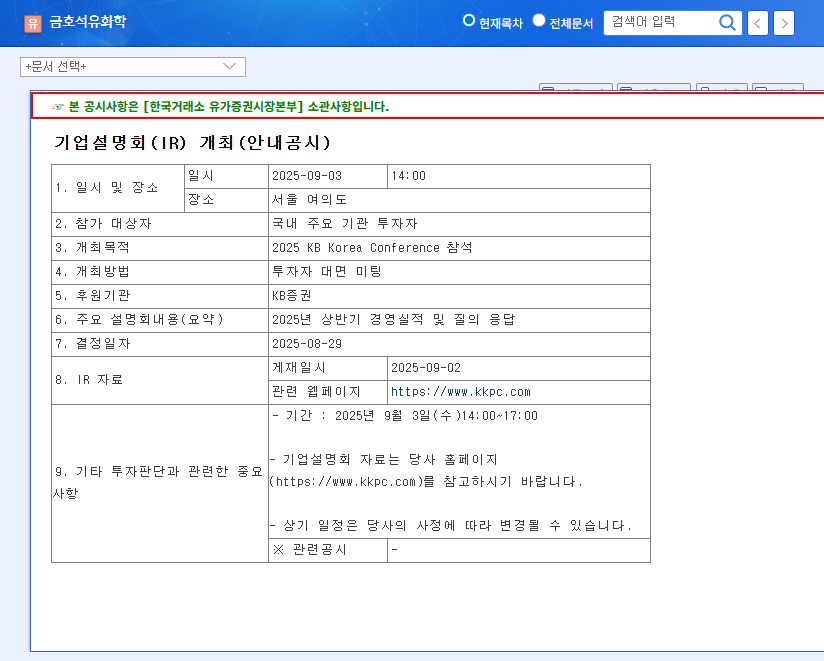

1. Kumho Petrochemical H1 2025 Earnings: A Mixed Bag

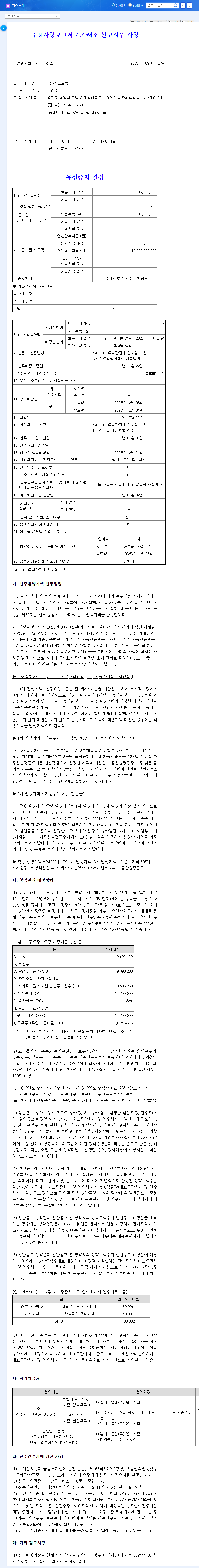

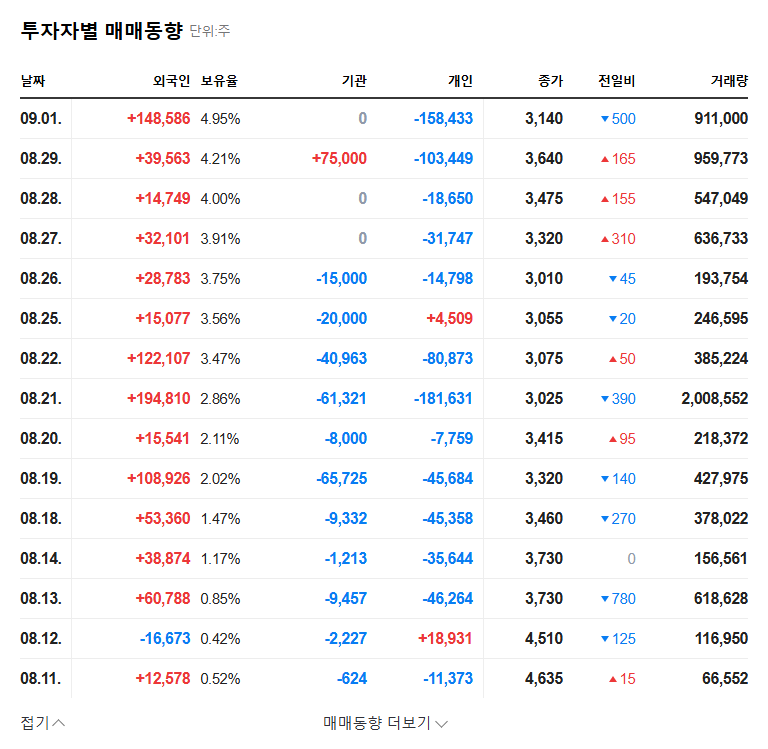

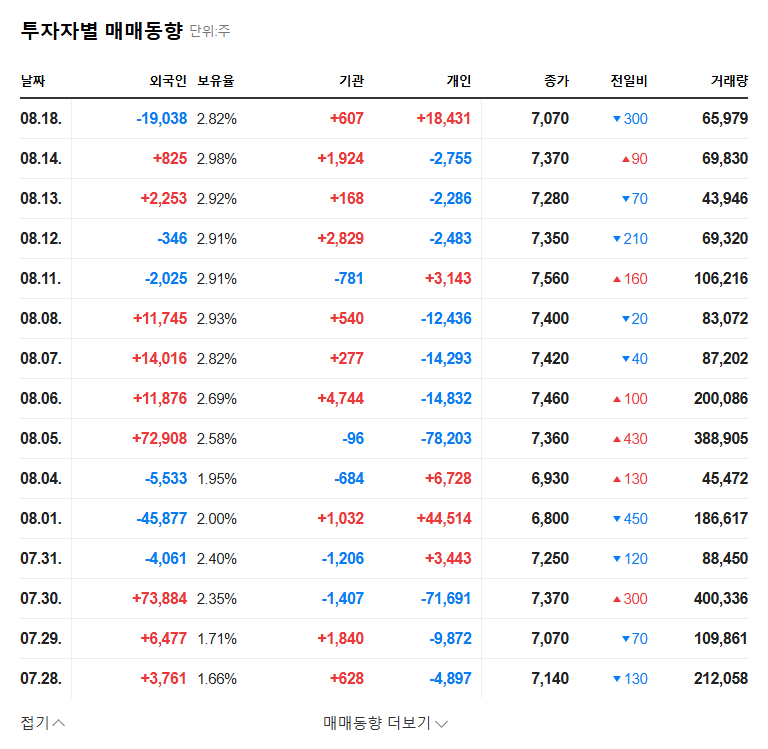

Kumho Petrochemical’s H1 2025 earnings presented a mixed picture of growth and decline. While synthetic rubber and fine chemicals showed robust growth, synthetic resins and CNT segments struggled.

2. Key IR Analysis: 3 Points to Focus On

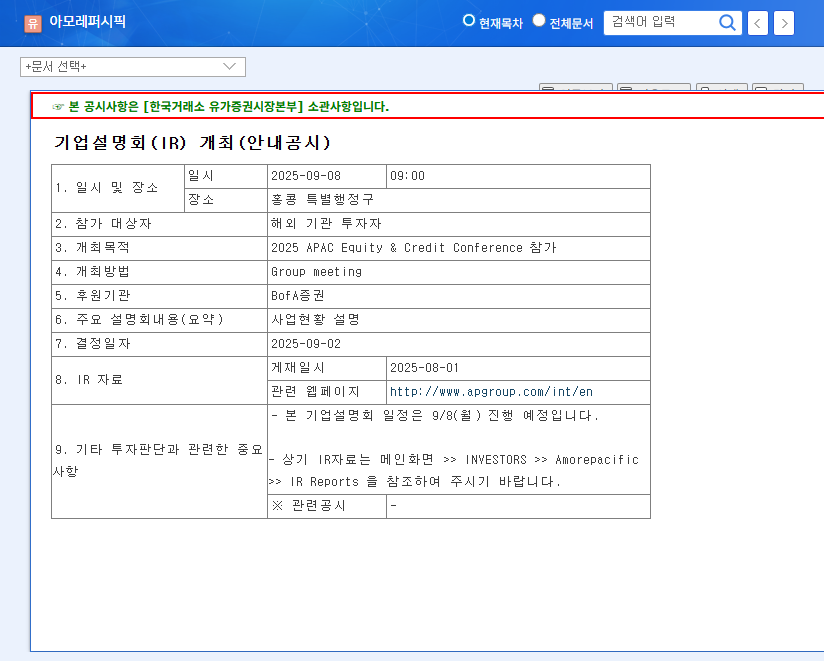

- Earnings: Earnings that exceed market expectations could trigger a stock price rally. The continued growth of synthetic rubber and fine chemicals is crucial.

- Future Growth Strategy: Announcements regarding strategies to address the CNT downturn, progress in new business ventures (ECH), and the impact of EPDM expansion will influence investor sentiment.

- Shareholder Return Policy: Any mention of share buybacks and cancellation plans can be interpreted as a positive signal for enhancing shareholder value.

3. Investment Strategy: Neutral Stance, Focus on IR Outcomes

While Kumho Petrochemical’s fundamentals appear solid, a neutral investment perspective is advisable considering external uncertainties. Carefully review the information revealed during the September 3rd IR and continue to monitor external factors like exchange rates, raw material prices, and global economic conditions.

4. Kumho Petrochemical Investment: 4 Key Checklist Items

- Check Key IR announcements: Scrutinize details on H1 earnings, future growth strategies, and shareholder return policies.

- Monitor Macroeconomic indicators: Analyze the impact of fluctuations in exchange rates, interest rates, and raw material prices.

- Competitor Analysis: Consider the potential for increased competition and cost pressures.

- Maintain a Long-term Perspective: Avoid being swayed by short-term stock price fluctuations and make investment decisions based on a long-term view.

Kumho Petrochemical Investment FAQs

What are Kumho Petrochemical’s main business segments?

Kumho Petrochemical operates in various business segments, including synthetic rubber, synthetic resins, fine chemicals, and CNT.

How did Kumho Petrochemical perform in H1 2025?

Synthetic rubber and fine chemicals experienced growth, while synthetic resins and CNT segments underperformed. Refer to the IR materials for detailed information.

What should investors consider when investing in Kumho Petrochemical?

Investors should exercise caution and consider macroeconomic uncertainties, increased competition, and fluctuations in raw material prices.