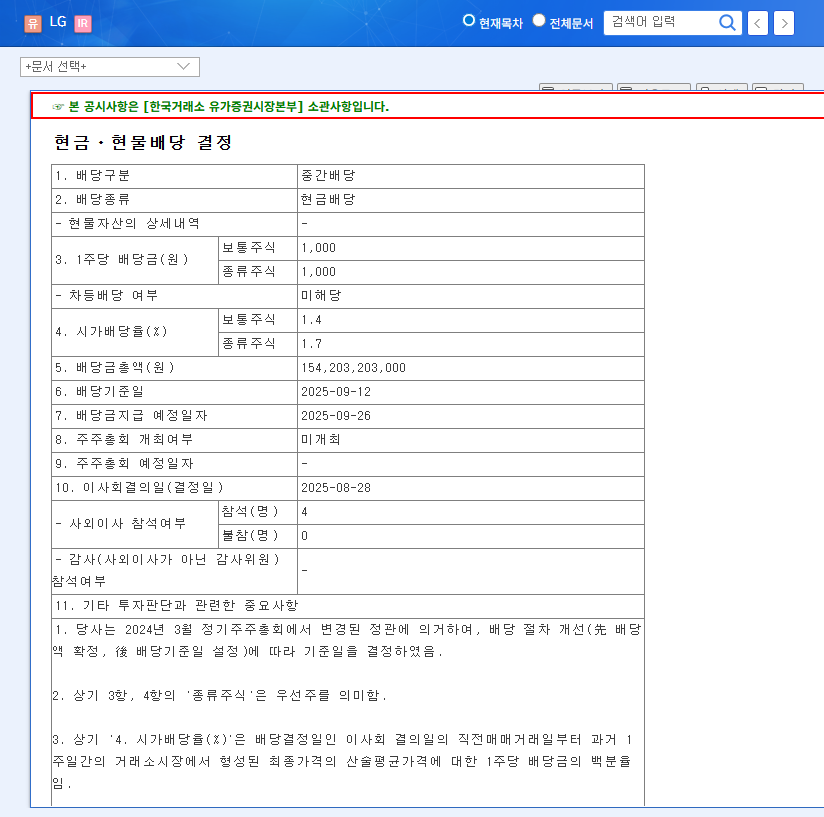

LG Interim Dividend: Key Details

On August 28, 2025, LG announced an interim dividend of KRW 1,000 per share. The record date is September 12, 2025, and the payment date is September 26, 2025. The dividend yield based on the current stock price is approximately 1.4% for common stock and 1.7% for preferred stock.

Why the Interim Dividend?

As a holding company, LG’s primary revenue sources are dividends from subsidiaries and trademark royalties. Following strong performance in the first half of 2025, LG decided on an interim dividend to enhance shareholder return. The improved performance of key subsidiaries like LG CNS, LG Chem, and LG Uplus contributed positively to this decision.

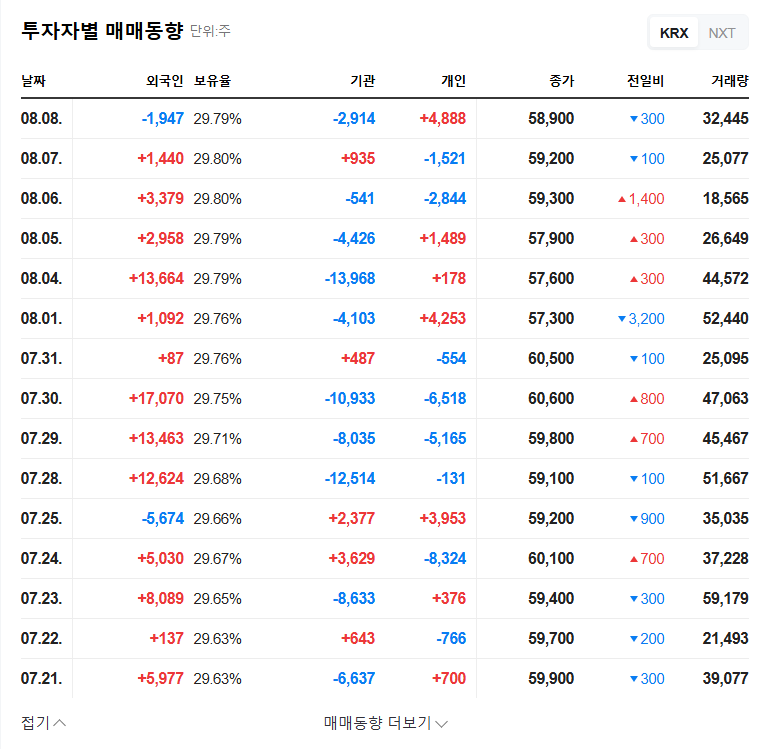

Impact on Stock Price

In the short term, the dividend announcement is expected to create positive momentum for the stock price. However, the long-term trajectory will depend on the growth and competitiveness of its subsidiaries. While dividend payments involve cash outflow, LG’s sound financial health suggests minimal impact.

Investor Action Plan

- Short-term investors: Consider buying before the ex-dividend date and selling after.

- Long-term investors: Analyze the growth potential and competitiveness of LG’s subsidiaries to make informed investment decisions. Pay close attention to macroeconomic conditions and intensifying competition, which pose potential risks.

LG’s Future: What to Watch

LG’s future hinges on securing new growth engines and strengthening the competitiveness of its subsidiaries. Adapting to the rapidly changing technological landscape and intensifying competition is also crucial. These factors will ultimately determine the sustainability of LG’s dividends in the long run.

When are the record and payment dates for the LG interim dividend?

The record date is September 12, 2025, and the payment date is September 26, 2025.

Will the LG interim dividend positively impact the stock price?

While positive momentum is expected in the short term, long-term stock performance depends on the growth and competitiveness of its subsidiaries.

What precautions should investors take regarding the LG interim dividend?

Investors should be aware of price volatility around the ex-dividend date and analyze the competitiveness and potential risks of LG’s subsidiaries.