1. CJ ENM IR Event Analysis: What Was Discussed?

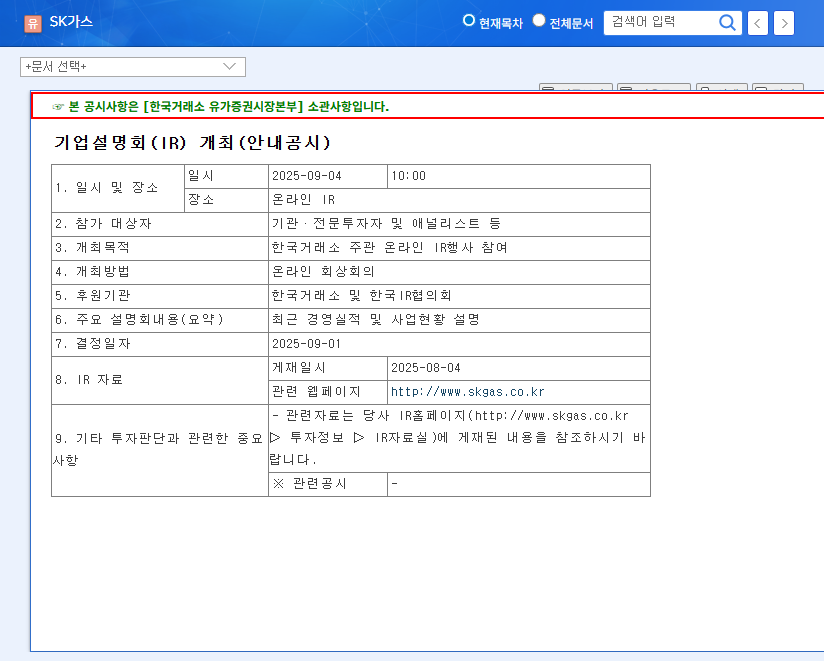

On September 2nd, CJ ENM held an Investor Relations (IR) meeting to discuss its current business performance and answer questions. Key announcements included future growth strategies like TVING’s global expansion and AI technology integration, along with efforts to improve fundamentals. Crucially, they detailed a turnaround strategy for the underperforming media and film/drama divisions.

