1. What Happened?

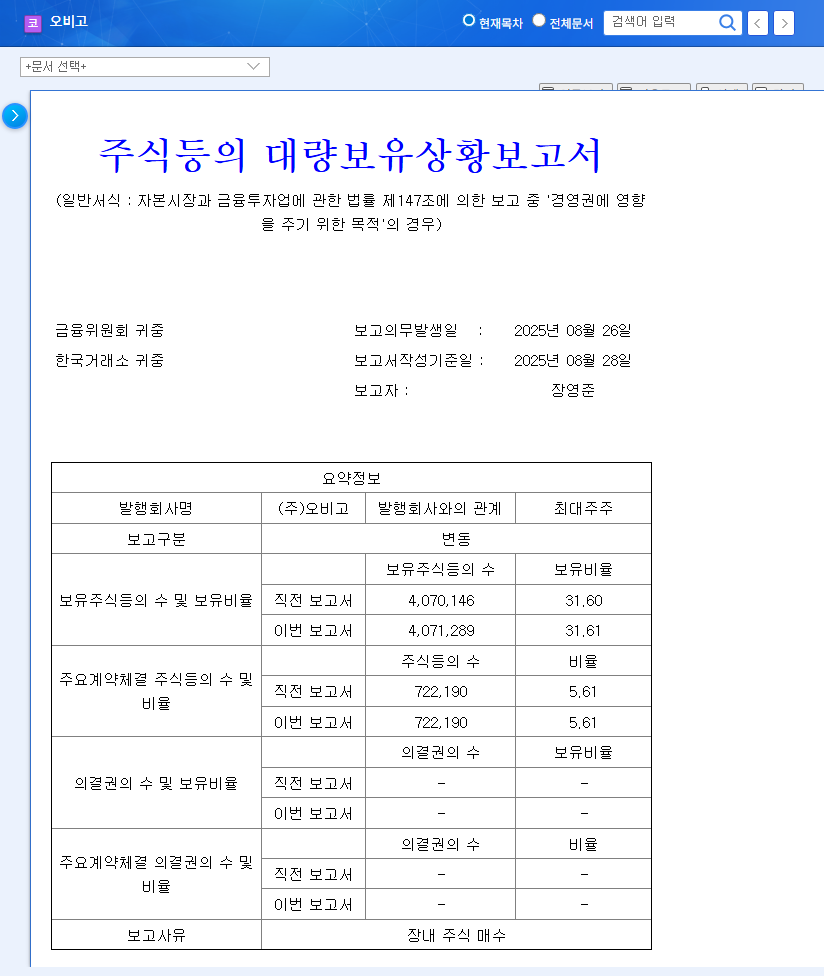

On August 28, 2025, Jang Young-jun, a major shareholder of Obigo, increased his stake from 31.60% to 31.61%. This was an open market purchase for management influence.

2. Why Does it Matter?

A major shareholder increasing their stake can be interpreted as a positive sign, demonstrating management’s confidence in the company. However, the small increase and Obigo’s current financial difficulties must be considered. There are concerns about deteriorating fundamentals, with sales decline and operating loss expected in 2025.

3. What’s the Potential Impact?

Short-term: A positive impact on the stock price is possible, but the magnitude of the increase is likely to be limited. Long-term: Earnings improvement will be key. Positive factors like receiving the balance payment from the LG Uplus contract and securing new contracts could create momentum for stock price appreciation. Conversely, continued poor performance would limit the impact of the stake increase.

- Positive Scenario: Active participation of major shareholder → Strengthened business strategy and execution → Long-term increase in corporate value

- Negative Scenario: Continued deterioration of financial health → Weakened investor sentiment → Stock price decline

4. What Should Investors Do?

Instead of reacting to short-term price fluctuations, investors should continuously monitor Obigo’s fundamental improvements. Pay close attention to the following:

- Quarterly earnings announcements: Check for sales and profitability improvements

- Receipt of balance payment from LG Uplus and new contract wins

- Competitive landscape and technological trends in the smart car market

While the stake increase is a positive sign, investment decisions should be made cautiously.

Who is the major shareholder?

Jang Young-jun.

How much did the stake increase?

From 31.60% to 31.61%, a 0.01% increase.

What is Obigo’s main business?

Developing and selling smart car software platforms.

What should investors be aware of?

Don’t be swayed by short-term events, and thoroughly analyze the company’s fundamentals and growth potential.