1. DK-Lok’s H1 2025 Performance: A Mixed Bag

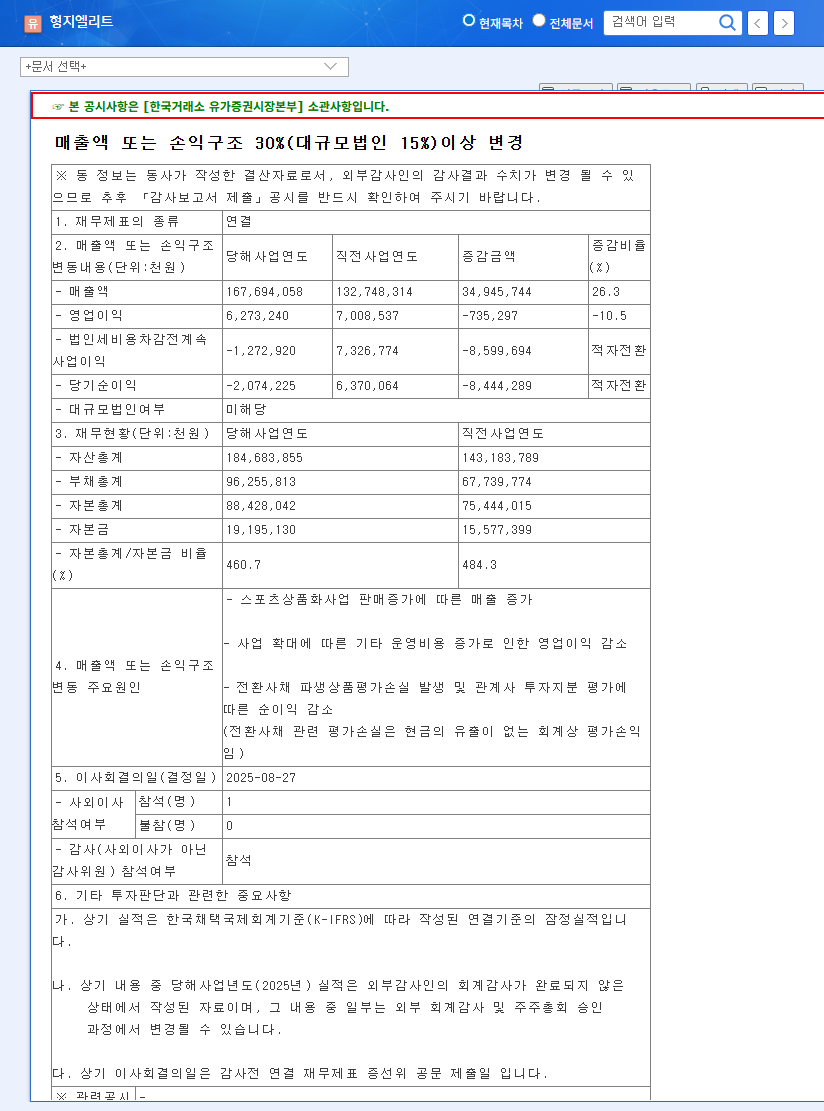

DK-Lok reported consolidated revenue of KRW 51.72 billion (down 7.16% YoY), operating profit of KRW 1.726 billion (turnaround), and a net loss of KRW 2.944 billion for H1 2025. Cost and administrative expense controls led to the operating profit turnaround. However, the net loss, potentially due to subsidiary performance or one-off expenses, needs to be addressed.

2. Key Takeaways from the IR: What Investors Should Focus On

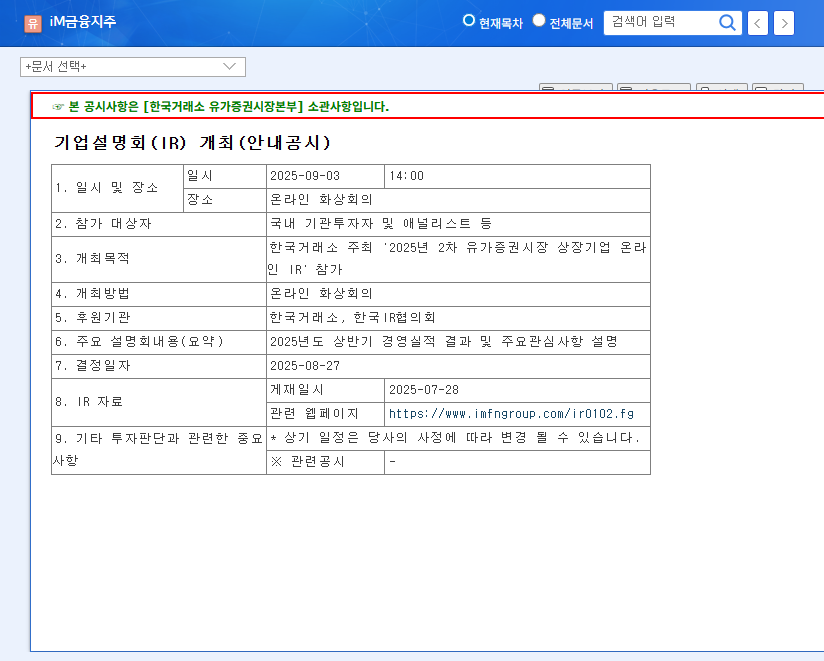

- Sustainability of Profitability: Management needs to provide clear explanations for the sustainability of the operating profit turnaround and plans for addressing the net loss.

- Financial Health Management: A concrete plan for managing the increasing inventory (KRW 59.38 billion) and debt-to-equity ratio (65%) is crucial.

- Future Growth Strategy: DK-Lok should outline a clear roadmap for growth in new business areas like hydrogen vehicles, aerospace, and defense, showcasing long-term potential.

3. Action Plan for Investors

- Active Participation in Q&A: Investors should utilize the opportunity to directly address management and clarify any concerns.

- Post-IR Analysis and Investment Decision: Thoroughly analyze the IR presentation and management’s responses before making investment decisions.

Frequently Asked Questions (FAQ)

What is DK-Lok’s main business?

DK-Lok specializes in the precision machining of instrumentation fittings and valves, supplying various industries such as semiconductors, shipbuilding, offshore plants, hydrogen vehicles, aerospace, and defense.

What are the key highlights of the H1 2025 results?

While revenue decreased, operating profit turned positive. However, the company reported a net loss. The increase in inventory and debt-to-equity ratio are also notable.

What should investors pay attention to in this IR?

Investors should carefully consider management’s explanations regarding the sustainability of profit improvement, financial health management plans, and future growth strategies.