2. CJ ENM Current Situation Analysis: Why the IR?

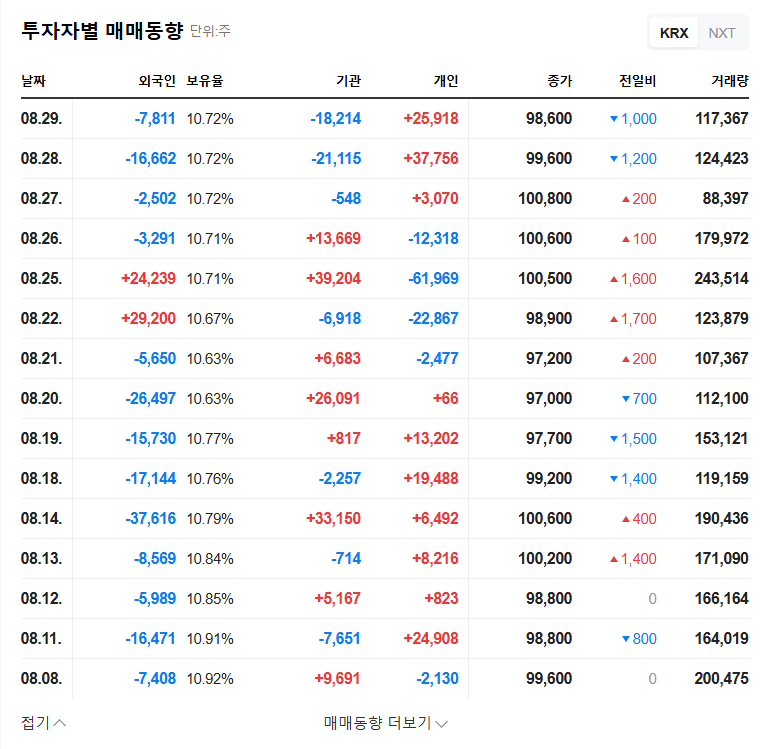

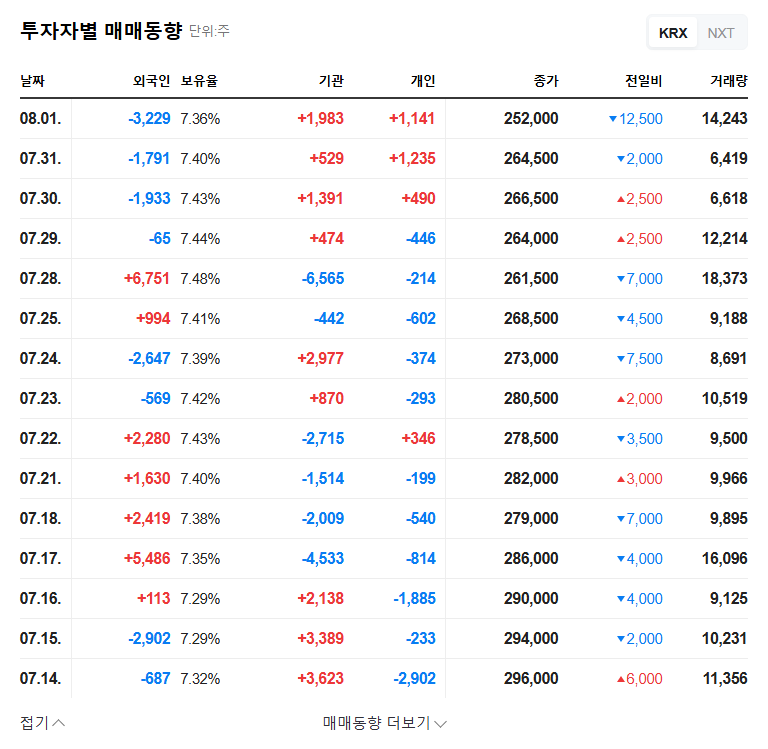

CJ ENM has diversified its business across media platforms, film/drama production, music, and commerce, seeing strong growth in its music division. However, challenges remain, including declining operating profits in the media platform and film/drama segments, and increasing competition in the OTT market. Addressing the impact of the current macroeconomic environment (interest rates, exchange rates, oil prices, etc.) is also critical.

3. Key IR Takeaways and Their Impact: What’s Next?

- Positive Impacts:

- Presentation of future growth strategies, including TVING’s global expansion and AI technology integration.

- Proposed strategies for navigating macroeconomic uncertainties.

- Sharing of global business performance and future plans.

- Potential Negative Impacts:

- Concerns regarding the profitability of core business segments.

- High debt ratio and financial burden.

- Potential downward revision of earnings forecasts due to worsening macroeconomic conditions.

4. Action Plan for Investors: What Should You Do?

CJ ENM outlined plans for profitability improvement, global expansion, and navigating the macroeconomic environment. Investors should carefully analyze the IR presentation to assess the company’s future growth and profitability potential before making investment decisions. Focus on their specific plans for improving profitability, the performance of their global expansion strategy, and their strategies for dealing with changes in the macroeconomic environment.

Frequently Asked Questions

What are CJ ENM’s main businesses?

CJ ENM operates across four business segments: media platforms, film/drama production, music, and commerce.

What were the key takeaways from the IR presentation?

The key takeaways included an overview of CJ ENM’s current performance, future growth strategies (TVING global expansion, AI technology integration), efforts to improve fundamentals, and strategies for navigating the changing macroeconomic environment.

What should investors consider when evaluating CJ ENM?

Investors should consider the company’s ability to improve profitability in its core business segments, its high debt ratio, and the potential impact of macroeconomic changes on its performance.