

Frequently Asked Questions

Why is institutional investment important?

Institutional investors make investment decisions based on professional analysis, so their investment can be interpreted as a positive signal about the value of the company.

What is the future outlook for NovaRex?

Positive growth is expected, considering the growth of the health functional food market and NovaRex’s solid competitiveness. However, continuous monitoring of changes in the external environment is necessary.

What should investors be aware of?

Investors should carefully observe the impact of macroeconomic variables and changes in the competitive environment. It is important to remember that the responsibility for investment decisions rests with the individual investor.

Leave a Reply